Wyoming Assignment of LLC Company Interest to Living Trust

Description

How to fill out Assignment Of LLC Company Interest To Living Trust?

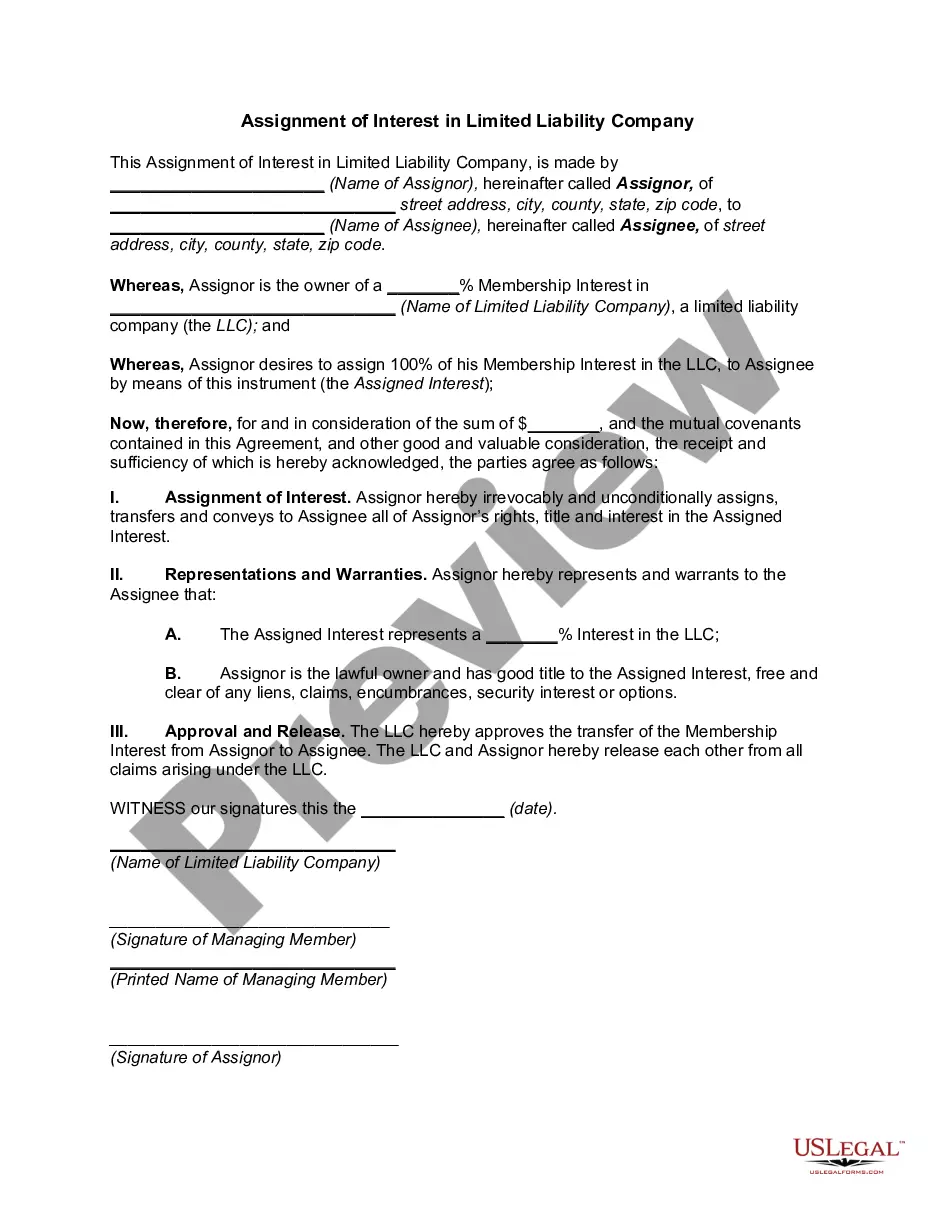

Are you currently in a location where you require documents for both business or personal use on a daily basis? There are numerous valid document templates available online, but finding ones you can trust isn't straightforward. US Legal Forms offers thousands of template documents, such as the Wyoming Assignment of LLC Company Interest to Living Trust, designed to comply with federal and state requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Wyoming Assignment of LLC Company Interest to Living Trust template.

If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct region/state.

- Use the Preview button to review the form.

- Check the outline to make sure you have selected the right form.

