Wyoming FCRA Disclosure and Authorization Statement

Description

How to fill out FCRA Disclosure And Authorization Statement?

US Legal Forms - among the largest collections of authentic documents in the United States - offers a vast selection of legitimate template options you can obtain or print.

By using the website, you can discover thousands of documents for business and personal purposes, sorted by categories, states, or keywords. You can find the latest versions of documents like the Wyoming FCRA Disclosure and Authorization Statement in just a few minutes.

If you already have an account, Log In and download the Wyoming FCRA Disclosure and Authorization Statement from the US Legal Forms catalog. The Download button will be visible on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Choose the format and download the form to your device.

Edit. Fill out, modify and print and sign the downloaded Wyoming FCRA Disclosure and Authorization Statement.

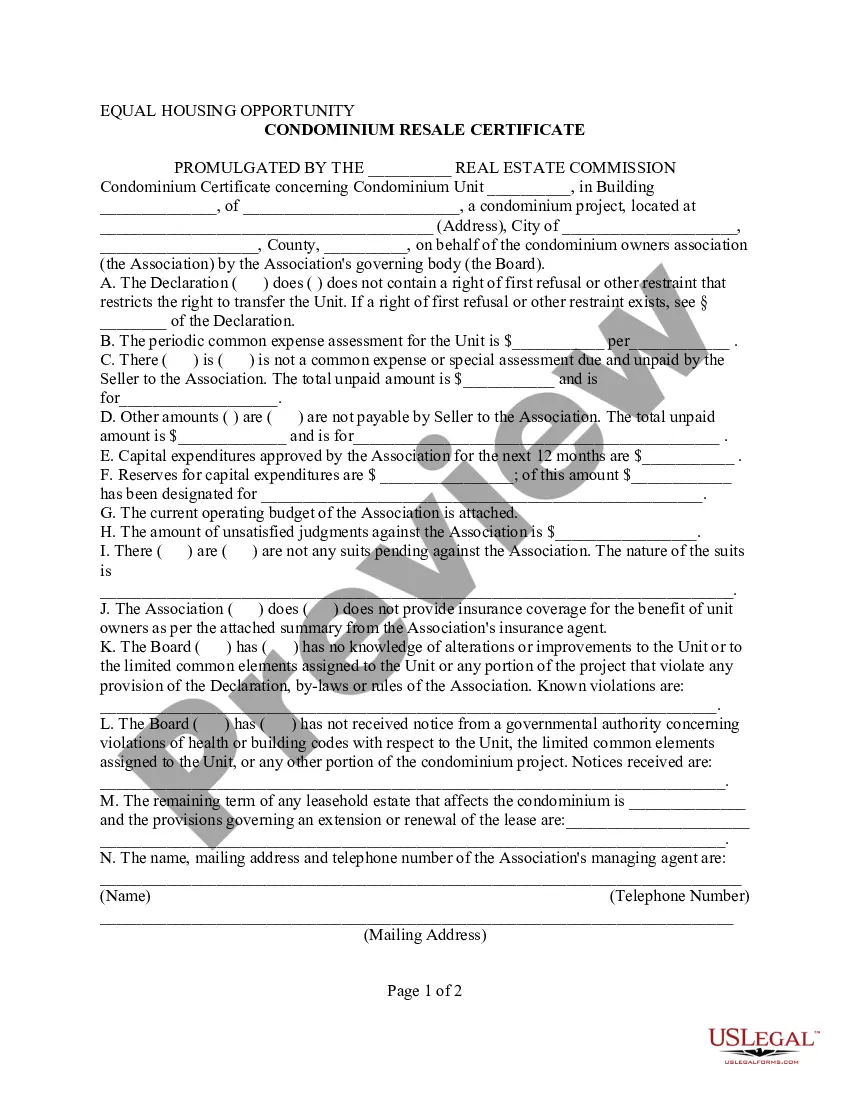

- Ensure that you have selected the appropriate form for your city/region. Select the Preview option to review the form's content.

