Wyoming Assignment and Bill of Sale to Corporation

Description

How to fill out Assignment And Bill Of Sale To Corporation?

Are you in a circumstance where you require documents for either business or personal purposes nearly every day.

There are numerous legitimate document templates available online, but finding reliable ones can be challenging.

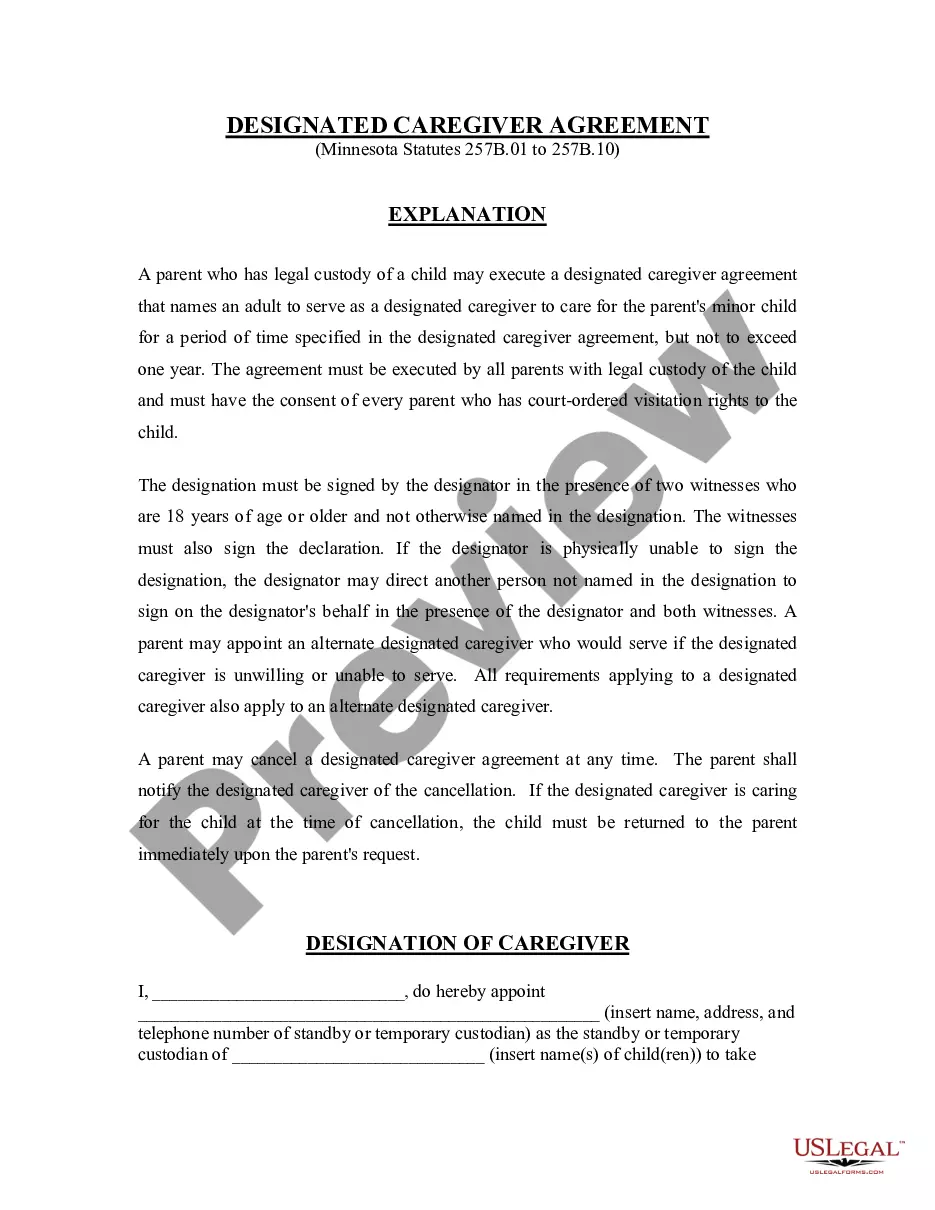

US Legal Forms offers a wide array of form templates, including the Wyoming Assignment and Bill of Sale to Corporation, which are designed to meet federal and state requirements.

Choose the payment plan you wish, fill in the required information to create your account, and complete the payment using your PayPal or credit card.

Select a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Wyoming Assignment and Bill of Sale to Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

- Utilize the Preview option to review the form.

- Check the description to make sure you have selected the correct form.

- If the form is not what you are looking for, use the Lookup field to find the form that meets your needs and specifications.

- When you find the correct form, click on Get now.

Form popularity

FAQ

Transferring ownership of an LLC in Wyoming involves drafting and executing a written agreement that outlines the transfer specifics, alongside notifying the state and updating the LLC's records. It's essential to follow the steps outlined in your operating agreement for a seamless process. Using a Wyoming Assignment and Bill of Sale to Corporation can provide not only clarity but also an official record of the ownership transfer for future reference.

To change the ownership of an LLC with the IRS, you must update the information on your LLC's tax forms, typically through Form 8832 or by filing articles of amendment with your state. Once ownership changes, make sure to reflect this on your tax filings to ensure compliance. Consider documenting this change with a Wyoming Assignment and Bill of Sale to Corporation to protect your interests during the transition.

