Wyoming Agreement to Assign Lease to Incorporator in Forming Corporation

Description

How to fill out Agreement To Assign Lease To Incorporator In Forming Corporation?

If you need to gather, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's user-friendly and efficient search feature to find the documents you need.

Many templates for business and personal purposes are organized by categories and states, or keywords. Utilize US Legal Forms to acquire the Wyoming Agreement to Assign Lease to Incorporator in Forming Corporation with just a few clicks.

Every legal document format you acquire is yours permanently. You have access to each form you have purchased in your account.

Visit the My documents section and select a form to print or download again. Complete, download, and print the Wyoming Agreement to Assign Lease to Incorporator in Forming Corporation with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Wyoming Agreement to Assign Lease to Incorporator in Forming Corporation.

- You can also access forms you previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct region/country.

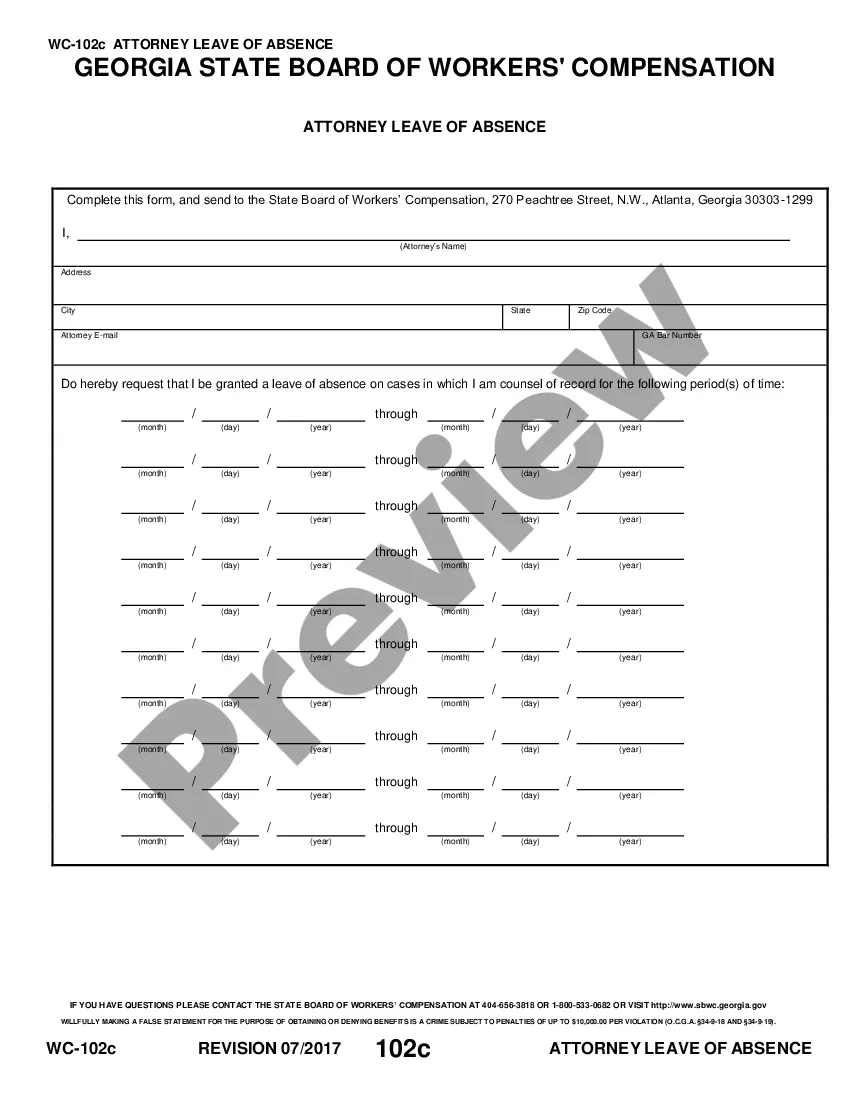

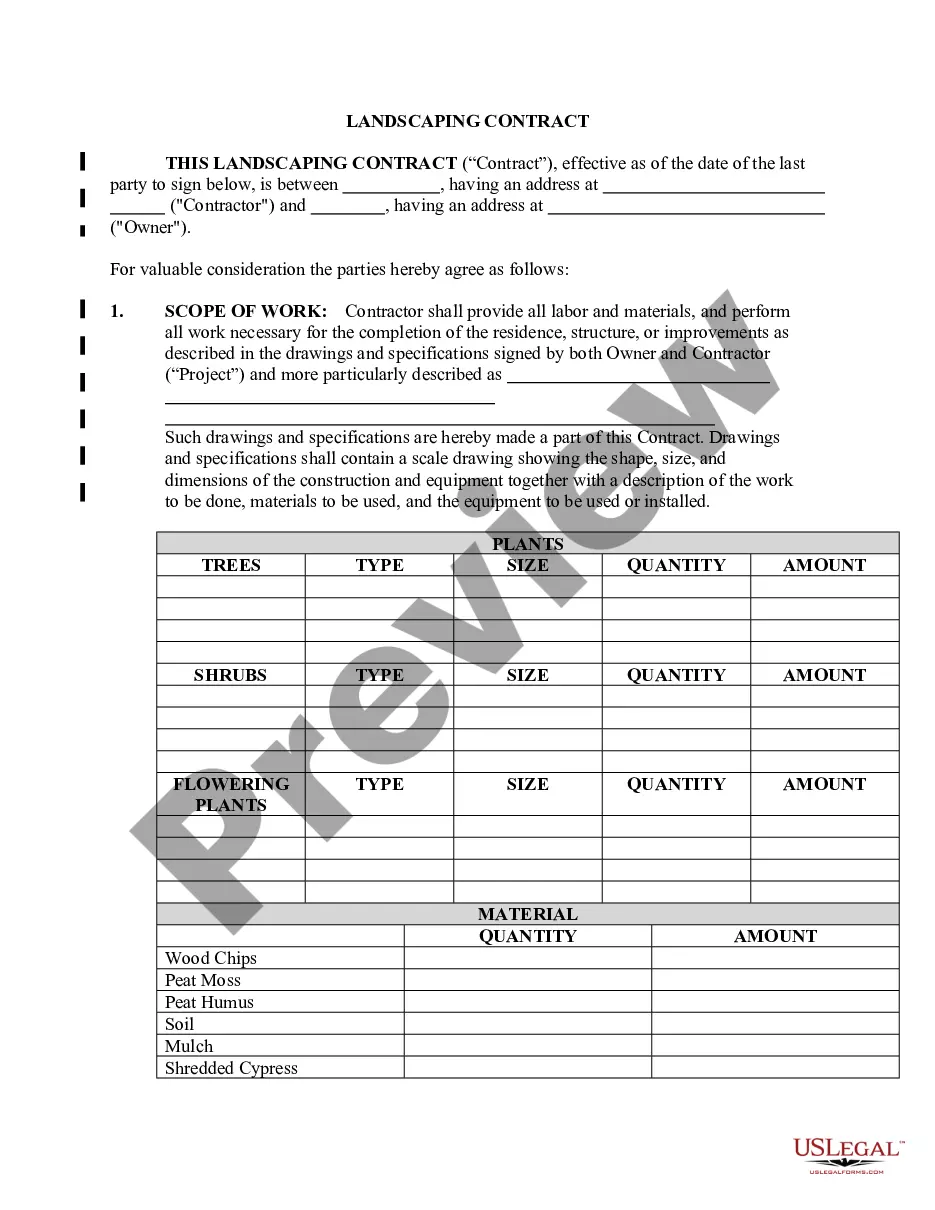

- Step 2. Utilize the Preview option to view the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document format.

- Step 4. Once you have located the form you need, click the Get now button. Choose your desired pricing plan and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Wyoming Agreement to Assign Lease to Incorporator in Forming Corporation.

Form popularity

FAQ

To form a corporation in Wyoming, you need to start by choosing a unique name for your business. Next, you will file the Articles of Incorporation with the Wyoming Secretary of State, along with the required fees. Additionally, to properly establish your corporation, you must create a Wyoming Agreement to Assign Lease to Incorporator in Forming Corporation, which allows you to assign any property lease necessary for your business operations. Utilizing the platform at uslegalforms can simplify the process, providing you with all the forms and guidance you need.

The key difference between a C Corp and an S Corp in Wyoming lies in their taxation and ownership structure. A C Corp faces double taxation on profits, whereas an S Corp allows for pass-through taxation, meaning profits are taxed only at the shareholder level. If you are considering using a Wyoming Agreement to Assign Lease to Incorporator in Forming Corporation, understanding these distinctions can help you make an informed decision on the best corporate structure for your needs.

