Wyoming Sales Prospect File

Description

How to fill out Sales Prospect File?

Are you currently in the situation where you require documents for both organizational or particular purposes daily.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of document templates, including the Wyoming Sales Prospect File, designed to meet federal and state requirements.

Once you locate the correct form, simply click Buy now.

Choose the pricing plan you require, fill in the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Wyoming Sales Prospect File template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is suitable for the correct city/state.

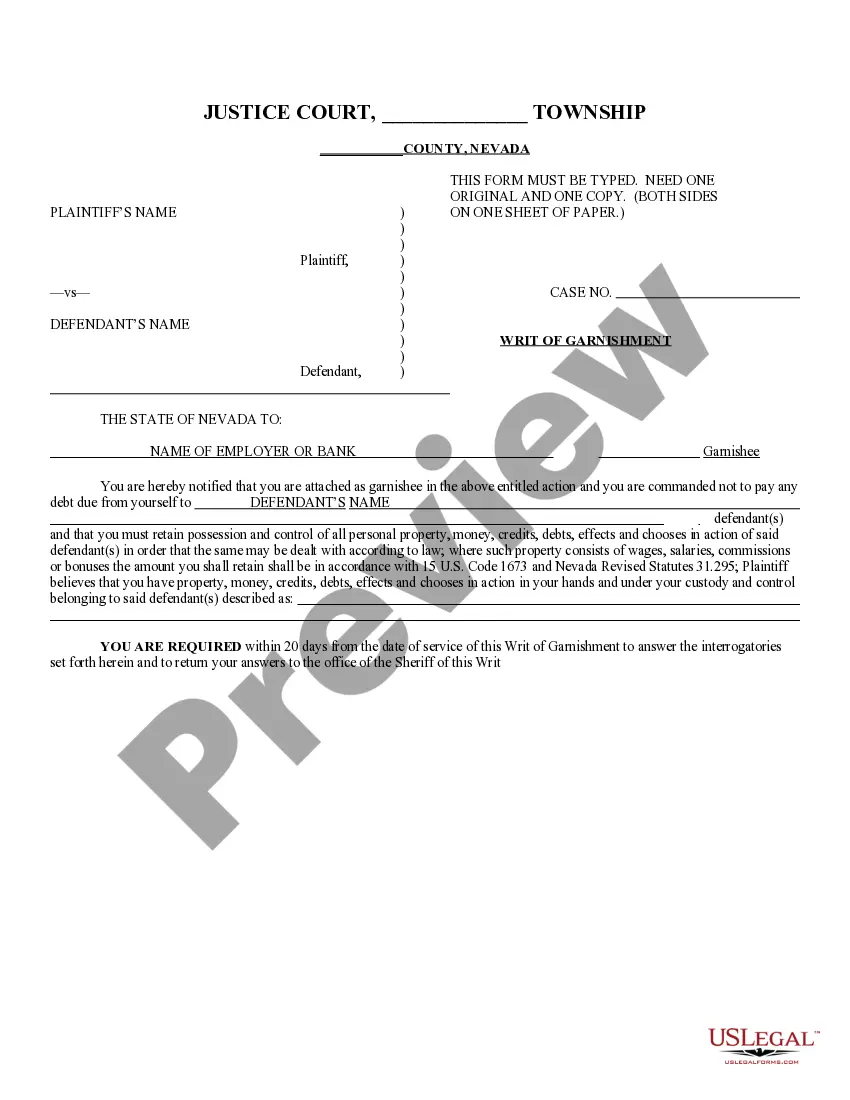

- Utilize the Review option to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search area to find the form that meets your needs.

Form popularity

FAQ

The highest sales tax rate in Wyoming is currently 4%, but local jurisdictions may add their own taxes, leading to higher rates in some areas. Knowing the local tax implications is crucial for businesses operating in the state. With the Wyoming Sales Prospect File, you can stay informed about local tax structures and trends.

Wyoming is regarded as a tax haven due to its lack of corporate income tax, franchise tax, and tax on personal income. This gives businesses an advantageous position to reinvest profits and stimulate growth. By leveraging the Wyoming Sales Prospect File, companies can uncover new prospects to capitalize on these tax advantages.

The tax-friendly nature of Wyoming stems from its unique combination of tax benefits and support for businesses. With no income tax and a streamlined regulatory environment, many business owners find it an inviting place to set up shop. The Wyoming Sales Prospect File can serve as a key resource in identifying potential clients and partners who appreciate these benefits.

Wyoming is classified as a tax-friendly state due to its favorable tax policies, such as no state income tax and low business taxes. These policies foster an environment conducive to entrepreneurship and economic growth. Entrepreneurs can greatly benefit by utilizing the Wyoming Sales Prospect File to navigate the advantageous landscape effectively.

Wyoming offers numerous tax advantages, including no personal or corporate income tax, low sales tax rates, and no inventory tax. This appealing structure enhances the business climate, making it a prime location for entrepreneurs. By tapping into the Wyoming Sales Prospect File, you can discover valuable insights on how to maximize these benefits.

Yes, if your business sells goods or services in Wyoming, you are required to collect sales tax. This applies to both physical and online sales, ensuring compliance with state regulations. Utilizing the Wyoming Sales Prospect File can help you determine your sales tax obligations more effectively.

To obtain a Wyoming sales tax ID, you must register your business with the Wyoming Department of Revenue. You can do this online or through mail by completing the required forms. Once registered, you can leverage the Wyoming Sales Prospect File to gain insights into your market and optimize your sales strategies.

Wyoming compensates for its lack of income tax with revenue from alternative sources, particularly sales and property taxes. This tax structure attracts businesses and individuals seeking a favorable environment for growth. As a result, many entrepreneurs find that the Wyoming Sales Prospect File aids in identifying opportunities in this tax-friendly state.

Filing a sale in Wyoming generally involves documenting the transaction and reporting it on your sales tax return. To ensure compliance with state regulations, maintain accurate records of each sale. Using services like US Legal Forms can simplify this process, allowing you to stay organized and informed.

In Wyoming, sales tax is applied at the point of sale and collected by the seller. Different localities may have varying rates, so it's important to stay informed about rates in your specific area. Platforms such as US Legal Forms offer guidance and tools to help you understand and manage sales tax obligations effectively.