Wyoming Sale of Goods, Short Form

Description

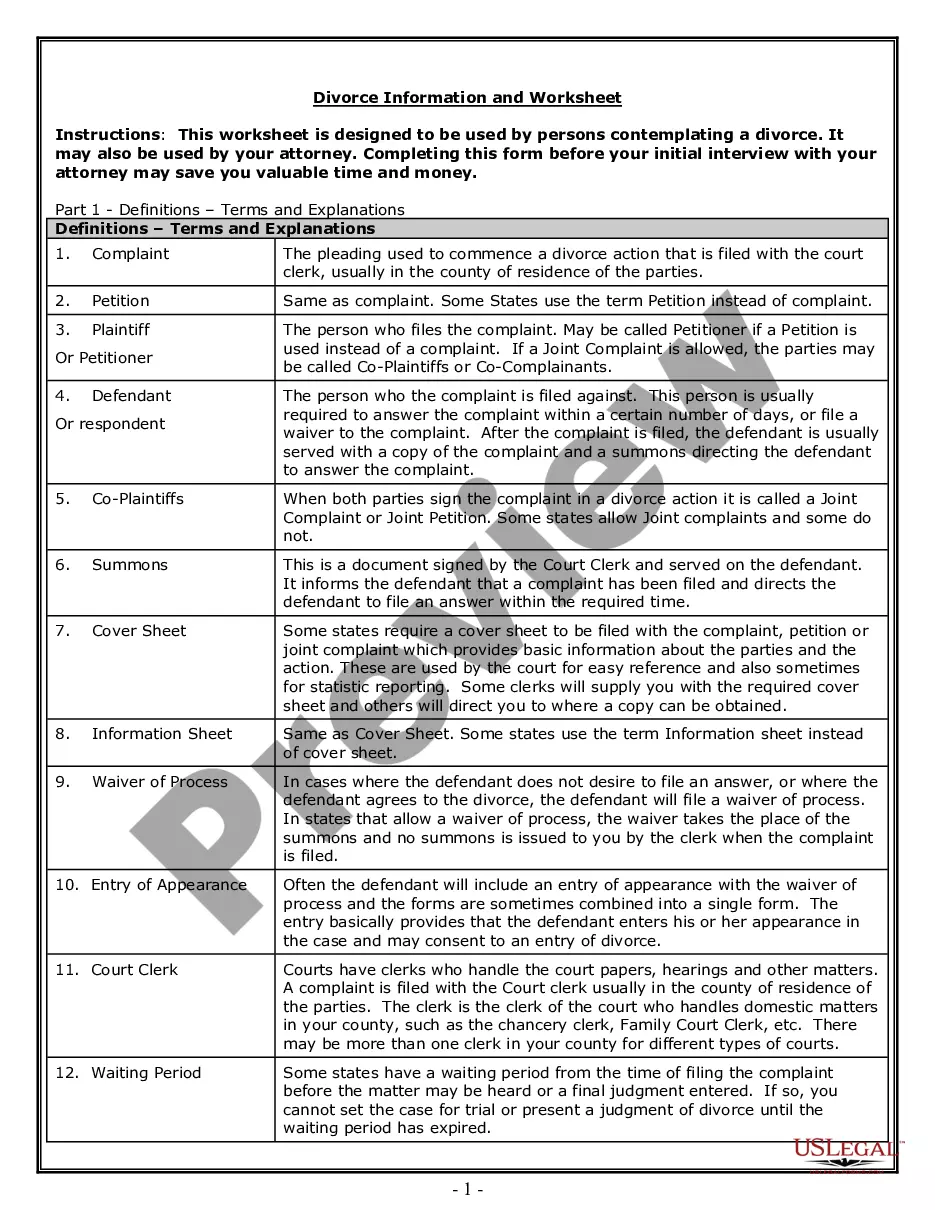

How to fill out Sale Of Goods, Short Form?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a selection of legal document templates that you can download or print.

