Wyoming Revocable Trust for Lottery Winnings

Description

How to fill out Revocable Trust For Lottery Winnings?

Are you in a situation where you require documents for both business or personal reasons almost every day? There are numerous legal document templates available online, but finding reliable versions is not straightforward. US Legal Forms offers a vast array of form templates, including the Wyoming Revocable Trust for Lottery Winnings, that are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Wyoming Revocable Trust for Lottery Winnings template.

If you do not have an account and wish to start using US Legal Forms, follow these steps.

Find all the document templates you have purchased in the My documents section. You can obtain another copy of the Wyoming Revocable Trust for Lottery Winnings anytime, if necessary. Simply click on the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and reduce errors. The service provides professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- Locate the form you need and ensure it is for the correct city/region.

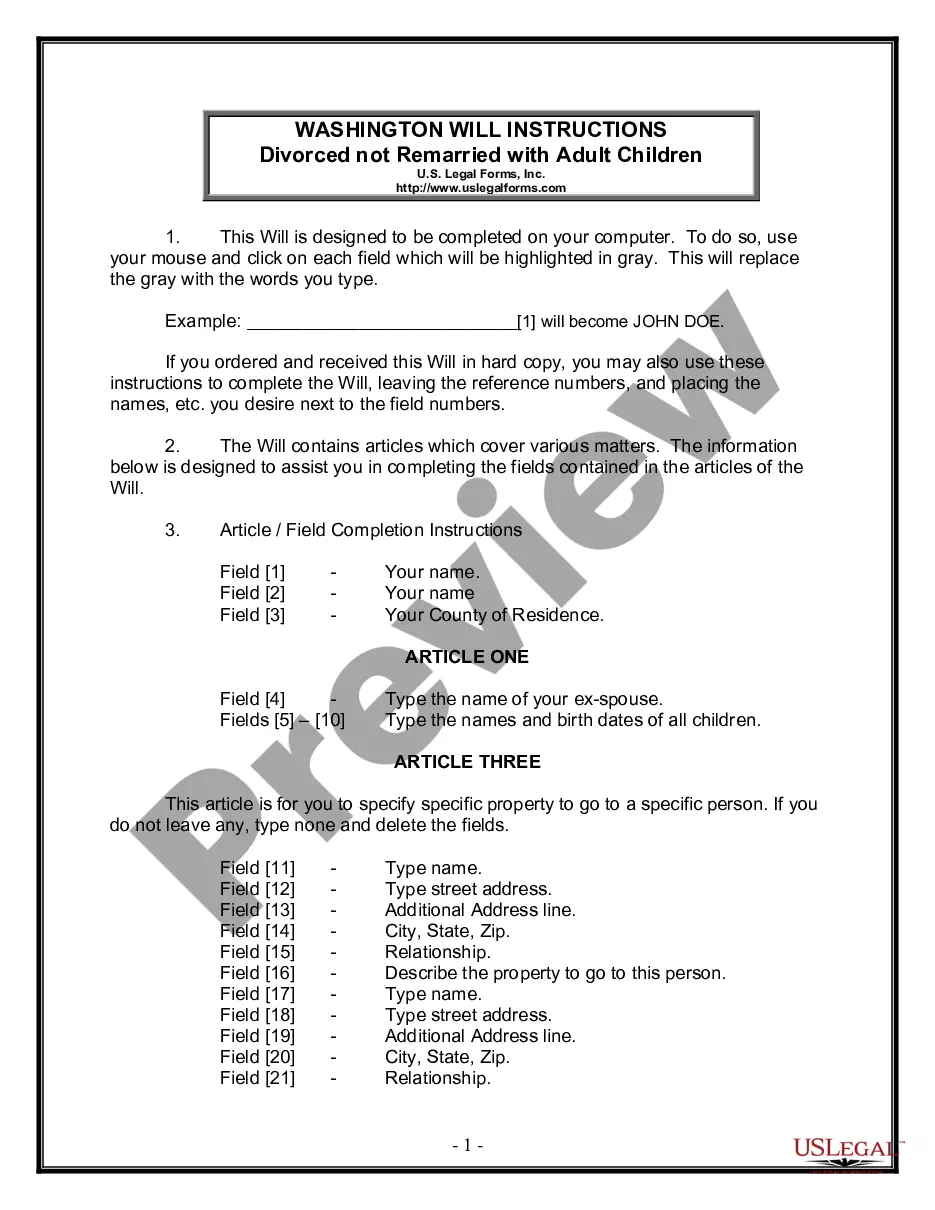

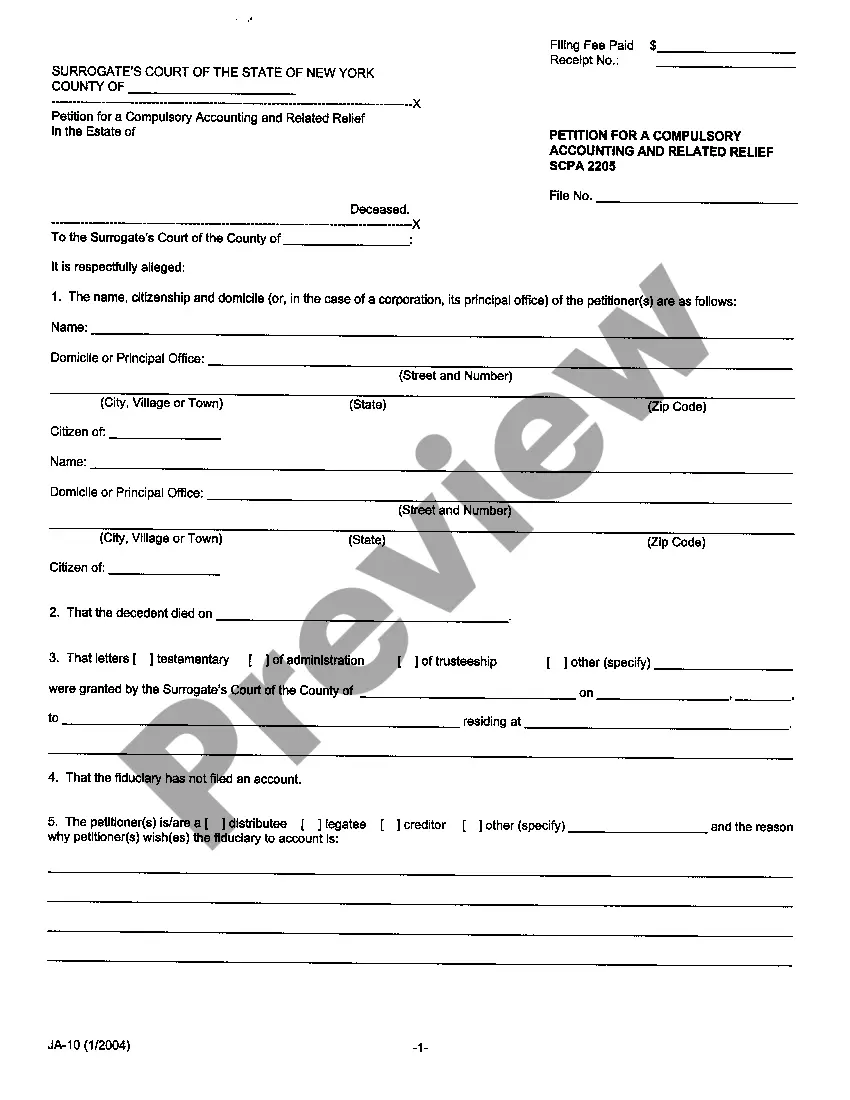

- Use the Review option to examine the form.

- Check the summary to confirm that you have chosen the right form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, click on Purchase now.

- Choose the pricing plan you wish, enter the required information to create your account, and process the payment via your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

To claim your lottery winnings using a Wyoming Revocable Trust for Lottery Winnings, start by establishing the trust with clear guidelines. Once set up, the trust can be named as the recipient on your lottery claim form. This process allows you to maintain privacy and protect your assets from potential claims. For assistance in creating your trust and ensuring compliance with state laws, consider using platforms like uslegalforms, which offer tailored solutions for this purpose.

To avoid gift tax on your lottery winnings, you might consider setting up a Wyoming Revocable Trust for Lottery Winnings. This type of trust allows for the distribution of assets without triggering gift taxes, as long as proceeds are kept within the trust. Additionally, it provides flexibility in how you manage and distribute your winnings. Consulting with a legal expert can guide you in establishing this trust effectively.