- If the form isn't what you're looking for, utilize the Search field to find the form that fits your needs and specifications.

- Once you have the correct form, click Purchase now.

- Choose the pricing plan you desire, fill in the required details to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Select a convenient document format and download your copy.

Form popularity

FAQ

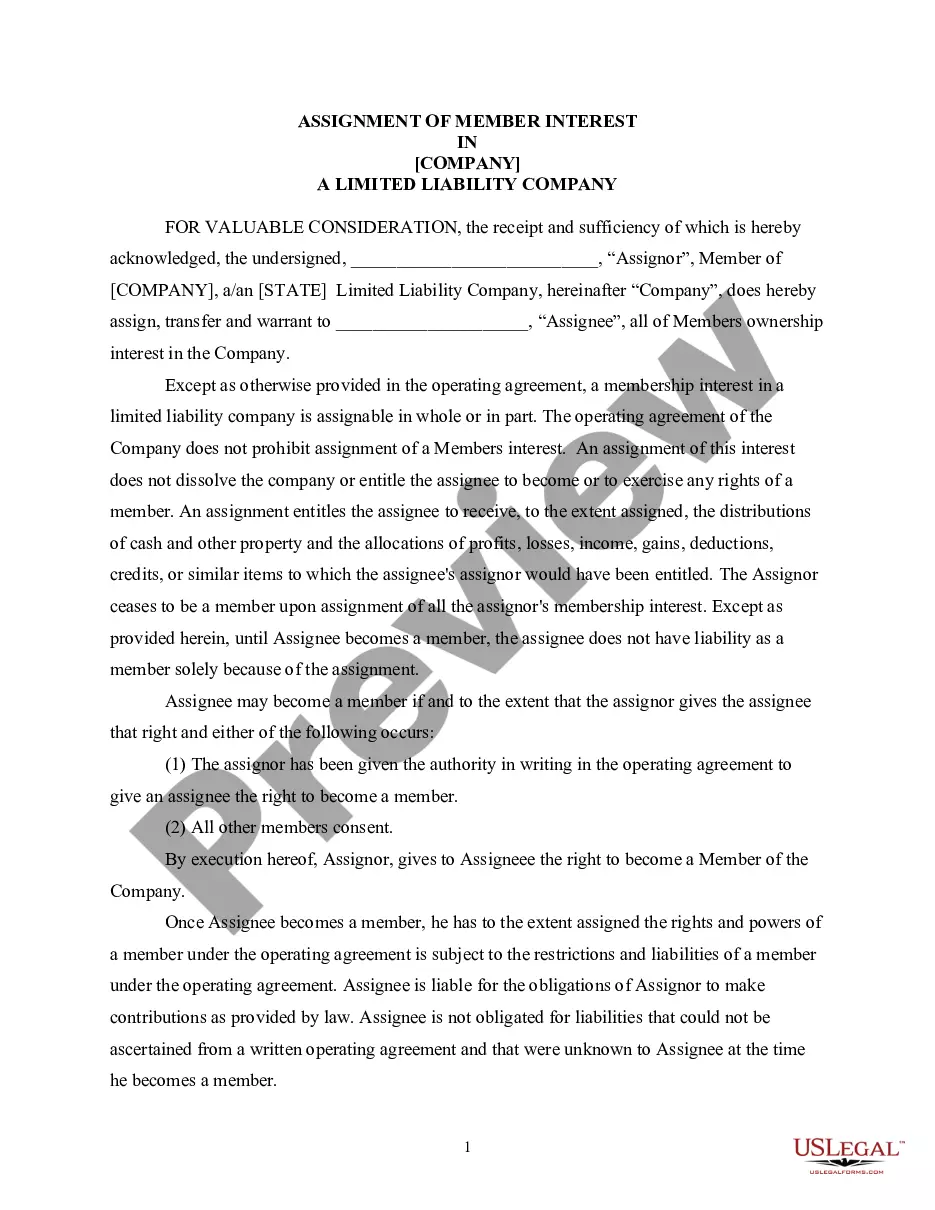

If an LLC member's interest is held in a trust, then the administrator, sometimes called a "trustee," will vote and otherwise exercise the duties and rights of the LLC member. Transferring the membership interest to the trust could require an official transfer document, which is similar to a bill of sale.

The answer is yes. First, trust law permits trusteeswho are acting on behalf of trusts, including revocable truststo own any asset, or almost any asset, that an individual can own, and this includes an interest in an LLC, which qualifies as an asset.

