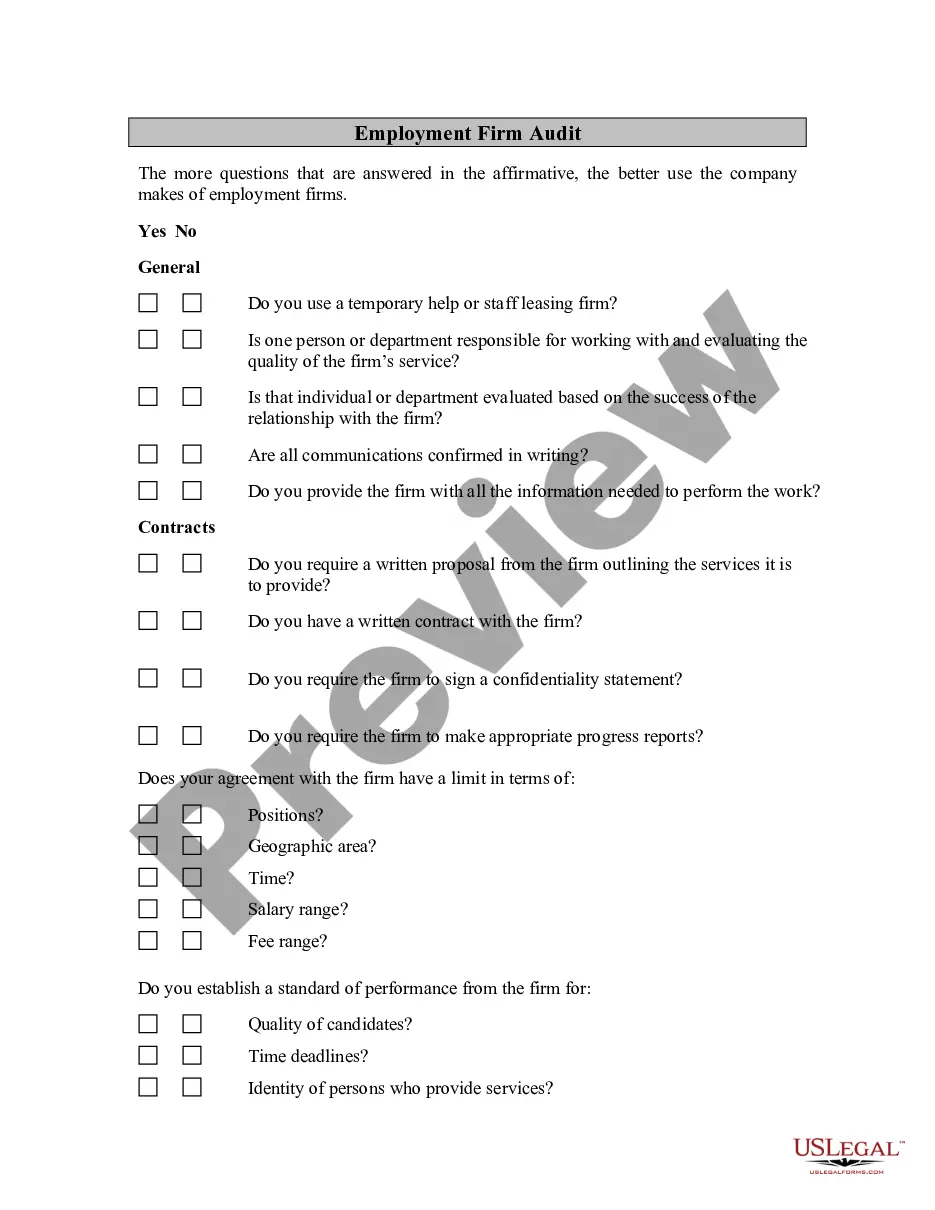

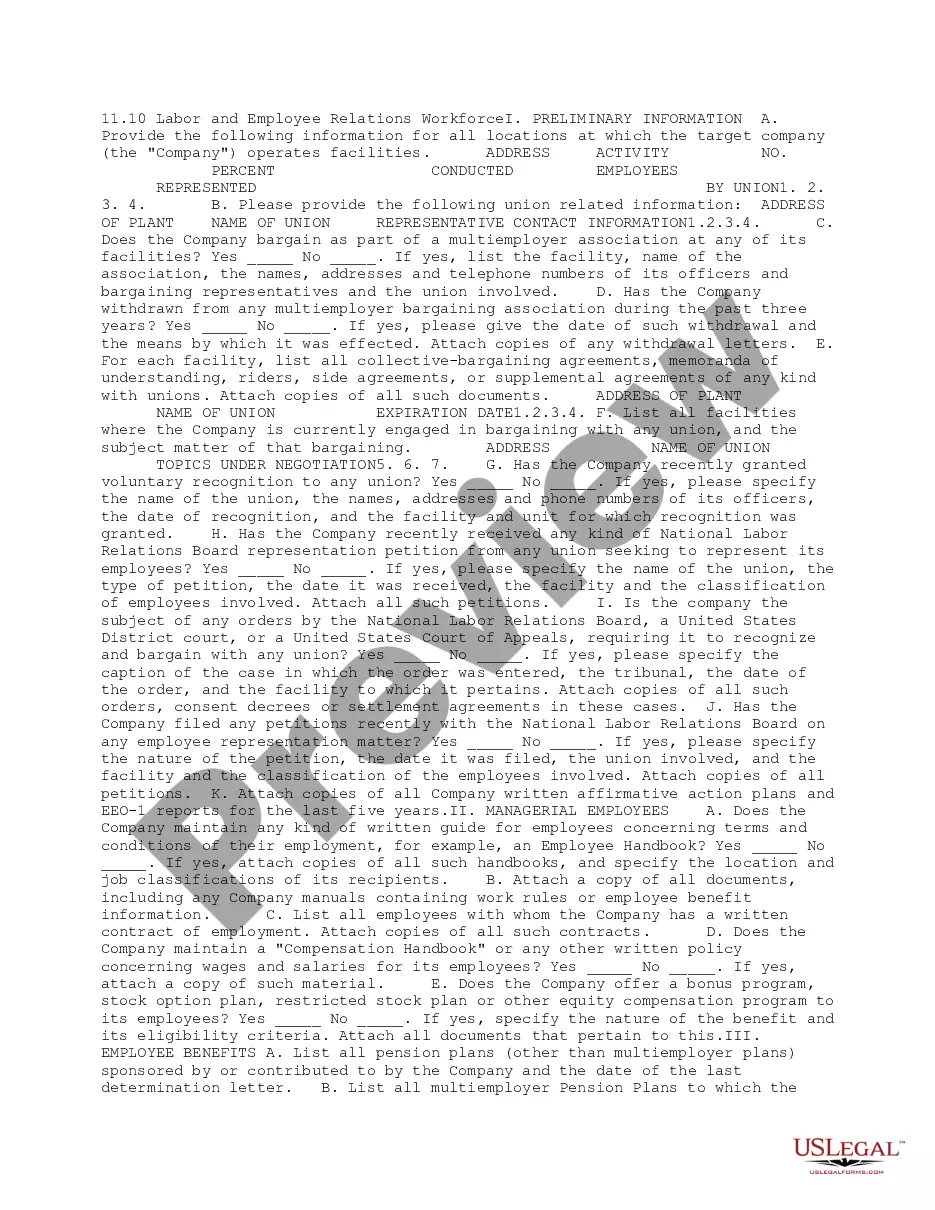

Wyoming Employment Firm Audit

Description

How to fill out Employment Firm Audit?

Locating the appropriate legal document format can be a challenge.

Certainly, there are numerous templates accessible online, but how can you obtain the legal form you need.

Utilize the US Legal Forms website.

First, ensure you have selected the correct form for the location/region. You can browse the form using the Preview option and read the form summary to confirm it meets your needs.

- This service offers a multitude of templates, including the Wyoming Employment Firm Audit, suitable for both business and personal purposes.

- All documents are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and select the Obtain option to download the Wyoming Employment Firm Audit.

- Use your account to review the legal forms you have previously ordered.

- Navigate to the My documents section of your account to obtain another copy of the required document.

- If you are a new user of US Legal Forms, here are straightforward steps for you to follow.

Form popularity

FAQ

Generally, the EDD employment tax audits cover a three-year statutory period, comprising the 12 most recently completed calendar quarters. An audit begins with the examination of records for a test year which is generally the most recent completed calendar year.