Yes, Wyoming is often considered a favorable state to incorporate due to its business-friendly environment, low taxes, and ease of regulations. The state offers strong privacy protections for business owners and allows for flexibility in corporate structures. Additionally, using a Wyoming Agreement to Assign Lease to Incorporator in Forming Corporation can streamline the process of establishing your business and securing essential resources.

Many entrepreneurs consider Wyoming one of the best states to incorporate due to its lack of state income tax, privacy protections, and flexible corporate laws. Furthermore, the state supports a variety of business structures, making it adaptable for your needs. Employing a Wyoming Agreement to Assign Lease to Incorporator in Forming Corporation can solidify your decision to incorporate in this optimal state.

A Wyoming corporation offers numerous advantages including low formation fees, no state income tax, and strong privacy protections for owners. Additionally, Wyoming's business-friendly environment attracts many entrepreneurs looking to incorporate. When integrating a Wyoming Agreement to Assign Lease to Incorporator in Forming Corporation, you can further enhance the legal structure of your business.

Wyoming statute 17 16 1501 addresses entity registration and outlines how corporations in Wyoming should maintain proper records. This statute plays a crucial role in ensuring that corporations remain compliant with state requirements. By utilizing a Wyoming Agreement to Assign Lease to Incorporator in Forming Corporation, you can ensure that record-keeping aligns with these legal standards.

To set up a Wyoming holding company, you will need to file articles of incorporation with the state and create an operating agreement that defines management and ownership. It is essential to address asset ownership clearly, potentially using a Wyoming Agreement to Assign Lease to Incorporator in Forming Corporation as part of your documentation. This will help ensure legal compliance and protection of your assets.

A statutory close corporation in Wyoming has a limited number of shareholders and operates with simplified management and operational flexibility. This type of corporation allows owners to maintain control without the formalities required for larger corporations. Utilizing a Wyoming Agreement to Assign Lease to Incorporator in Forming Corporation can streamline the establishment of such entities.

Section 17 16 821 of the Wyoming Business Corporation Act outlines the procedures and requirements for corporate actions such as mergers and consolidations. This section emphasizes the importance of proper documentation, including the Wyoming Agreement to Assign Lease to Incorporator in Forming Corporation, which can facilitate seamless transitions during corporate changes.