- Examine the form description to confirm that you've chosen the correct template.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your information to register for an account.

- Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the purchase.

Form popularity

FAQ

The Fair Credit Reporting Act (FCRA) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. The law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your consumer reports.

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and. privacy of information in the files of consumer reporting agencies.

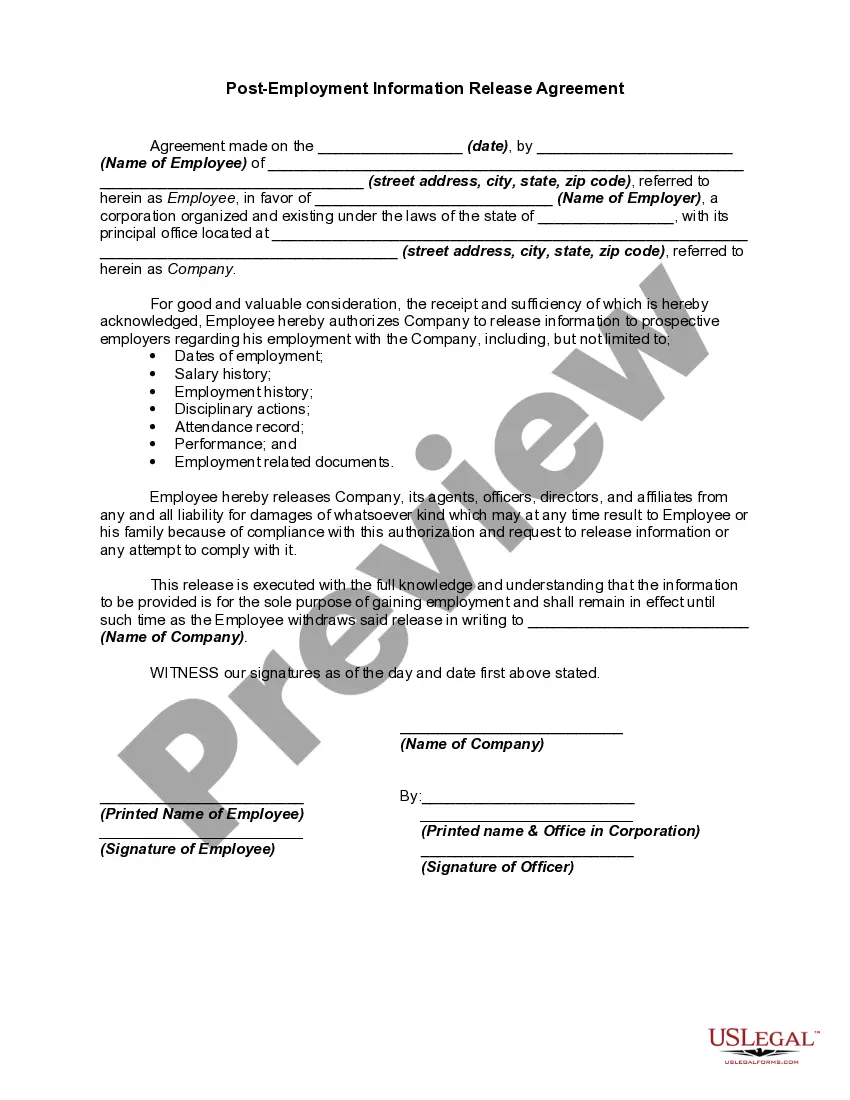

FCRA compliance is required for any employer that partners with a background screening company to conduct pre-employment checks. Ironically, some of the simplest requirements of the FCRA are most often mishandled and become the basis of litigation.

The primary law is the Fair Credit Reporting Act (FCRA). Among other things, the FCRA limits who can access your credit reports and for what purposes. Here are some of the rights provided to consumers under the FCRA: 1. Credit bureaus must provide your credit report to you when you ask for it.

A Summary of Your Rights Under the Fair Credit Reporting Act. The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of. information in the files of consumer reporting agencies.

