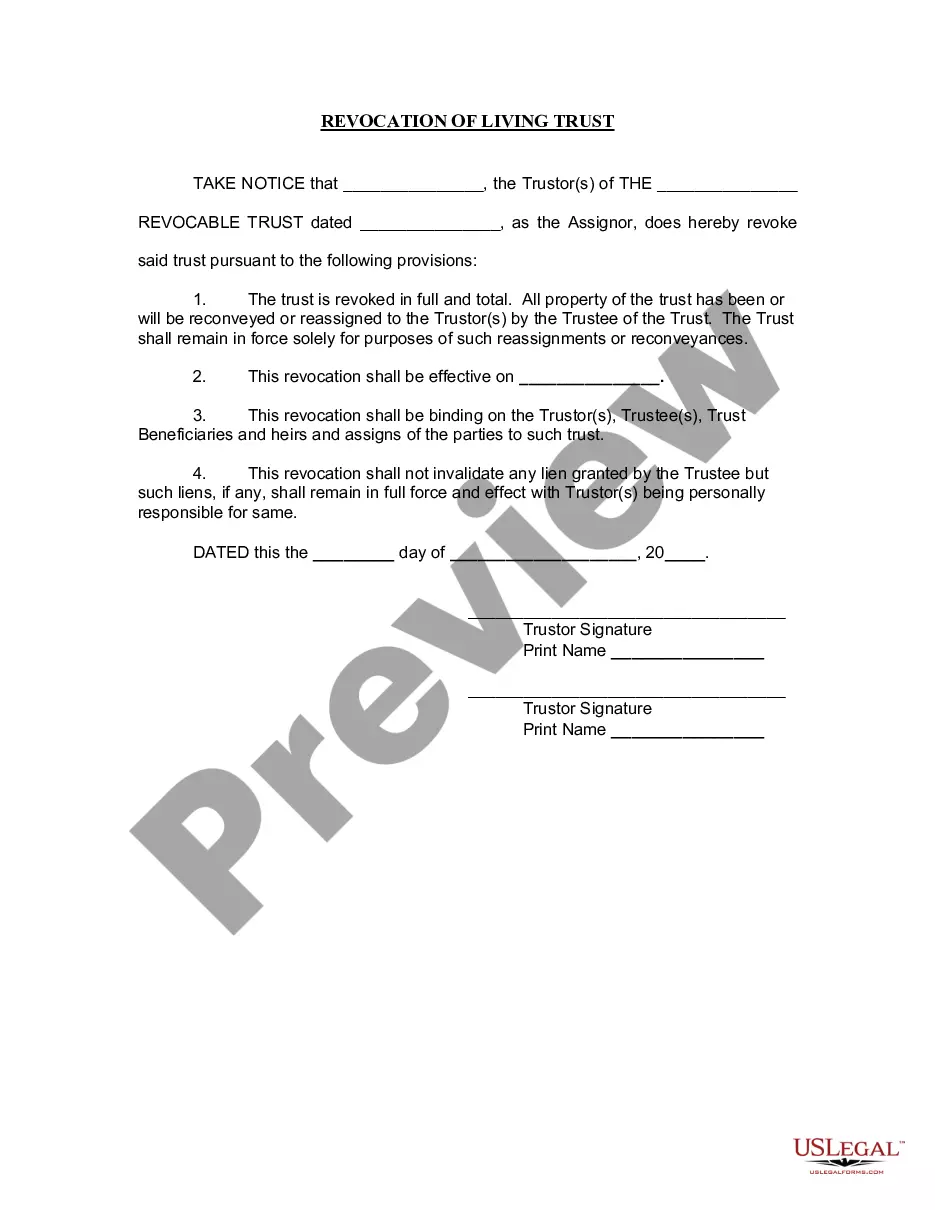

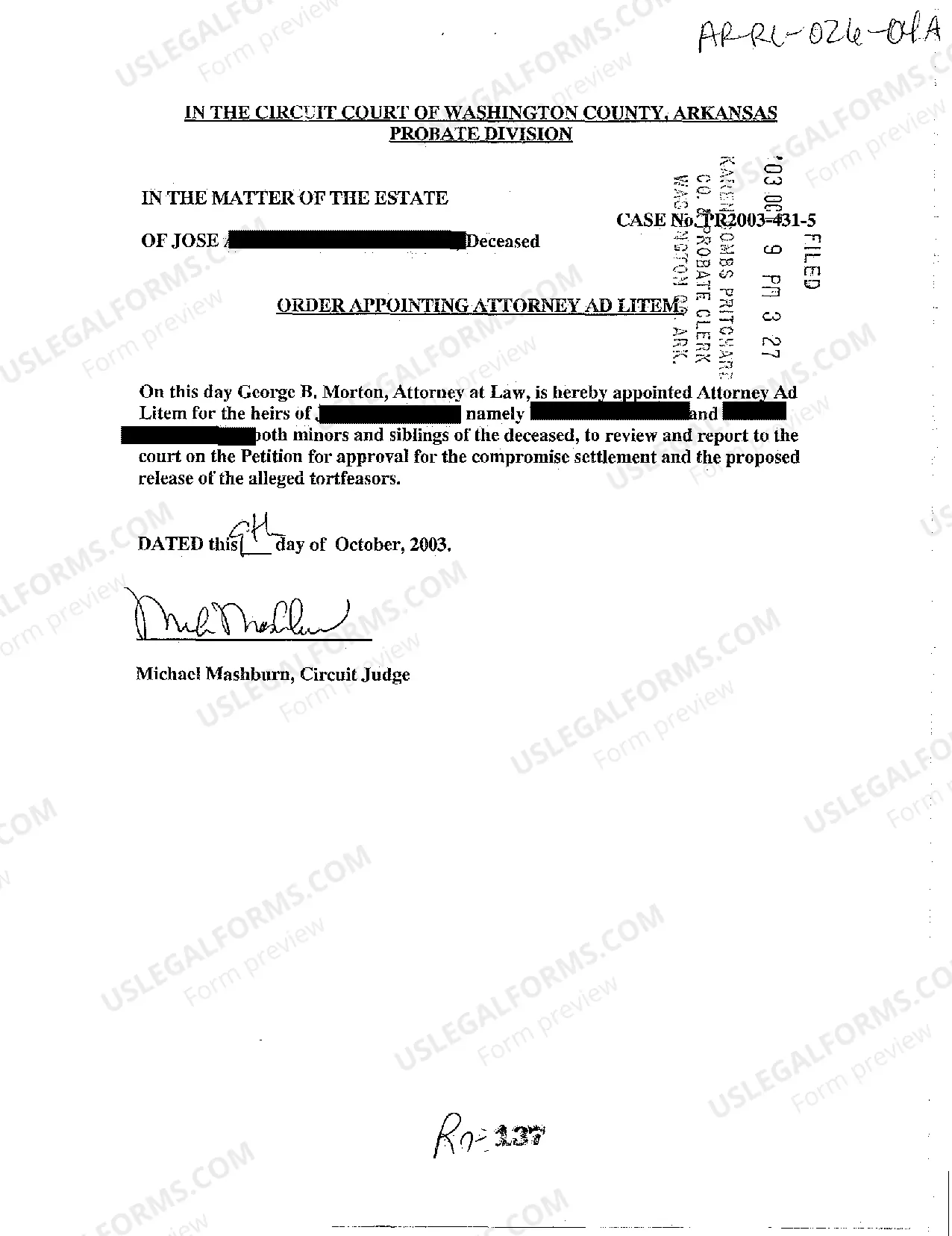

Wyoming Sample Letter to Workers Compensation Commission for Issuance of Subpoena

Description

How to fill out Sample Letter To Workers Compensation Commission For Issuance Of Subpoena?

US Legal Forms - one of several greatest libraries of lawful varieties in the United States - offers a variety of lawful papers layouts you may acquire or printing. Utilizing the site, you will get a large number of varieties for organization and person functions, sorted by types, claims, or key phrases.You will discover the most recent variations of varieties such as the Wyoming Sample Letter to Workers Compensation Commission for Issuance of Subpoena within minutes.

If you already have a registration, log in and acquire Wyoming Sample Letter to Workers Compensation Commission for Issuance of Subpoena from the US Legal Forms local library. The Obtain option can look on each kind you look at. You have access to all earlier delivered electronically varieties within the My Forms tab of your accounts.

If you wish to use US Legal Forms the very first time, listed below are straightforward recommendations to obtain started:

- Be sure you have chosen the proper kind for the metropolis/area. Select the Preview option to analyze the form`s content material. Browse the kind description to ensure that you have selected the right kind.

- If the kind does not fit your demands, make use of the Search field on top of the display to obtain the the one that does.

- Should you be content with the shape, affirm your option by simply clicking the Get now option. Then, choose the rates plan you prefer and give your credentials to register for an accounts.

- Procedure the deal. Make use of your Visa or Mastercard or PayPal accounts to finish the deal.

- Choose the structure and acquire the shape in your device.

- Make adjustments. Fill out, revise and printing and indicator the delivered electronically Wyoming Sample Letter to Workers Compensation Commission for Issuance of Subpoena.

Each and every template you added to your account lacks an expiration time and it is your own permanently. So, if you want to acquire or printing one more copy, just visit the My Forms area and click on in the kind you want.