By using the website, you will find thousands of forms for business and personal purposes, sorted by categories, states, or keywords. You can quickly access the most recent versions of forms like the Wyoming Sale of Goods, Short Form.

If you have a subscription, Log In and download the Wyoming Sale of Goods, Short Form from your US Legal Forms library. The Download button will appear on each document you view. You can access all previously downloaded forms in the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Wyoming Sale of Goods, Short Form. Each template you add to your account does not have an expiration date and is yours forever. Therefore, if you wish to download or print another version, simply head to the My documents section and click on the form you need. Access the Wyoming Sale of Goods, Short Form with US Legal Forms, the largest repository of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- Ensure you have selected the correct document for your city/county.

- Click on the Preview button to examine the form's content.

- Check the form details to confirm that you have chosen the appropriate document.

- If the document does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, select the pricing plan you want and provide your credentials to register for an account.

Form popularity

FAQ

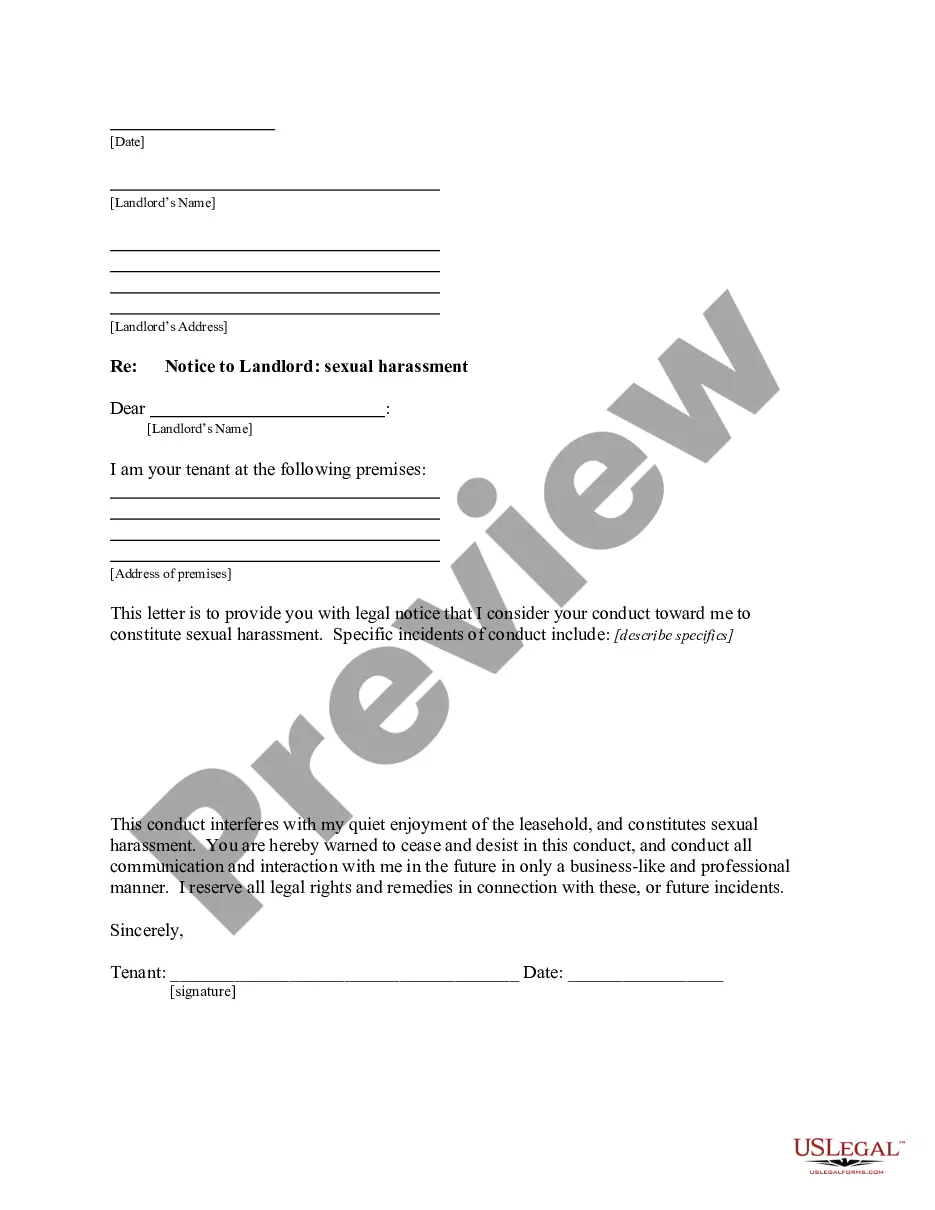

A contract for the sale of a product is a legally binding agreement where a seller agrees to provide goods to a buyer in exchange for payment. This contract outlines all relevant details, such as product descriptions, terms of delivery, and payment conditions. When using the Wyoming Sale of Goods, Short Form, a well-defined contract supports a transparent transaction process. Having a solid contract helps safeguard the interests of both parties.

Under UCC guidelines, any contract for the sale of goods priced at $500 or more must be in writing to be enforceable. This requirement ensures clarity and accountability for large transactions. When considering the Wyoming Sale of Goods, Short Form, it’s important to document these contracts properly. By creating a written record, you can avoid potential disputes down the road.

Statute 35-7-1031 in Wyoming covers regulations related to the sale of goods and the obligations of sellers and buyers. This statute is part of the Wyoming Uniform Commercial Code, which aims to facilitate commerce within the state. Familiarizing yourself with this law is advantageous when dealing with the Wyoming Sale of Goods, Short Form. Knowing your rights and obligations can enhance your confidence in sales transactions.