The EDD conducts benefit audits on a daily, weekly, and quarterly basis to help pay Unemployment Insurance (UI) benefits to only eligible claimants, help you control your UI costs, and protect the integrity of the UI Program and UI Trust Fund.

What happens if I get audited by EDD? If you get an EDD audit, you could be liable to face penalties and interest on taxes that you owe. These sorts of fines include a percentage of unpaid taxes, set dollar amounts for each case of unreported employees or independent contractors, among others.

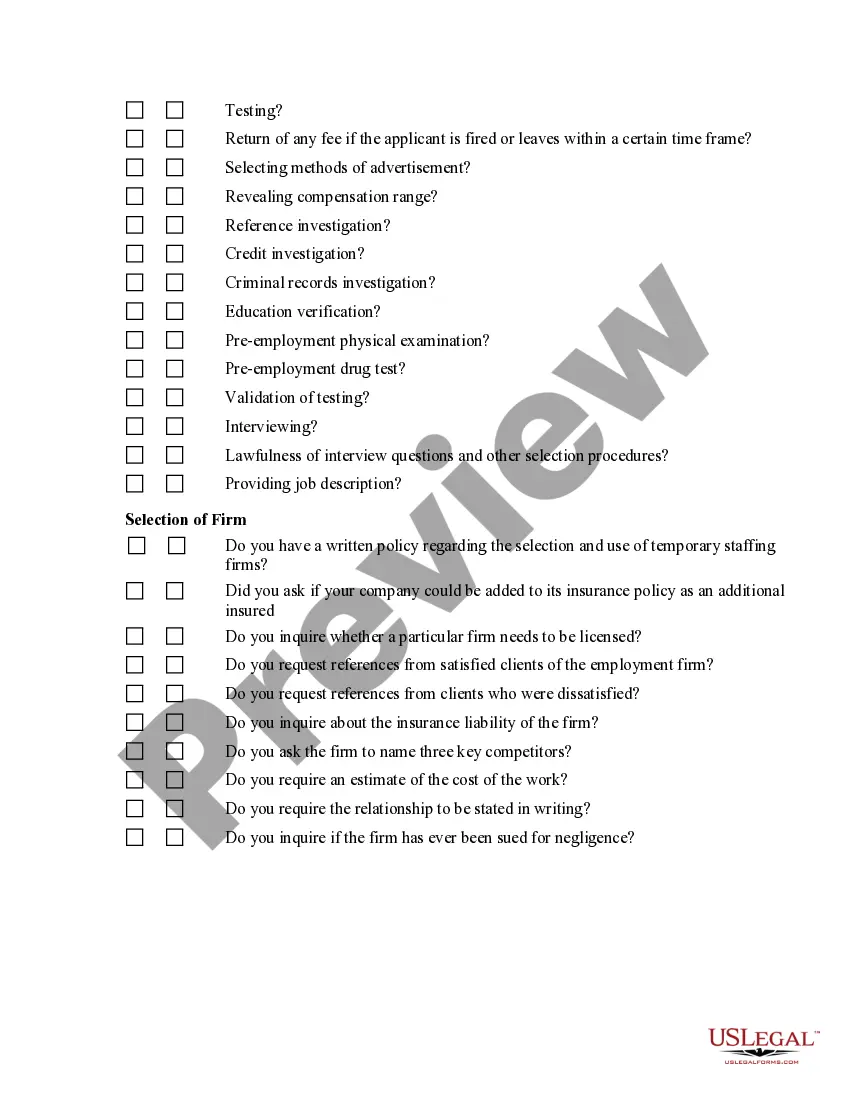

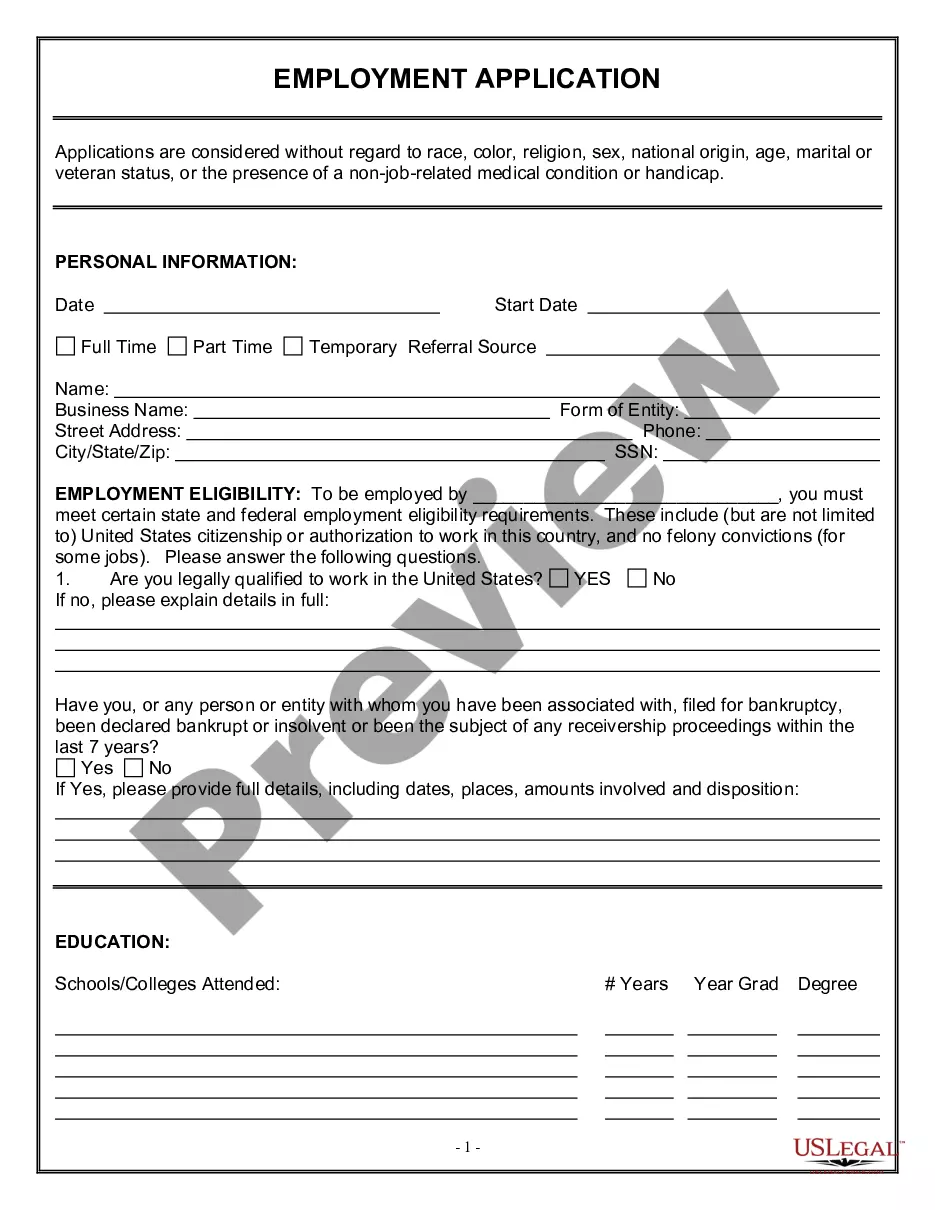

An audit can be as simple as reviewing employment files to ensure that they are in order or it can involve reviewing effectiveness of corporate HR policies, which may include interviewing supervisors, managers and employees. Audits can be broad, incorporating how a business operates and reviewing efficiencies.

Discrepancies in reported wageIf a former worker files for unemployment benefits, and wages reported to MDES do not match the records for the worker, an audit may be initiated.

Overview of ESD Audits. The Washington State Employment Security Department (ESD) audits records of employers located in Washington to confirm that wages and hours are accurately reported and to ensure compliance with the state's unemployment insurance laws and rules.

A job audit is a formal review of the current duties and responsibilities assigned to a position to ensure appropriate classification within the classified pay program. An audit should be requested if the duties and responsibilities of a position have significantly changed.

The EDD Verification Process While the Employment Development Department does not audit all employers, rather it does conduct verification audits of companies that are selected at random or based on certain criteria.

The EDD can decide to audit if a worker makes the case that he or she is an employee rather than an independent contractor (typically found out when the employee tries to apply for unemployment insurance). Other triggers for an audit include: Filing or paying late. Errors in time records or other statement or documents.