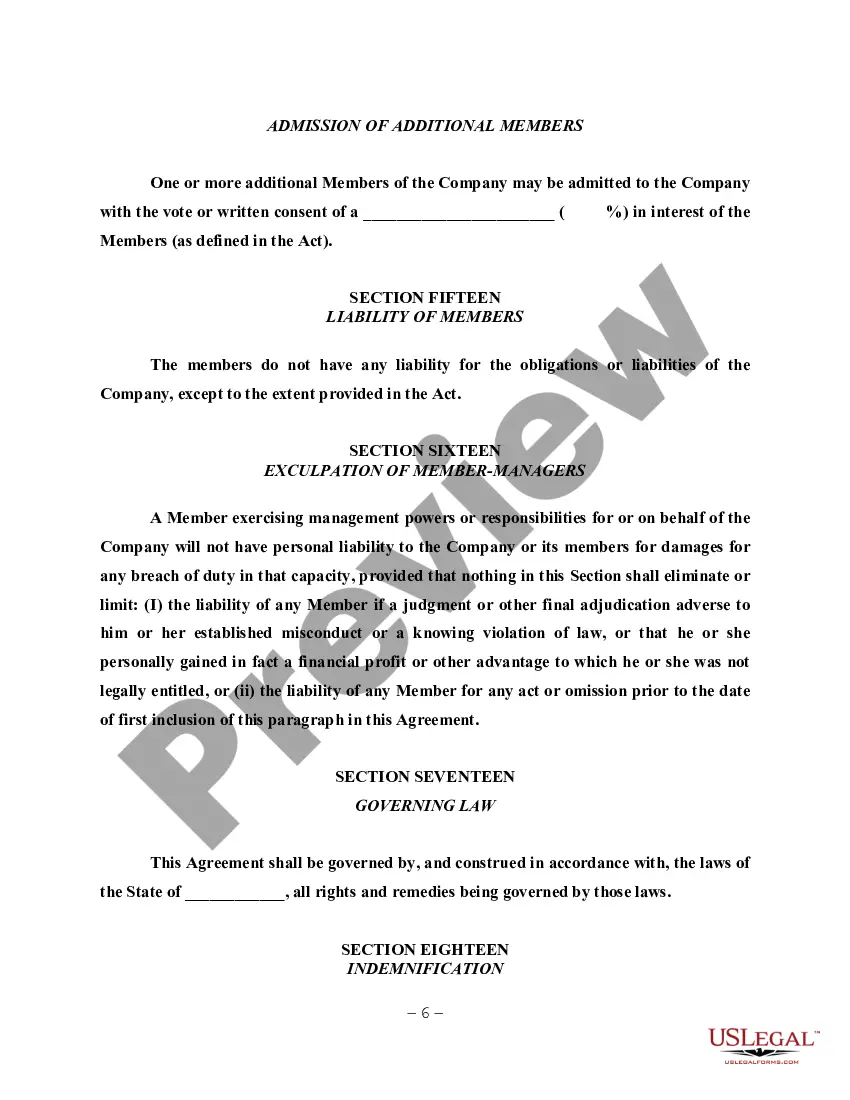

Wyoming Sample LLC Operating Agreement

Description

How to fill out Sample LLC Operating Agreement?

Selecting the appropriate legal document template can be quite a challenge.

Naturally, there are numerous designs accessible online, but how do you find the legal document you desire? Utilize the US Legal Forms website.

The service offers a vast selection of templates, such as the Wyoming Sample LLC Operating Agreement, which can be utilized for business and personal purposes.

