Wyoming Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor

Description

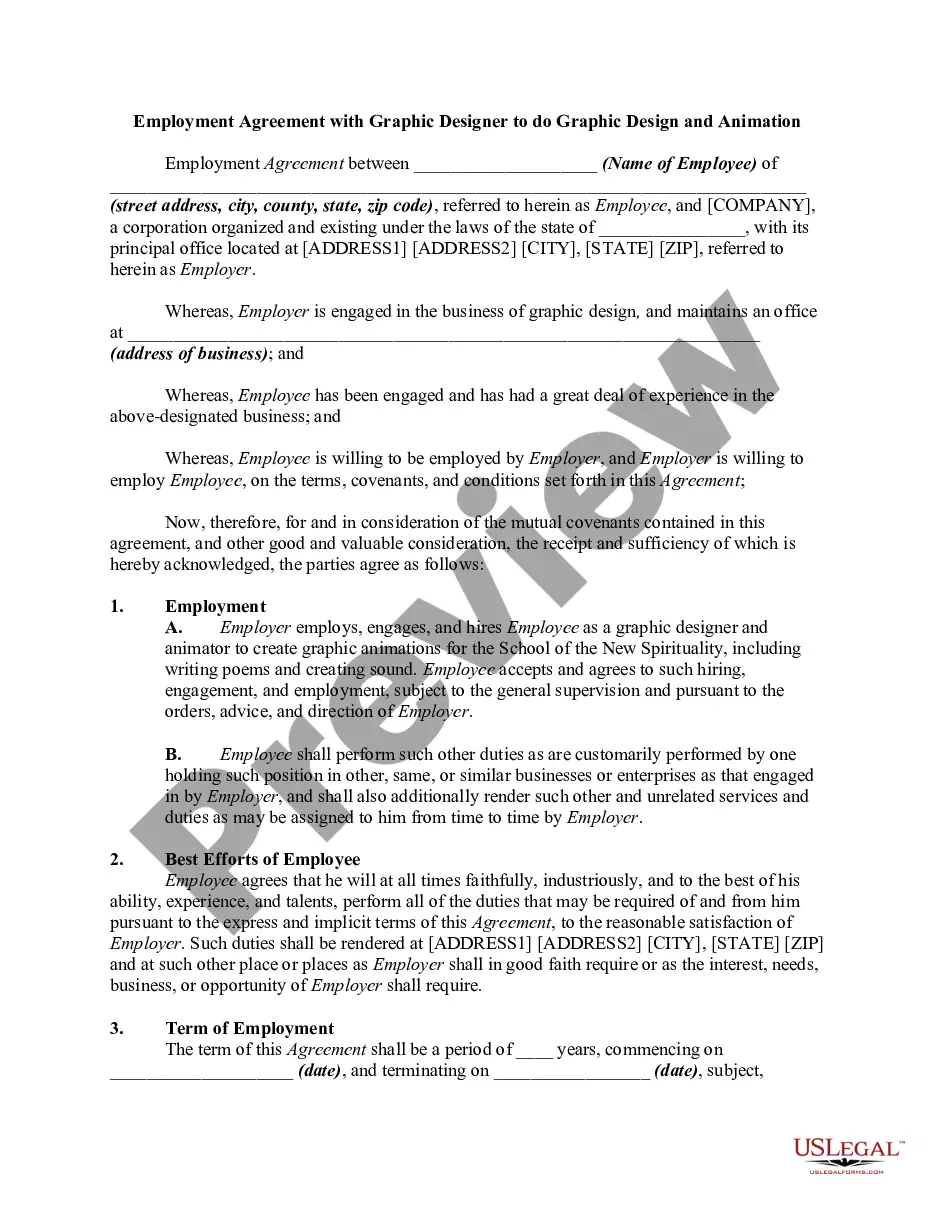

How to fill out Partnership Buy-Sell Agreement Fixing Value And Requiring Sale By Estate Of Deceased Partner To Survivor?

US Legal Forms - one of many greatest libraries of authorized types in the United States - offers a wide range of authorized papers themes you can obtain or print out. Making use of the web site, you will get 1000s of types for enterprise and individual functions, sorted by classes, claims, or keywords.You will discover the most recent models of types much like the Wyoming Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor within minutes.

If you have a monthly subscription, log in and obtain Wyoming Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor from your US Legal Forms library. The Download option will appear on each type you view. You gain access to all formerly delivered electronically types from the My Forms tab of your respective account.

In order to use US Legal Forms for the first time, allow me to share simple recommendations to get you started:

- Be sure you have picked the best type for the town/county. Go through the Review option to check the form`s content. See the type explanation to ensure that you have chosen the appropriate type.

- In the event the type doesn`t satisfy your demands, make use of the Lookup discipline at the top of the display screen to obtain the one who does.

- If you are pleased with the form, verify your option by clicking the Get now option. Then, pick the costs program you want and give your references to sign up on an account.

- Method the transaction. Use your bank card or PayPal account to complete the transaction.

- Pick the formatting and obtain the form on the system.

- Make changes. Load, edit and print out and sign the delivered electronically Wyoming Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor.

Each format you included with your bank account lacks an expiry time and is yours eternally. So, if you would like obtain or print out an additional version, just visit the My Forms section and click on the type you need.

Gain access to the Wyoming Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor with US Legal Forms, one of the most extensive library of authorized papers themes. Use 1000s of professional and status-particular themes that meet up with your business or individual requirements and demands.

Form popularity

FAQ

A business valuation is a general process of determining the economic value of a whole business or company unit. Business valuation can be used to determine the fair value of a business for a variety of reasons, including sale value, establishing partner ownership, taxation, and even divorce proceedings.

This is one of the few ways that the parties can feel comfortable that the valuation will be unbiased and take into consideration the company's current condition. The valuation provision of a buy-sell agreement covers how a shareholder's interest will be priced.

The key elements of a buy-sell agreement include:Element 1. Identify the parties.Element 2. Triggered buyout event.Element 3. Buy-sell structure.Element 4. Company valuation.Element 5. Funding resources.Element 6. Taxation considerations.

A purchase and sale agreement is different from a purchase agreement in one particular way. Rather than complete the transaction, a purchase and sale agreement will facilitate it while providing clear guidance regarding party responsibility. By signing the contract, you do not agree to buy or sell the house.

Cross-purchase agreements allow remaining owners to buy the interests of a deceased or selling owner. Redemption agreements require the business entity to buy the interests of the selling owner.

The creation of buy-sell agreements involves a certain amount of future-thinking. The parties must think about what could, might, or will happen and write an agreement that will work for all sides in the event an agreement is triggered at some unknown time in the future.

Right to access books and accounts: Each partner can inspect and copy books of accounts of the business. This right is applicable equally to active and dormant partners. Right to share profits: Partners generally describe in their deed the proportion in which they will share profits of the firm.

Buyout agreement (also known as a buy-sell agreement) refers to a contract that gives rights to at least one party of the contract to buy the share, assets, or rights of another party given a specific event. These agreements can arise in a variety of contexts as stand-alone contracts or parts of larger agreements.

Using a buy/sell agreement to establish the value of a business interest. A buy/sell agreement is a contract between the members of an LLC that provides for the sale (or offer to sell) of a member's interest in the business to the other members or to the LLC when a specified event or events occur.