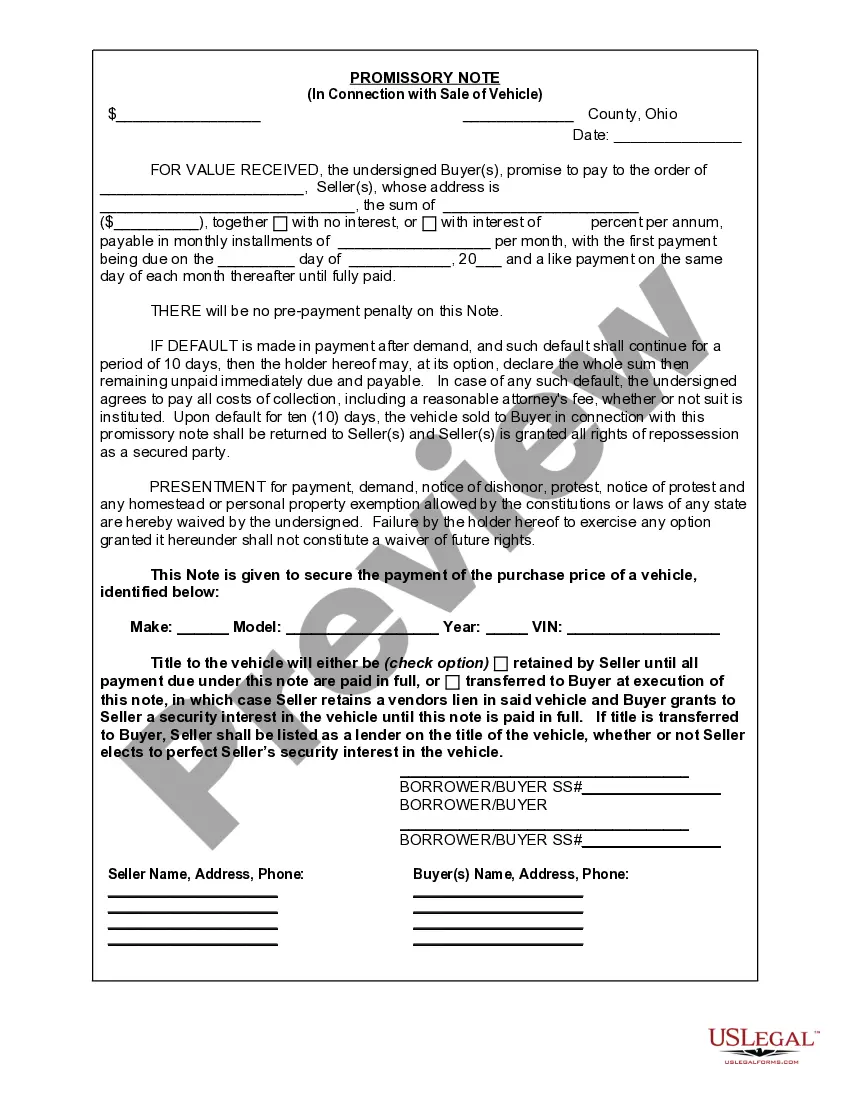

In Wyoming, you can drive a vehicle for up to 30 days with a bill of sale while waiting for formal registration. This temporary allowance gives you a grace period to complete necessary documentation. During this time, ensure that your bill of sale clearly outlines the transaction details, as it serves as a legal record of the sale under the Wyoming Assignment and Bill of Sale to Corporation.

To remove a member from a Wyoming LLC, you should refer to the operating agreement for specific procedures. Typically, this may involve a vote by remaining members followed by a written notice of removal. Additionally, documenting the removal through a Wyoming Assignment and Bill of Sale to Corporation can provide a clear record of ownership changes for future reference.

Section 17 16 821 of the Wyoming Business Corporation Act pertains to the procedures for the transfer of shares and ownership in a corporation. This section outlines the necessary steps for properly executing a transfer, which is essential for maintaining clear records and legal compliance. Understanding this section is crucial, especially when utilizing a Wyoming Assignment and Bill of Sale to Corporation in ownership transitions.

To transfer property from an LLC to an individual, you typically need to execute a transfer document, such as a bill of sale or an assignment agreement. This document should clearly state the details of the property being transferred and include signatures from authorized members of the LLC. Using a Wyoming Assignment and Bill of Sale to Corporation can help ensure that the transfer is recognized legally and properly documented.

To start a corporation in Wyoming, you first need to choose a unique name that complies with state regulations. Next, prepare and file your Articles of Incorporation with the Wyoming Secretary of State. After this, you should obtain an Employer Identification Number (EIN) from the IRS and open a business bank account. Incorporating in Wyoming is efficient, and utilizing services like USLegalForms can simplify the process of creating essential documents, including a Wyoming Assignment and Bill of Sale to Corporation.

A Wyoming bill of sale does not necessarily need to be notarized to be valid; however, including notarization can strengthen the document's credibility. To ensure a smooth transaction involving a Wyoming Assignment and Bill of Sale to Corporation, it is often recommended to notarize the document. Notarization provides an added layer of protection for both parties involved, offering peace of mind and reducing the chance of disputes.

To transfer a title in Wyoming, you must complete the appropriate title transfer form and provide a bill of sale. Both parties should sign this document to validate the transaction. Additionally, using a Wyoming Assignment and Bill of Sale to Corporation can simplify the paperwork and make the transfer process smoother.

A title transfer can act as a bill of sale, but it often depends on the specifics of the transaction. In most cases, a bill of sale accompanies the title transfer to provide additional proof of the sale. When dealing with corporations, ensure that you have a Wyoming Assignment and Bill of Sale to Corporation to cover all necessary documentation.