Wyoming Complaint for Impropriety Involving Loan Application

Description

How to fill out Complaint For Impropriety Involving Loan Application?

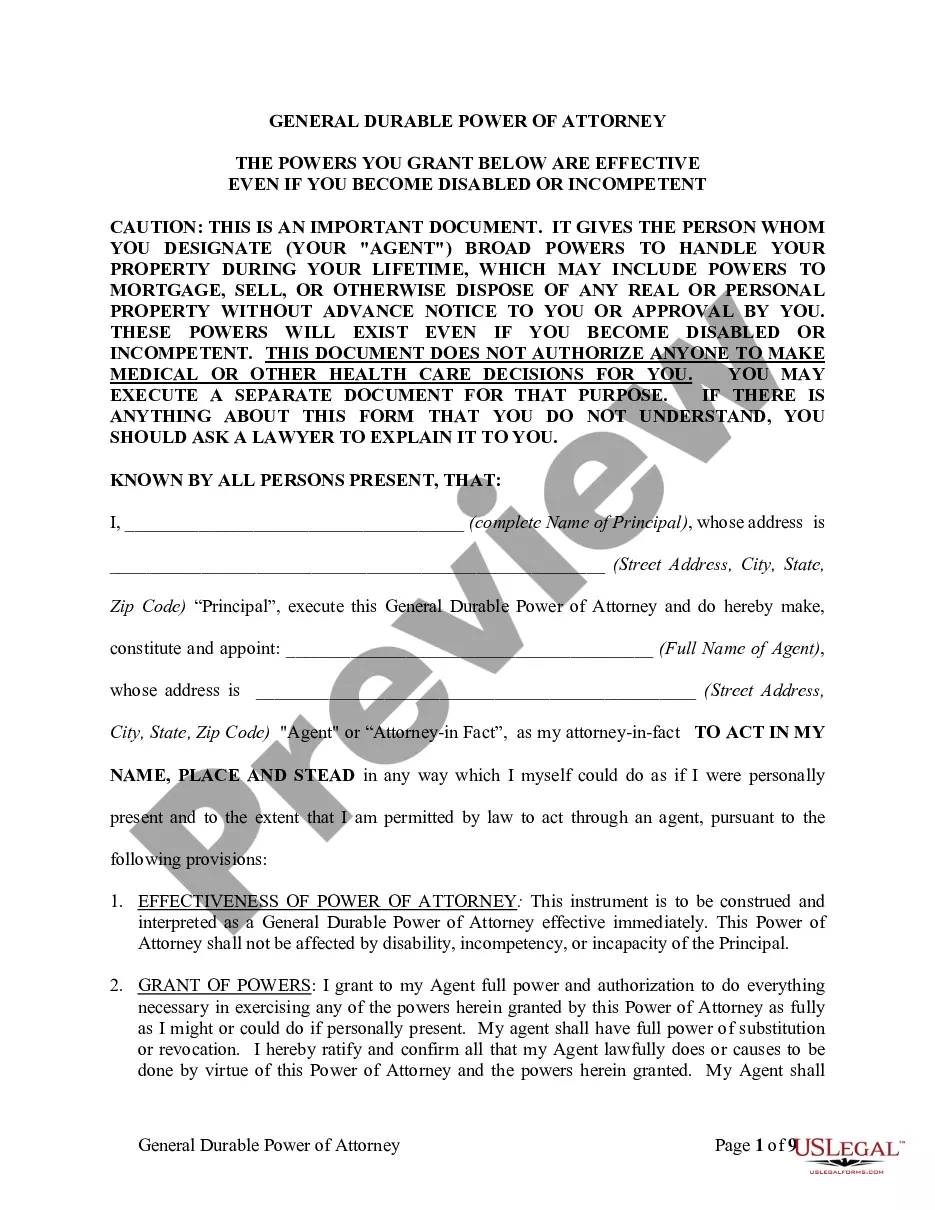

Are you in the place in which you need to have documents for either business or individual reasons virtually every day time? There are tons of lawful papers templates available online, but discovering kinds you can trust isn`t straightforward. US Legal Forms delivers 1000s of kind templates, just like the Wyoming Complaint for Impropriety Involving Loan Application, that are created to satisfy state and federal specifications.

Should you be previously acquainted with US Legal Forms site and get an account, merely log in. After that, you may obtain the Wyoming Complaint for Impropriety Involving Loan Application design.

Should you not provide an account and want to begin to use US Legal Forms, abide by these steps:

- Obtain the kind you will need and make sure it is to the appropriate town/county.

- Take advantage of the Review key to examine the form.

- See the outline to actually have selected the appropriate kind.

- In the event the kind isn`t what you`re searching for, make use of the Research area to obtain the kind that meets your requirements and specifications.

- When you obtain the appropriate kind, click Acquire now.

- Select the pricing strategy you would like, fill out the required details to produce your money, and pay for an order making use of your PayPal or credit card.

- Pick a handy paper file format and obtain your copy.

Discover each of the papers templates you might have purchased in the My Forms menus. You can aquire a more copy of Wyoming Complaint for Impropriety Involving Loan Application at any time, if possible. Just click the necessary kind to obtain or printing the papers design.

Use US Legal Forms, the most comprehensive assortment of lawful kinds, to save lots of some time and avoid faults. The assistance delivers expertly produced lawful papers templates which you can use for a range of reasons. Create an account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

How does the FDIC resolve a closed bank? In the unlikely event of a bank failure, the FDIC acts quickly to protect insured depositors by arranging a sale to a healthy bank, or by paying depositors directly for their deposit accounts to the insured limit. Purchase and Assumption Transaction.

You may also file a complaint via the FDIC's FDIC Information and Support Center. State your inquiry or complaint, making certain to include the name and street address of the bank. Provide a brief description of your complaint. Enclose copies of related documentation.

File banking and credit complaints with the Consumer Financial Protection Bureau. If contacting your bank directly does not help, visit the Consumer Financial Protection Bureau (CFPB) complaint page to: See which specific banking and credit services and products you can complain about through the CFPB.

In most cases, the FDIC will try to find another banking institution to acquire the failed bank. If that happens, customers' accounts will simply transfer over to the new bank. You will get information about the transition, and you will likely get new debit cards and checks (if applicable).

You may also file a complaint via the FDIC's FDIC Information and Support Center. State your inquiry or complaint, making certain to include the name and street address of the bank. Provide a brief description of your complaint. Enclose copies of related documentation.