Four Basic Steps to FCRA ComplianceStep 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must:Step 2: Certification To The Consumer Reporting Agency.Step 3: Provide Applicant With Pre-Adverse Action Documents.Step 4: Notify Applicant Of Adverse Action.

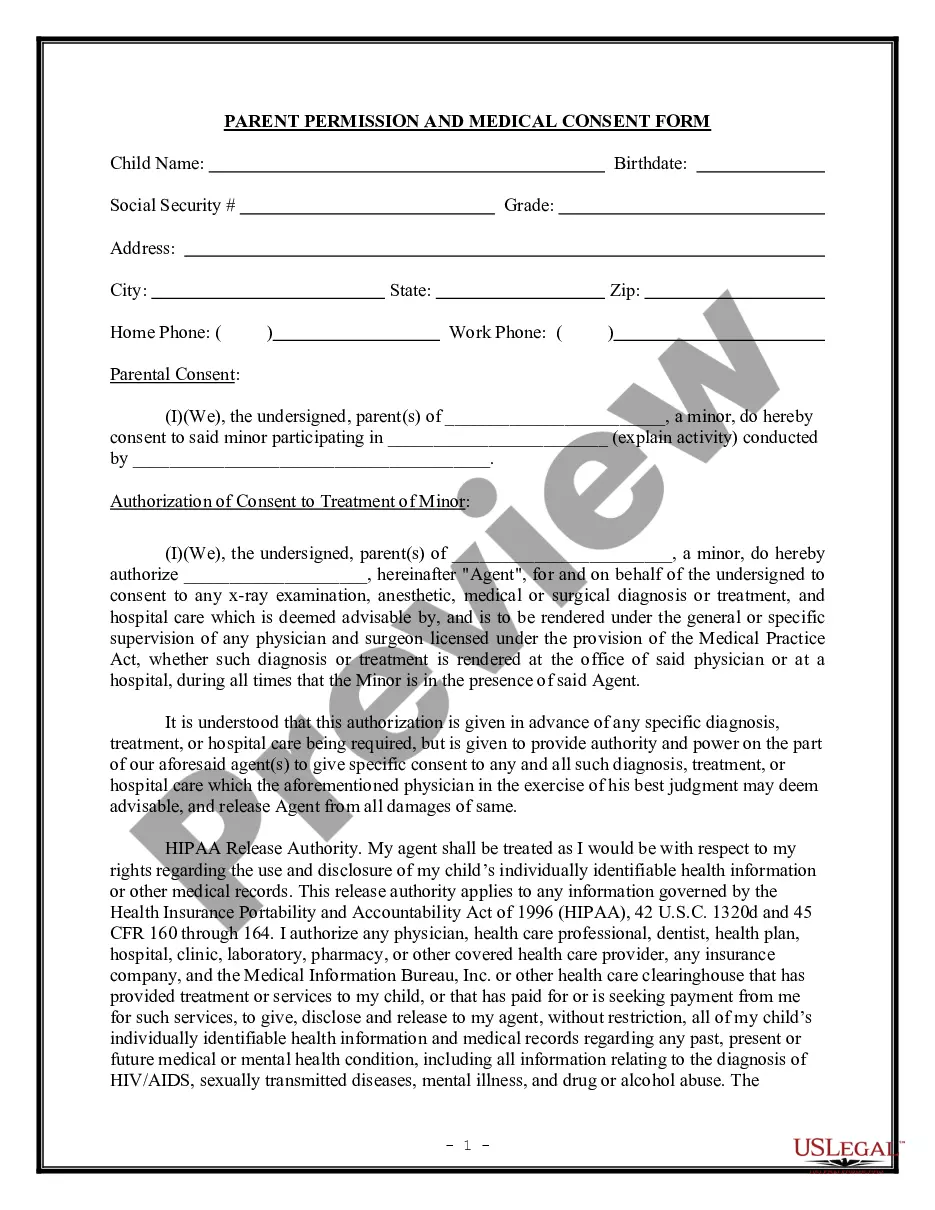