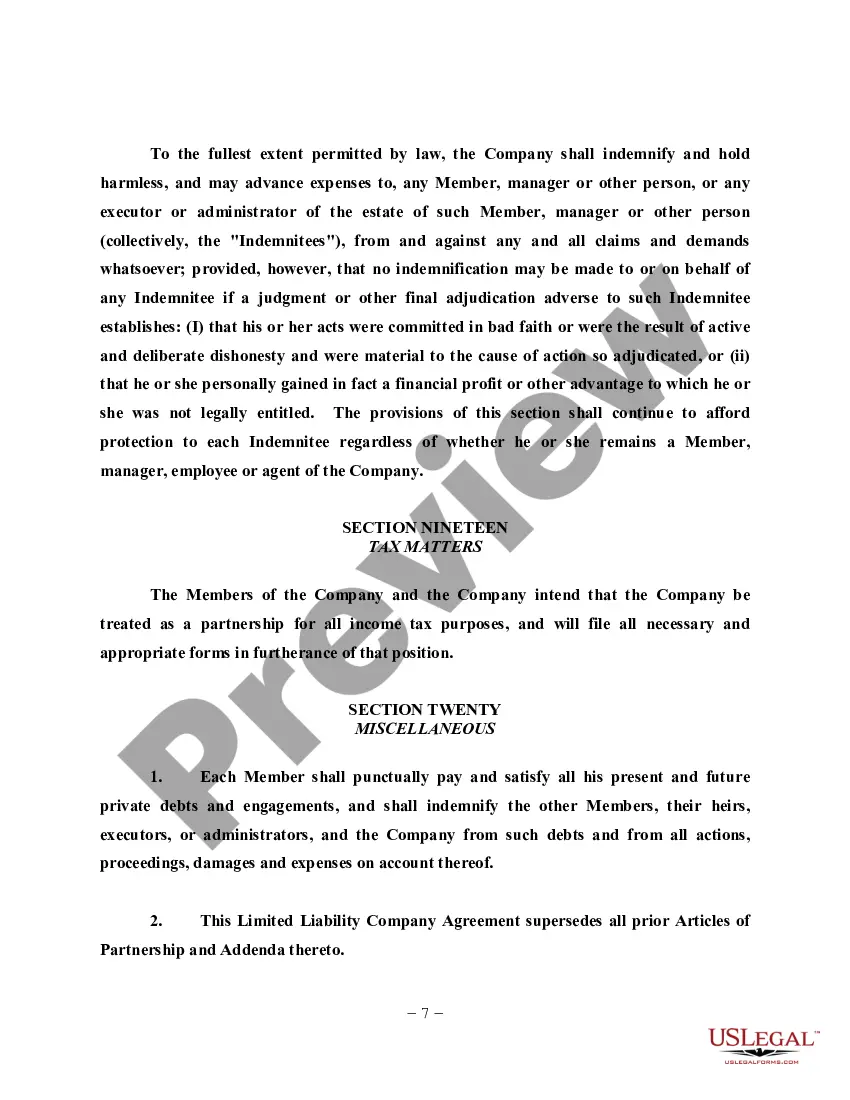

Should the document not meet your requirements, use the Search field to find the appropriate form. Once you are sure that the document is accurate, click on the Buy now button to obtain the document. Choose the pricing plan you prefer, provide the necessary details, create your account, and pay for the order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Wyoming Sample LLC Operating Agreement. US Legal Forms is the largest repository of legal templates through which you can find a variety of document designs. Utilize the service to obtain properly crafted documents that comply with state regulations.

- All templates are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Wyoming Sample LLC Operating Agreement.

- Use your account to review the legal templates you have previously obtained.

- Navigate to the My documents section of your account to download an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, confirm that you have selected the correct document for your location. You can view the document using the Preview button and read the document description to ensure it is suitable for you.

Form popularity

FAQ

In Wyoming, the Series LLC is established by statute. The statute provides that the Series shall have the power and capacity to contract, hold title to assets and have separate rights with respect to the asset, and can hold the Series in the name of the Series or in the name of the limited liability company.

A Series LLC gives you all the same benefits as a regular LLC, but it serves as a sort of "umbrella company" with additional flexibility and protections for multiple companies or lines of business within your overall operation.

The main benefits of forming a LLC in Wyoming are:No state income tax on limited liability companies. Asset protection and limited liability. LLC assets are safe from personal liabilities. Charging order protection extended to single member LLC's.

Is an LLC Operating Agreement required in Wyoming? No. An Operating Agreement is not required in Wyoming. Although it is not required, the SBA recommends that all LLCs in every state have a clear and detailed Operating Agreement.

Has 2 LLC filings to maintain (a Domestic Wyoming LLC and a Foreign California LLC) has 2 state filing fees. has to meet annual requirements and fees in both states. may have increased Registered Agent fees.

Wyoming does not levy state and business taxes on LLCs. This is helpful for Wyoming residents since they won't have to pay double taxes. Being one of the zero-income tax states, Wyoming remains appealing to many LLC owners. It also implements zero corporate tax, franchise tax, and stock tax.

With a Series LLC, a holding company can hold all individual businesses under a single umbrella while mitigating the risk of one business' assets being used to satisfy the debts or liabilities incurred by another of its businesses.

Moreover, because Wyoming also doesn't have a personal income tax, LLC members generally will owe no state tax on income they earn from a Wyoming LLC. The only tax for LLCs, mentioned above, is the annual license tax of $50 or a small percentage of the value of your LLC's assets located in Wyoming.

The Close LLC is designed with small businesses in mind. The Wyoming LLC Act allows close companies to sidestep onerous formalities while otherwise keeping the benefits of a Wyoming LLC. Generally, the designation is for single-member LLCs and for when members are close to one another, i.e. family and close friends.

Wyoming is better than Delaware for forming an LLC. Delaware is made for Fortune 500 Corporations, not for small business owners who desire low fees and asset protection. Wyoming is a leading incorporation provider with low fees and no corporate income taxes.