Wyoming Sample Letter for Estate - Correspondence from Attorney

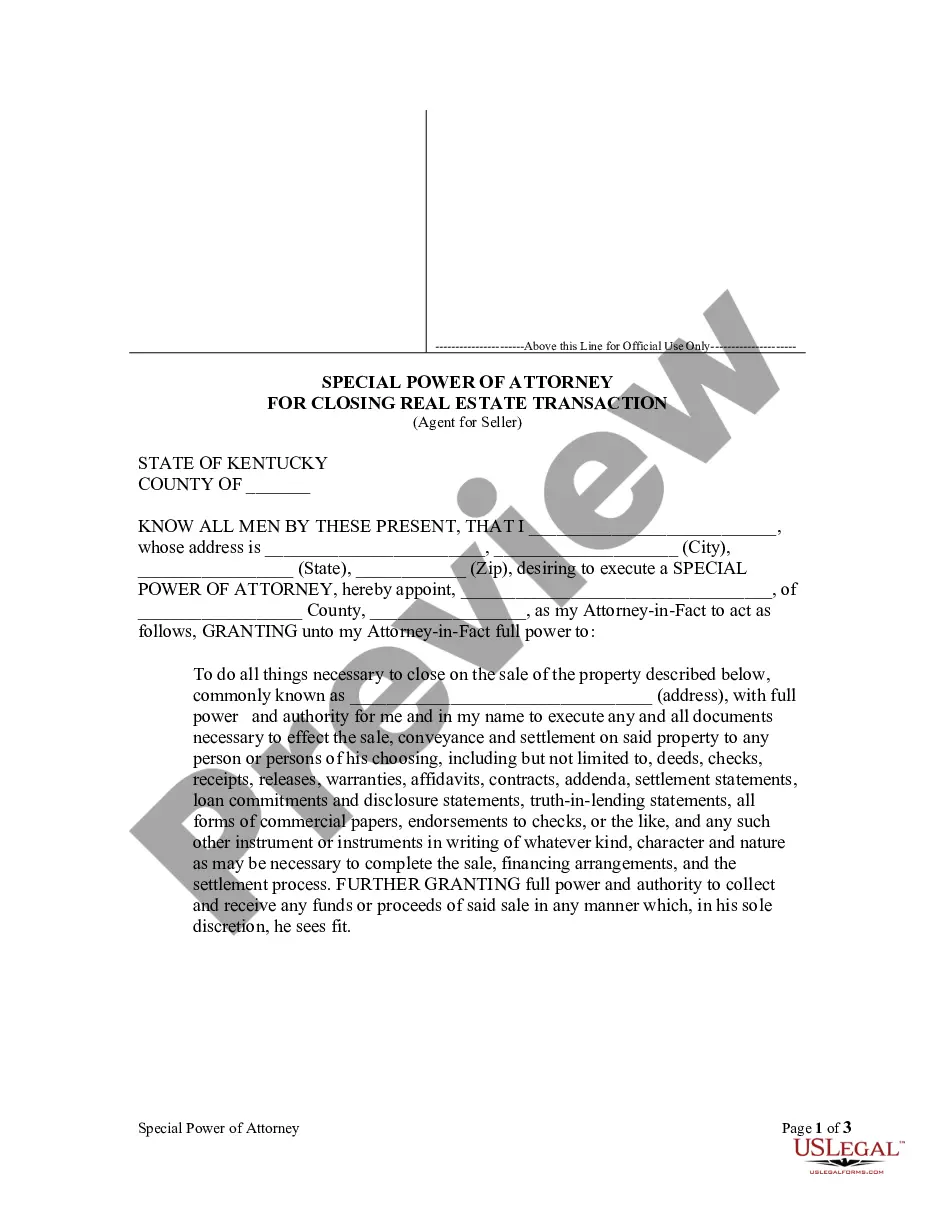

Description

How to fill out Sample Letter For Estate - Correspondence From Attorney?

Choosing the best legal record web template can be quite a struggle. Of course, there are tons of web templates accessible on the Internet, but how would you get the legal develop you need? Use the US Legal Forms website. The services delivers 1000s of web templates, for example the Wyoming Sample Letter for Estate - Correspondence from Attorney, which you can use for organization and personal needs. All of the forms are checked by specialists and fulfill state and federal needs.

In case you are currently authorized, log in for your bank account and click the Obtain option to have the Wyoming Sample Letter for Estate - Correspondence from Attorney. Utilize your bank account to search with the legal forms you possess bought previously. Check out the My Forms tab of your respective bank account and acquire yet another duplicate from the record you need.

In case you are a fresh user of US Legal Forms, allow me to share straightforward guidelines for you to follow:

- First, make certain you have chosen the appropriate develop for the city/state. You can check out the form using the Review option and study the form information to ensure it will be the right one for you.

- When the develop does not fulfill your expectations, take advantage of the Seach discipline to discover the proper develop.

- Once you are positive that the form is proper, click on the Acquire now option to have the develop.

- Opt for the pricing plan you need and enter the needed info. Create your bank account and purchase the transaction making use of your PayPal bank account or Visa or Mastercard.

- Choose the submit file format and down load the legal record web template for your gadget.

- Complete, modify and printing and sign the received Wyoming Sample Letter for Estate - Correspondence from Attorney.

US Legal Forms may be the greatest local library of legal forms where you can find different record web templates. Use the company to down load expertly-produced files that follow express needs.

Form popularity

FAQ

A good rule of thumb is probate can take anywhere from around six months to about a year for an average estate in Wyoming to be settled. Of course, more complex and larger estates can take years, and simpler, basic estates might even be handled more quickly.

A Wyoming small estate affidavit is a document that speeds up the settlement of a recently deceased person's estate, as long as the value of the entire estate is less than $200,000. This form is generally referred to as the Application for a Decree of Summary Distribution of Property.

Joint accounts and joint title are widely-used ways to avoid probate. Married couples can own real estate or financial accounts through joint tenancy with right of survivorship. Some states also allow tenancy in the entirety for real estate to avoid probate.

A probate will be necessary to transfer the decedent's estate to the heir if the decedent owned assets there were: Located in Wyoming. Worth more than $200,000 (as of the writing of this article, not counting mortgages and other encumbrances) Held in the decedent's sole name, rather than in a trust or joint tenancy.

Probate of a Small Estate The Affidavit for Distribution and the Application for Decree of Distribution can be used individually or together, depending on whether the decedent owned real property or personal property, or both. However, the total value of real and personal property must be less than $200,000.00.

In Wyoming, a probate court will name an estate executor after a person passes without a will or a living trust. The executor must begin the probate process within 30 days of learning that the estate owner passed away. If they fail to file within 30 days, the court may establish a new executor.

In Wyoming, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Living trusts A living trust is often the best choice for a large estate or if there are many beneficiaries. To avoid probate, most people create a living trust commonly called a revocable living trust.