Wyoming Changing state of incorporation

Description

How to fill out Changing State Of Incorporation?

Have you been in a place in which you need files for sometimes enterprise or individual reasons nearly every time? There are a lot of legitimate papers templates available on the net, but finding ones you can depend on is not straightforward. US Legal Forms provides 1000s of form templates, much like the Wyoming Changing state of incorporation, which are composed to satisfy state and federal specifications.

In case you are already familiar with US Legal Forms site and get your account, simply log in. After that, you can obtain the Wyoming Changing state of incorporation template.

If you do not have an account and want to begin using US Legal Forms, abide by these steps:

- Get the form you require and ensure it is for your appropriate metropolis/county.

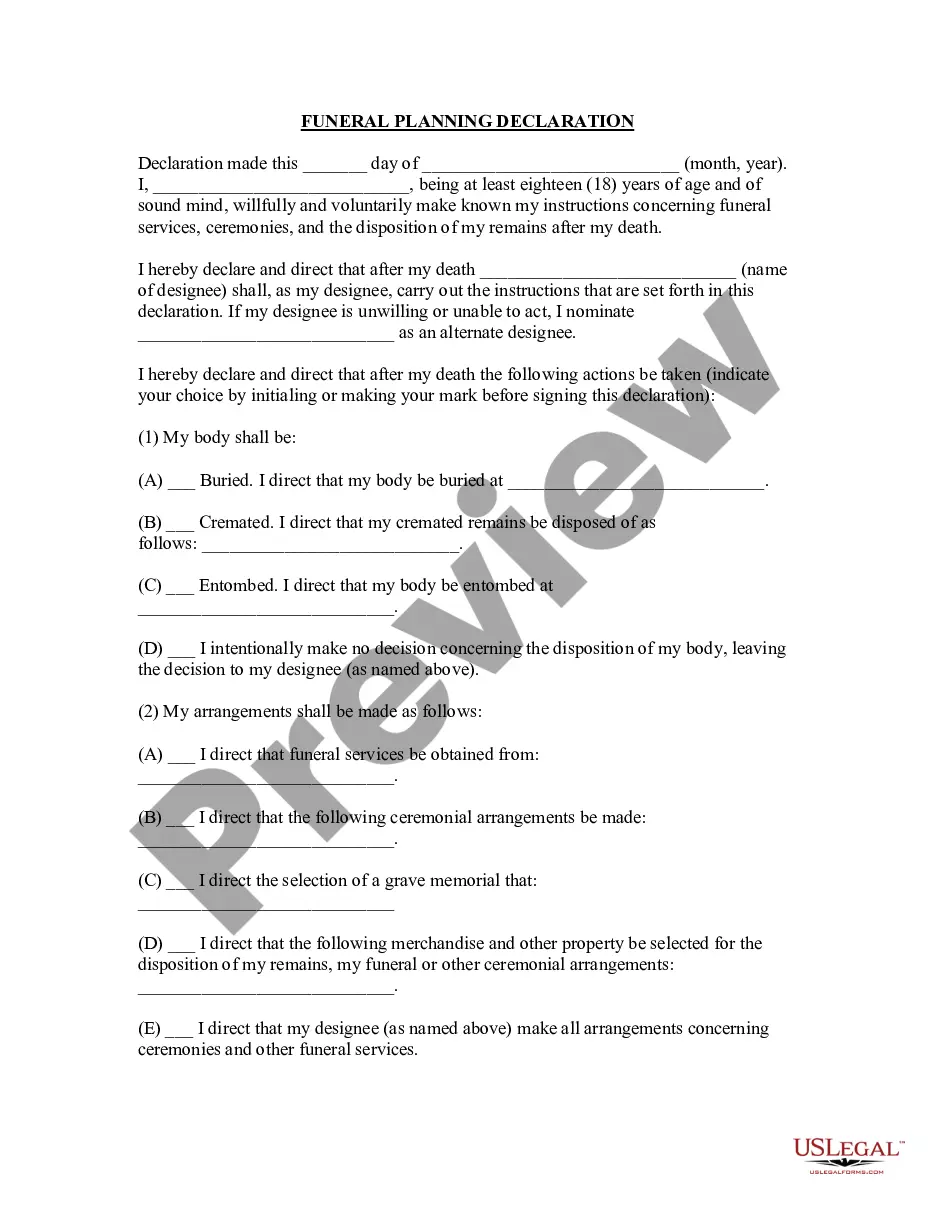

- Make use of the Preview option to examine the form.

- Read the outline to actually have chosen the appropriate form.

- If the form is not what you are seeking, use the Lookup area to find the form that meets your needs and specifications.

- When you get the appropriate form, click on Get now.

- Opt for the prices strategy you need, fill in the required info to produce your bank account, and pay money for your order using your PayPal or bank card.

- Choose a hassle-free document file format and obtain your copy.

Find all of the papers templates you may have bought in the My Forms food selection. You can aquire a more copy of Wyoming Changing state of incorporation whenever, if required. Just click on the essential form to obtain or produce the papers template.

Use US Legal Forms, the most substantial variety of legitimate kinds, to save lots of efforts and prevent errors. The support provides professionally made legitimate papers templates which can be used for a variety of reasons. Make your account on US Legal Forms and begin producing your daily life easier.

Form popularity

FAQ

Why Incorporate in Wyoming? Wyoming is a popular corporate haven due to its lack of taxes and endemic privacy concerns. These factors drive many new incorporations. Wyoming also has the added benefit of allowing you to hold your shares in a Wyoming LLC or a Wyoming Trust for additional asset protection.

The 2021 state business tax climate index by tax foundation has ranked Wyoming as #1 ? right at the top! Some of the reasons for the tax friendly climate or low tax burden are: The state has no corporate state income tax. There is no personal state income tax.

While beautiful Wyoming is mostly known for its scenic byways, national parks and incredible views, it's also one of the top five best states to form an LLC in. With its low LLC fees, beneficial tax structures and asset protection laws, the Cowboy State has a lot more to offer than just good looks.

If a company is ?conducting business activities? in a state other than its state of formation, it will need to register as a ?Foreign Entity? in the second state while maintaining its Registered Agent and good standing in the state in which it was originally formed.

Submit your filing to the WY Secretary of State: Certificate of Good Standing and Certified Copy of the AOI. Articles of Domestication. Registered Agent Consent Form (We send to you) One set of originals and one set of copies. A $100 check for the Wyoming Secretary of State.

We can also serve as the registered agent for your corporation. You may consider this option if you have privacy concerns, as the articles of incorporation are a public document. It is better to incorporate in Wyoming than Nevada because there are no taxes in Wyoming, significantly lower fees and better privacy.

Advantages of Incorporating in Nevada Nevada has no state corporate income tax and imposes no fees on corporate shares. There is neither personal income tax nor franchise tax for corporations or LLCs (but initial and annual statement fees and a business license fee apply).

The Corporation Articles of Amendment should be mailed to the Wyoming Secretary of State. There is a $50 filing fee. The amendment will be processed roughly within a week, and a stamped copy will be sent to you through the mail.