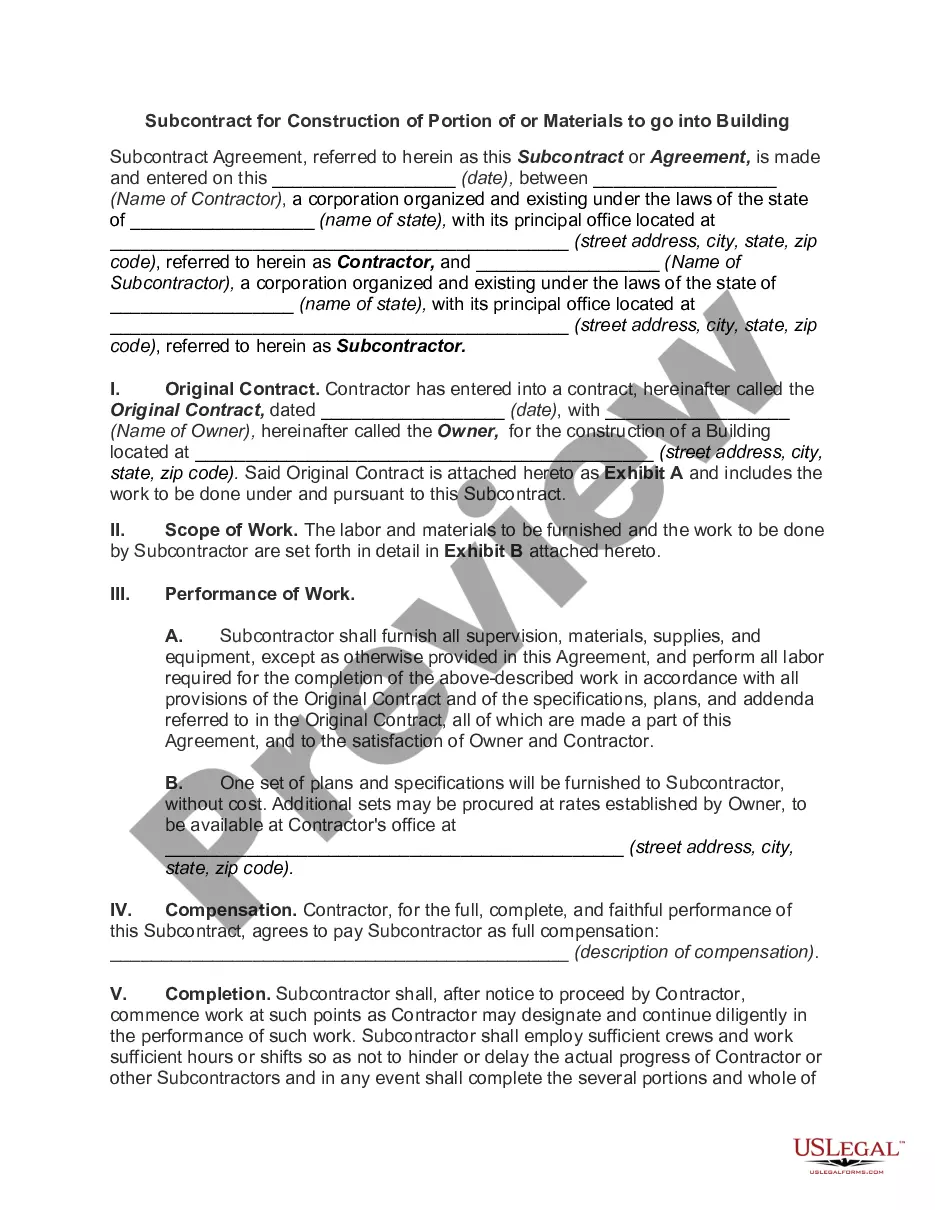

Yes. California LLC members can sell their ownership interests through either a partial transfer of just your interest or through a complete sale of the LLC. However, any other members in the LLC must agree to the transfer.

Updated July 13, 2020: If you're wondering can a trust own a corporation, the answer is yes, but only specific types of trusts qualify. As a legally separate entity, a trust manages and holds specific assets for a beneficiary's benefit.

For an LLC interest to be properly transferred to a revocable trust, the LLC must change the owner of record to the trust (specifically, to the trustee, as trustee of the trust).

