Wyoming Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

US Legal Forms - one of many most significant libraries of authorized varieties in America - delivers a wide range of authorized file layouts you are able to download or produce. Making use of the site, you will get a large number of varieties for business and specific reasons, sorted by classes, suggests, or keywords and phrases.You can get the latest models of varieties such as the Wyoming Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 within minutes.

If you currently have a registration, log in and download Wyoming Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 from your US Legal Forms library. The Obtain button can look on every kind you look at. You get access to all earlier delivered electronically varieties in the My Forms tab of the account.

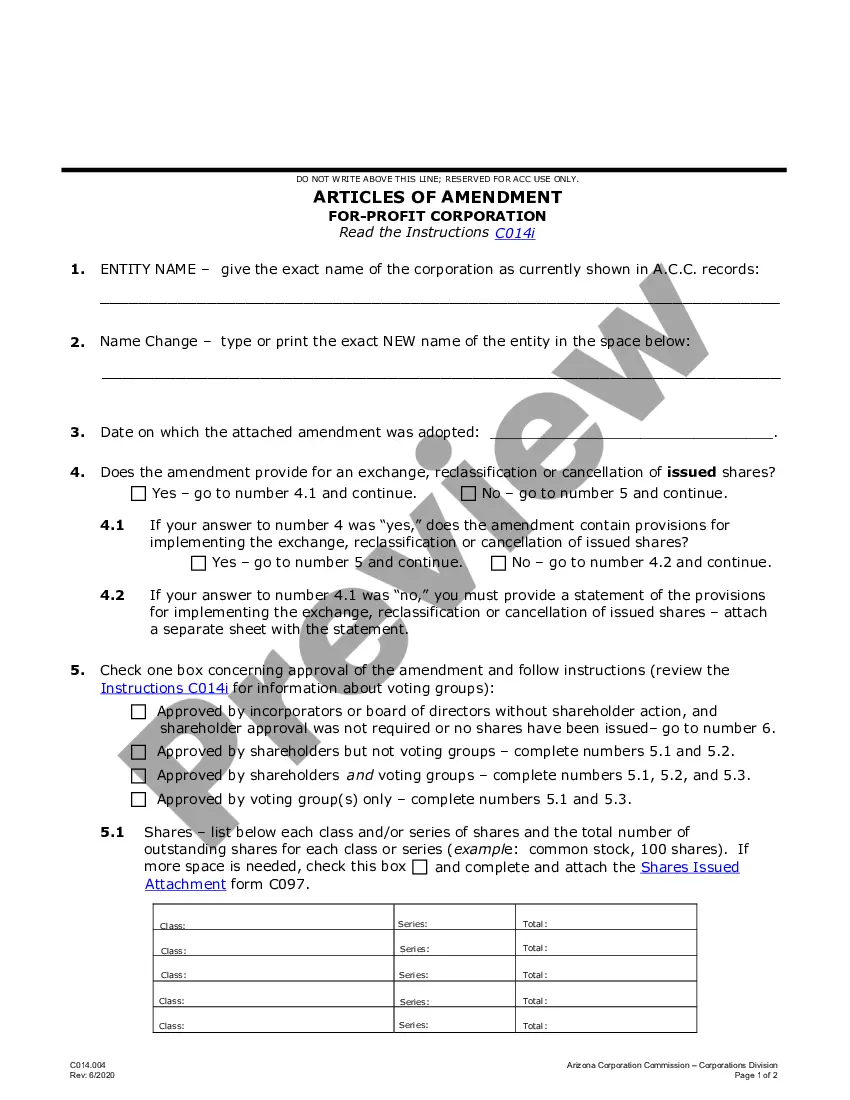

If you want to use US Legal Forms the very first time, here are easy guidelines to help you started:

- Be sure you have picked the best kind for the metropolis/area. Click the Preview button to check the form`s articles. See the kind outline to ensure that you have selected the appropriate kind.

- When the kind doesn`t fit your specifications, make use of the Research field near the top of the display screen to obtain the one who does.

- When you are content with the shape, affirm your choice by simply clicking the Buy now button. Then, select the prices program you prefer and supply your references to sign up to have an account.

- Procedure the deal. Use your Visa or Mastercard or PayPal account to finish the deal.

- Find the file format and download the shape on the device.

- Make adjustments. Complete, edit and produce and sign the delivered electronically Wyoming Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

Each and every web template you included with your money lacks an expiration particular date and is your own property eternally. So, if you wish to download or produce one more version, just visit the My Forms portion and click in the kind you will need.

Gain access to the Wyoming Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 with US Legal Forms, probably the most comprehensive library of authorized file layouts. Use a large number of professional and condition-specific layouts that meet your business or specific requirements and specifications.

Form popularity

FAQ

Once you know how much of your benefits are taxable, you must include that amount on Line 6b of Form 1040. That income will be taxable, along with any other income, based on your tax bracket and the income tax rate tied to it.

If your income is modest, it is likely that none of your Social Security benefits are taxable. As your gross income increases, a higher percentage of your Social Security benefits become taxable, up to a maximum of 85% of your total benefits.

You don't put anything on line 16 (or any other line) of the 1040. TurboTax does that based on your input in the program interview. If you're doing a form by hand, or online fillable, line 16 is usually looked up in the tax table, based on the taxable income on line 15.

Box 6 "Medicare tax withheld": This is Medicare tax withheld from your pay for the Medicare component of social security taxes. The rate is 1.45% of the Medicare wage base. Box 7 "Social Security Tips": This is total reported tips subject to social security tax.

Steps To Completing Schedule C Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. If You Have a Business Loss.

How to Fill Out Form 1040 for 2022 | Taxes 2023 | Money Instructor YouTube Start of suggested clip End of suggested clip The form 1040 can also help you determine whether tax credits or withholding taxes covered your tax.MoreThe form 1040 can also help you determine whether tax credits or withholding taxes covered your tax. Bill.

Here's the information you'll need to provide: Exemption system you're using. ... Description of property. ... Schedule A/B line number. ... Current value of the portion you own. ... Amount of exemption you claim. ... Specific laws that allow the exemption. ... Claiming a homestead exemption more than $189,050.

Schedule D: Secured Debts Official Form 106D, called Schedule D: Creditors Who Hold Claims Secured By Property (individuals), is for secured debts. It lists debt secured by an interest in either real property (like a house) or personal property. The most common types of secured debts are car loans and home mortgages.