Wyoming Notice of Changes to Credit Card Agreement

Description

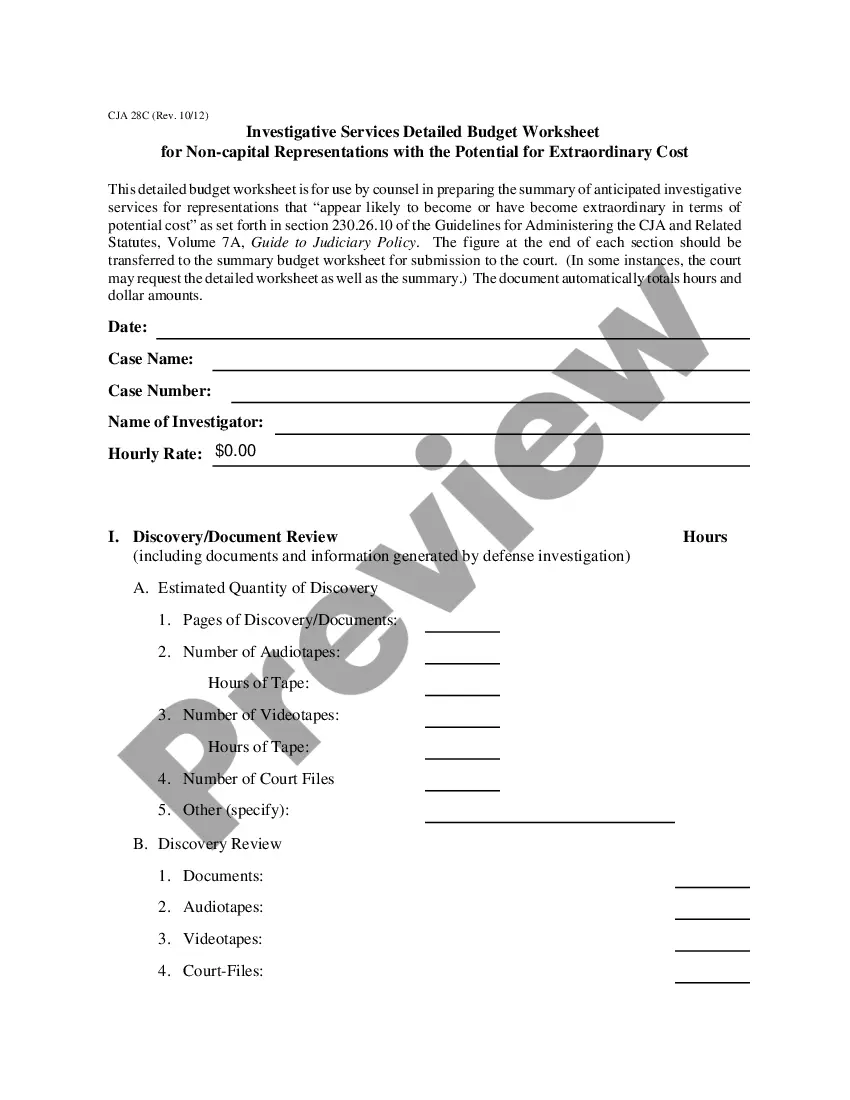

How to fill out Notice Of Changes To Credit Card Agreement?

Are you presently within a situation that you will need files for sometimes organization or personal purposes virtually every day time? There are a variety of legitimate papers themes accessible on the Internet, but getting types you can depend on is not simple. US Legal Forms gives a large number of type themes, like the Wyoming Notice of Changes to Credit Card Agreement, that are created to satisfy state and federal needs.

If you are already acquainted with US Legal Forms website and possess a free account, simply log in. Afterward, you can acquire the Wyoming Notice of Changes to Credit Card Agreement template.

Should you not provide an profile and would like to begin using US Legal Forms, abide by these steps:

- Discover the type you require and make sure it is for that proper town/state.

- Make use of the Preview switch to review the form.

- Look at the outline to ensure that you have chosen the correct type.

- In the event the type is not what you`re trying to find, take advantage of the Research discipline to discover the type that meets your requirements and needs.

- If you find the proper type, simply click Buy now.

- Select the prices prepare you need, complete the necessary information and facts to generate your bank account, and buy your order making use of your PayPal or Visa or Mastercard.

- Pick a practical paper format and acquire your backup.

Find all of the papers themes you may have bought in the My Forms food selection. You can aquire a further backup of Wyoming Notice of Changes to Credit Card Agreement any time, if necessary. Just click the needed type to acquire or print out the papers template.

Use US Legal Forms, probably the most considerable collection of legitimate forms, to save some time and steer clear of errors. The assistance gives skillfully created legitimate papers themes that you can use for an array of purposes. Make a free account on US Legal Forms and initiate generating your life a little easier.

Form popularity

FAQ

Key Takeaways A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans.

Key Takeaways. The cardholder agreement is the document specifying the exact provisions of a credit card. Due to consumer protection laws, cardholder agreements must be written in language that can be easily read and understood by the public.

Generally, the notice must be provided to you at least 45 days before the change takes effect. There are some exceptions: If you agreed to a particular change, the bank must still provide you with a written notice, but it does not have to be provided before the change takes effect.

Loans and credits are different finance mechanisms. While a loan provides all the money requested in one go at the time it is issued, in the case of a credit, the bank provides the customer with an amount of money, which can be used as required, using the entire amount borrowed, part of it or none at all.

Remember, a credit card agreement is a legally-binding document.

A credit card agreement is defined as the written document or documents evidencing the terms of the legal obligation, or the prospective legal obligation, between a card issuer and a consumer for a credit card account under an open-end (not home-secured) consumer credit plan.

If your bank switched a card from Visa to Mastercard, it was likely because they felt the features and benefits of Mastercard were better than those of Visa. For example, the issuer might take into consideration processing fees or network-level benefits like travel insurance or purchase protection.

When they plan to increase your rate or other fees. Your credit card company must send you a notice 45 days before they can increase your interest rate; change certain fees (such as annual fees, cash advance fees, and late fees) that ap- ply to your account; or make other significant changes to the terms of your card.