The answer is yes. First, trust law permits trusteeswho are acting on behalf of trusts, including revocable truststo own any asset, or almost any asset, that an individual can own, and this includes an interest in an LLC, which qualifies as an asset.

Yes, an irrevocable trust can own an LLC.

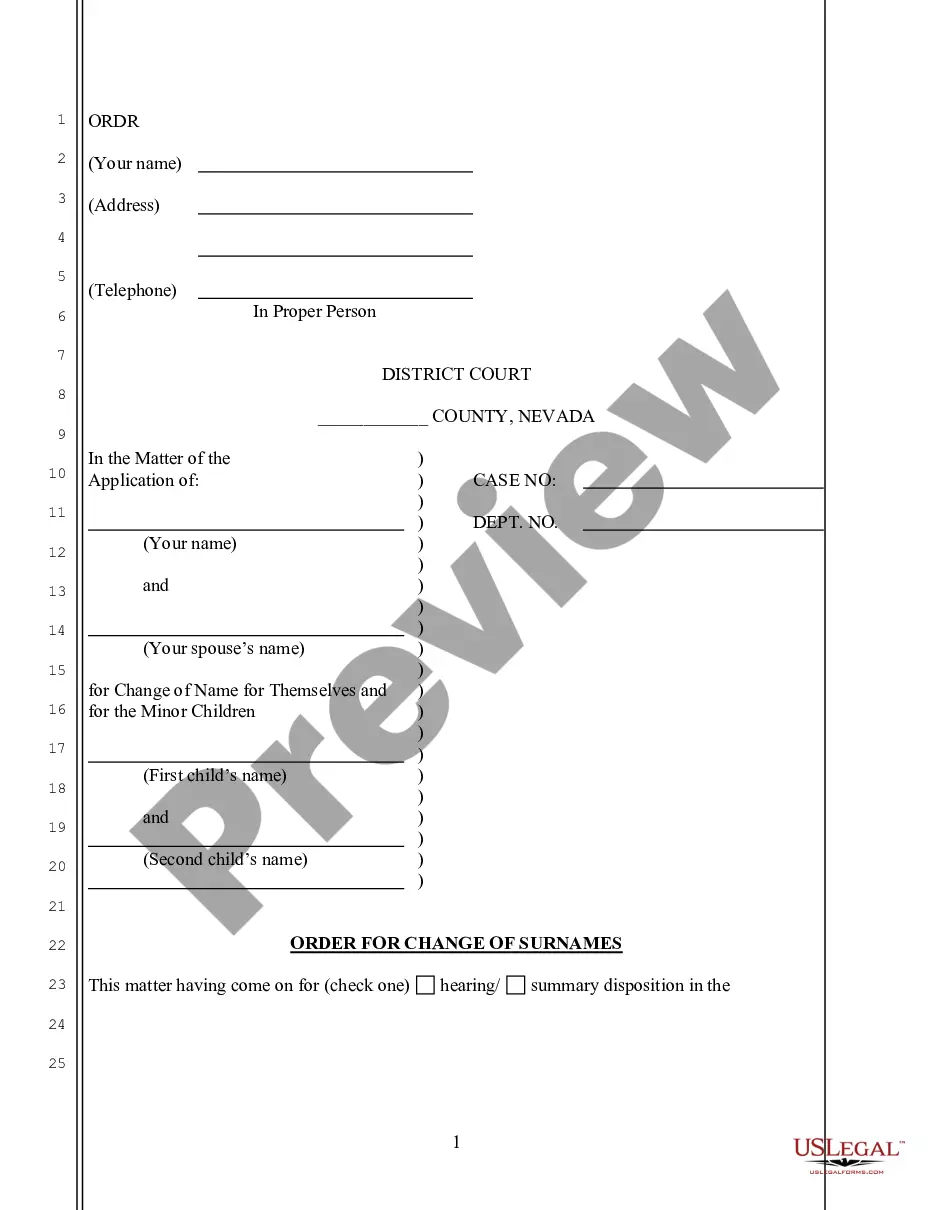

Here is how you can transfer your LLC to your Trust:Draft and Execute the Transfer Document.Draft and File an Amendment to your Articles of Organization with the Arizona Corporation Commission.Amend the Operating Agreement.Have LLC Members Sign a Resolution Accepting Transfer.

Generally, holding each piece of real property in a separate limited liability company (LLC) owned by a revocable trust is an effective way of ownership with a number of business and estate planning advantages: Asset Protection. Owning property through an LLC maximizes the protection for your personal assets.