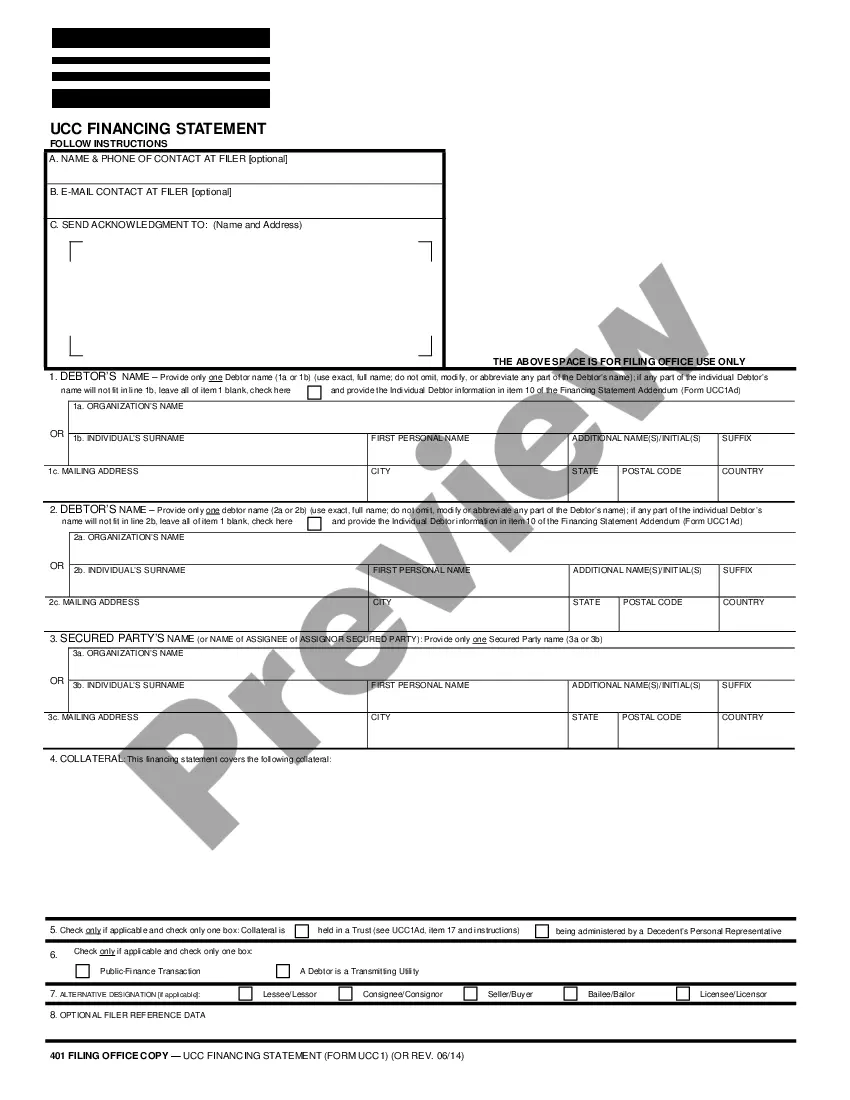

Wyoming Private placement of Common Stock

Description

How to fill out Private Placement Of Common Stock?

US Legal Forms - one of many biggest libraries of legitimate forms in the United States - delivers a wide array of legitimate file web templates you may obtain or printing. Making use of the internet site, you can get a huge number of forms for company and person reasons, categorized by types, suggests, or keywords.You will discover the latest versions of forms much like the Wyoming Private placement of Common Stock within minutes.

If you already have a subscription, log in and obtain Wyoming Private placement of Common Stock through the US Legal Forms catalogue. The Obtain option can look on every single form you look at. You have accessibility to all earlier acquired forms within the My Forms tab of your own profile.

If you would like use US Legal Forms the first time, here are basic guidelines to help you get started out:

- Ensure you have picked out the best form for the city/area. Click on the Review option to examine the form`s content. Look at the form explanation to actually have chosen the correct form.

- If the form does not suit your needs, use the Search area near the top of the monitor to discover the one which does.

- Should you be happy with the form, affirm your option by clicking the Buy now option. Then, opt for the prices plan you favor and give your qualifications to register on an profile.

- Approach the purchase. Utilize your credit card or PayPal profile to finish the purchase.

- Choose the formatting and obtain the form on the system.

- Make alterations. Load, modify and printing and sign the acquired Wyoming Private placement of Common Stock.

Every single format you included with your money lacks an expiration particular date which is the one you have for a long time. So, in order to obtain or printing an additional copy, just proceed to the My Forms portion and then click around the form you will need.

Get access to the Wyoming Private placement of Common Stock with US Legal Forms, by far the most considerable catalogue of legitimate file web templates. Use a huge number of specialist and express-distinct web templates that fulfill your small business or person needs and needs.

Form popularity

FAQ

A private placement is a security that's sold to an investor. Some common examples of private placements include: Real Estate Investment Trusts (REITs) Non-Traded REITs.

How to Complete a Private Placement Deal Launch. The first step, Deal Launch, initiates the window of time from which the issue is offered to investors, to when a decision must be made, typically 1-3 weeks. ... Negotiations. ... Information Gathering. ... Investment Risk Analysis. ... Pricing. ... Rate Lock. ... Closing.

Consent of Shareholders, if general meeting called at shorter notice. Copy of Board Resolution for allotment of securities. Copy of Valuation Report. List of allottees. a complete record of private placement offers and acceptances in Form PAS-5 is required.

A private placement is an offering of unregistered securities to a limited pool of investors. In a private placement, a company sells shares of stock in the company or other interest in the company, such as warrants or bonds, in exchange for cash.

Regulation D is a provision that exempts some companies from the registration requirements associated with a public offering. It gives smaller companies access to investment capital by letting them offer specific types of private placements.

There are two kinds of private placement?preferential allotment and qualified institutional placement. A listed company can issue securities to a select group of entities, such as institutions or promoters, at a particular price. This scenario is known as a preferential allotment.

Advantages of private placement One major advantage of private placement is that the issuer isn't subject to the SEC's strict regulations for a typical public offering. With a private placement, the issuing company isn't subject to the same disclosure and reporting requirements as a publicly offered bond.

A private placement is when a company looks to raise capital directly from private investors by issuing them newly created shares (Equity Offering) or debt (Debt Offering). Prospectus. A legal document that must be provided by public companies doing a private placement.

FINRA Rule 5123 (Private Placements of Securities) requires firms to file with FINRA's Corporate Financing Department within 15 calendar days of the date of first sale of a private placement, a private placement memorandum, term sheet or other offering document, or indicate that no such offerings documents were used.