Another common name for the sales contract is a sales agreement. This term emphasizes the mutual consent between the seller and buyer for the transaction. As you explore the Wyoming Sale of Goods, Short Form, you will find that using clear language in your sales agreement can help ensure smooth negotiations. An effective sales agreement protects both parties involved.

Not necessarily, as each state has its own regulations regarding seller's permits. Typically, you need a seller's permit in any state where you conduct business or have a physical presence. Therefore, if you're selling goods across various states, including Wyoming, it’s essential to understand the requirements for each location within the context of Wyoming Sale of Goods, Short Form.

Yes, Wyoming does accept out of state resale certificates for purchasing goods that you intend to resell. This allows businesses from other states to buy items without paying sales tax upfront. Ensure that your certificate conforms to the guidelines stipulated by Wyoming Sale of Goods, Short Form to avoid complications.

A vendor's license and a seller's permit are often used interchangeably, but they may have slightly different implications depending on the state. In Wyoming, a seller's permit is specifically required for tax purposes when selling goods. Therefore, it’s crucial to ensure you have the appropriate permit that aligns with Wyoming Sale of Goods, Short Form regulations.

Yes, Wyoming requires a seller's permit for businesses engaged in selling tangible personal property. This permit allows you to collect sales tax from consumers, which is essential for your compliance with the state's taxation requirements. If you are planning to sell goods in Wyoming, obtaining this permit is a necessary step under the Wyoming Sale of Goods, Short Form.

To obtain a sales tax ID in Wyoming, you must register your business with the Wyoming Department of Revenue. This process can usually be completed online through their official website. After submitting your application, you will receive your sales tax ID, enabling you to collect sales tax under Wyoming Sale of Goods, Short Form. It's a straightforward process that helps you comply with state tax laws.

Certain items are exempt from sales tax in Wyoming, including groceries, some medical supplies, and certain agricultural products. Understanding these exemptions is crucial for compliance in sales transactions. For a comprehensive list and guidance on navigating exemptions, US Legal Forms offers resources tailored for the Wyoming Sale of Goods, Short Form.