Obtain access to the Wyoming Sample Letter to Workers Compensation Commission for Issuance of Subpoena with US Legal Forms, the most comprehensive local library of lawful papers layouts. Use a large number of professional and express-specific layouts that fulfill your organization or person demands and demands.

Form popularity

FAQ

Your Social Security number. Contact information for your last employer, including their mailing address. The last day you worked. Names of employers and dates you worked for any employment outside the state of Wyoming within the past 18 months.

At any time more than 60 days after service of the complaint and at least 28 days before the date set for trial, any party may serve on an opposing party an offer to allow settlement or judgment on specified terms, with the costs then accrued.

The Unemployment Tax Rates in Wyoming are assigned per W.S. 27-3 Article 5. Employers with at least three years of ?experience? on their account will be assigned a base rate calculated on their specific benefit ratio.

(A) In addition to the disclosures required by paragraph (1), (1.1) or (1.2), a party must disclose to the other parties the identity of any witness it may use at trial to present evidence under Wyoming Rule of Evidence 702, 703, or 705. (B) Witnesses Who Must Provide a Written Report.

Determination ? An official decision by the Unemployment Insurance Division regarding the unemployment claim of a person. Disqualified or Disqualification ? A condition, as defined in the Wyoming Statutes, which may disqualify a claimant from receiving benefits.

Unemployment insurance recipients in Wyoming must meet the following criteria in order to qualify for benefits: Recipients must have lost employment through no fault of their own. Recipients must have earned sufficient wages during the base period?the first 12 months of the 15 months prior to filing a claim.

Temporary Total Disability benefits are the equivalent of 2/3 of your gross monthly wage at the time of injury, but cannot exceed the Statewide Average Wage for the quarter you were injured. Temporary Total Disability benefits are not taxable.

Final Payments The State of Wyoming requires an employer to issue a final paycheck to an employee who resigns or is discharged no later than the employer's usual practice on regularly scheduled payroll dates. Wyo. Stat. § 27-4-104.