The best investment after winning the lottery often includes a mix of low-risk opportunities and growth potential. For example, you might consider real estate, stocks, or mutual funds. Setting up a Wyoming Revocable Trust for Lottery Winnings allows you to manage these investments more effectively, ensuring your wealth continues to grow.

The best way to handle large lottery winnings is to develop a clear financial plan and seek professional advice. Setting up a Wyoming Revocable Trust for Lottery Winnings can help you manage your assets responsibly, ensuring you achieve your financial goals. By taking these steps, you can make informed decisions about investments and distributions.

The best place to deposit lottery winnings is in a reputable bank that offers secure accounts with a good interest rate. A high-yield savings account or a trust account under a Wyoming Revocable Trust for Lottery Winnings can both serve your needs well. This strategy will help you safeguard your funds while maximizing their potential growth.

The best trust to set up if you win the lottery is a Wyoming Revocable Trust for Lottery Winnings. This trust type offers flexibility in managing and distributing your assets, while also providing protection from potential creditors. By establishing this trust, you can ensure your winnings are handled according to your wishes.

Setting up a revocable trust in Wyoming involves choosing a trustee, deciding on beneficiaries, and drafting a trust document. It's advisable to consult legal services that specialize in estate planning for comprehensive guidance. Utilizing platforms like USLegalForms can streamline this process and help you create a Wyoming Revocable Trust for Lottery Winnings effectively.

The best account for lottery winnings is typically a high-yield savings account, as it offers interest while being easily accessible. If you integrate this account with a Wyoming Revocable Trust for Lottery Winnings, you can manage your assets more effectively and protect your wealth. This strategy ensures your funds are not only secure but also growing.

The first step after winning the lottery is to remain calm and plan your next moves carefully. Setting up a Wyoming Revocable Trust for Lottery Winnings can provide you the structure and safety you need for your newfound wealth. Consulting with financial and legal advisors at this stage is crucial to ensure you make informed decisions.

Yes, you can claim lottery winnings anonymously in Wyoming by setting up a Wyoming Revocable Trust for Lottery Winnings. By having the trust claim the prize on your behalf, you can keep your identity private. This approach also helps protect your assets from public scrutiny.