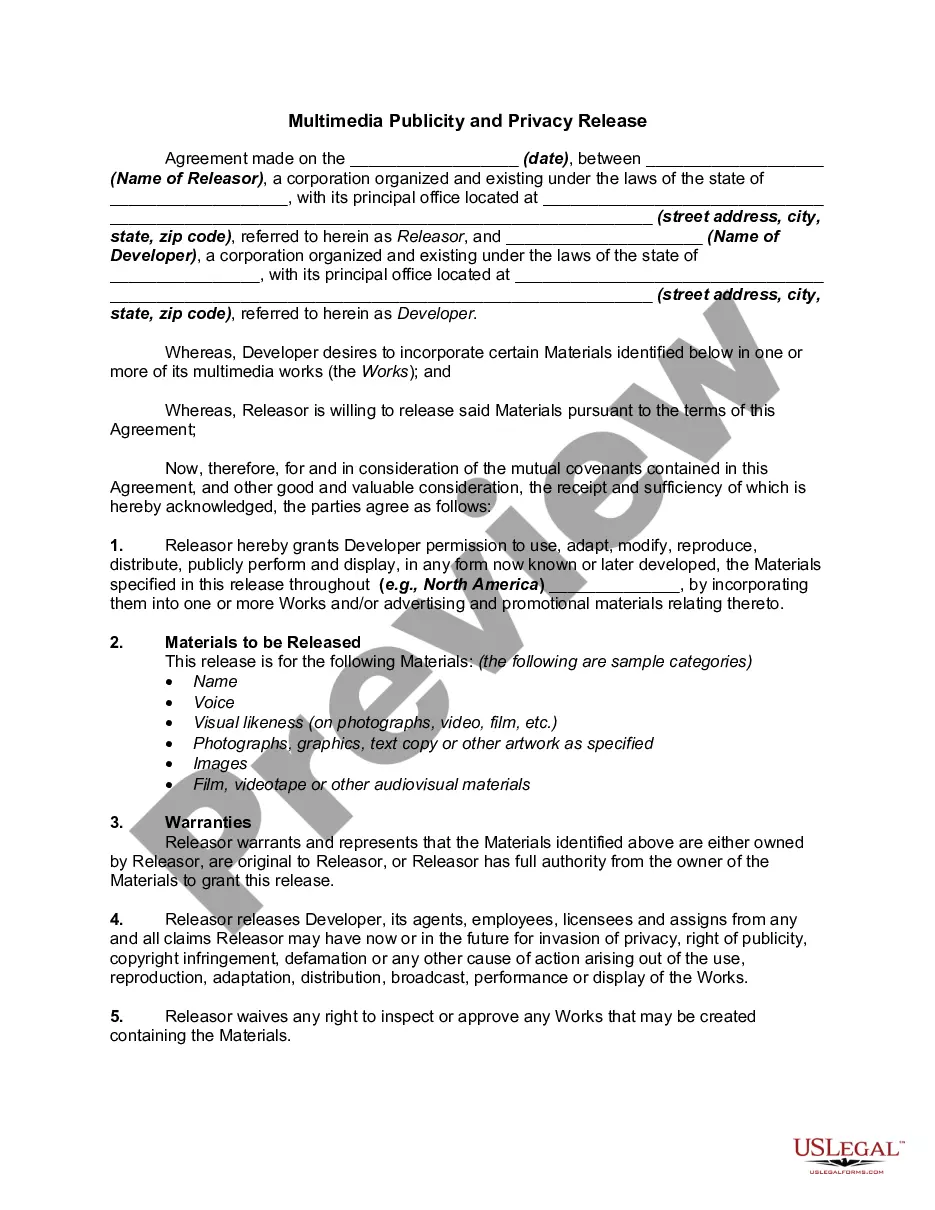

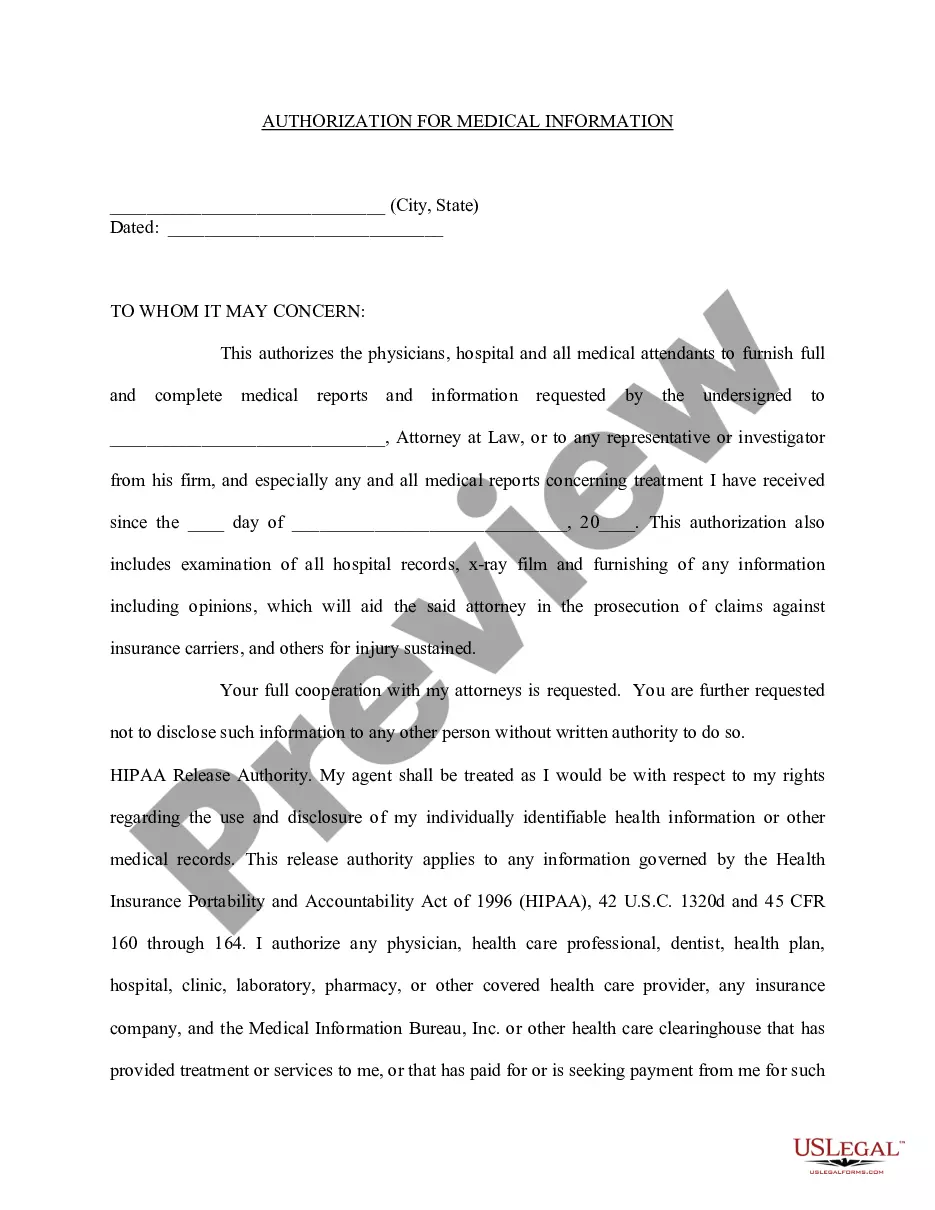

FCRA Authorization: Obtain Permission for a Background Check A compliant FCRA authorization form is an acknowledgement that a pre-employment background check will be conducted. It can be presented as a self-contained document or jointly with an FCRA disclosure form.

Specifically, the FCRA requires that you must provide a clear and conspicuous written notice that consists solely of the disclosure. In other words, the disclosure must be (1) clear and conspicuous; and (2) exist as a standalone document.