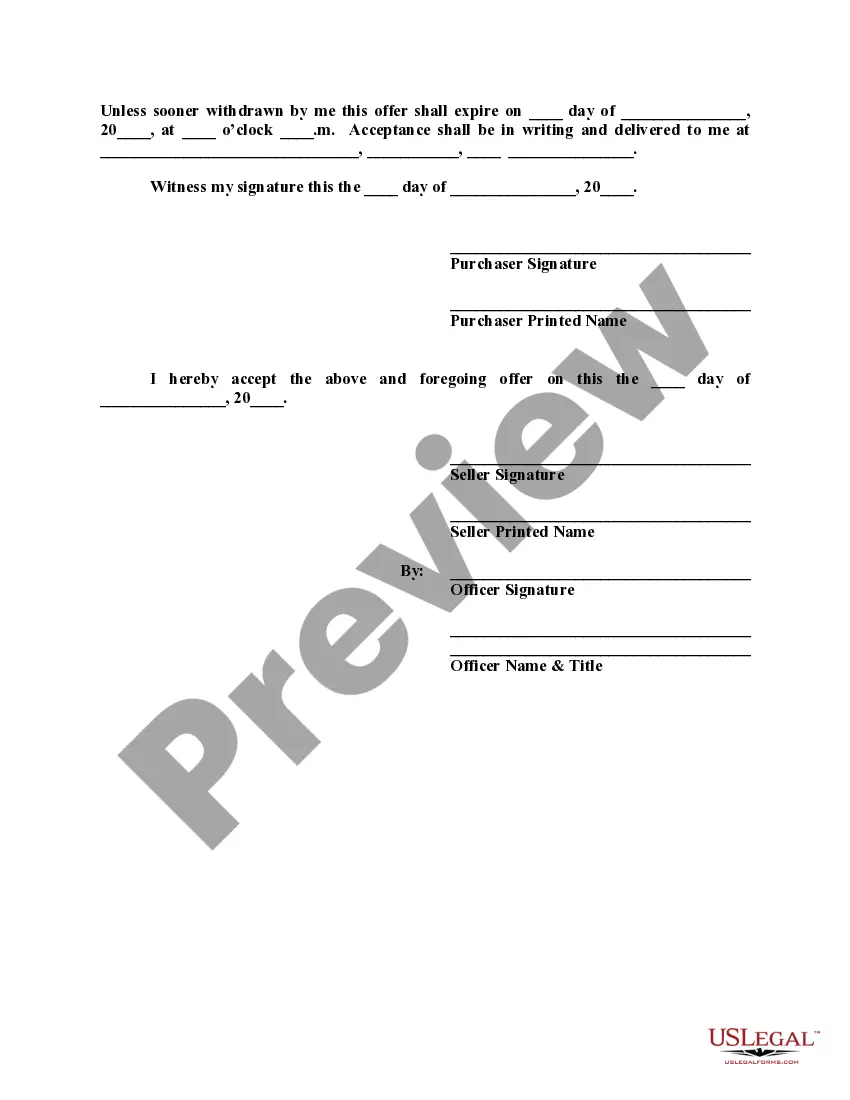

A contract is based upon an agreement. An agreement arises when one person, the offeror, makes an offer and the person to whom is made, the offeree, accepts. There must be both an offer and an acceptance. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wyoming Offer to Purchase Vacant Unimproved Land

Description

How to fill out Offer To Purchase Vacant Unimproved Land?

If you desire to be thorough, download, or print legal document templates, use US Legal Forms, the largest assortment of legal forms available online.

Make use of the site’s straightforward and functional search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and titles, or keywords.

Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the Wyoming Offer to Purchase Vacant Unimproved Land within just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain option to access the Wyoming Offer to Purchase Vacant Unimproved Land.

- You can also retrieve forms you have previously acquired from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific area/land.

- Step 2. Use the Review feature to examine the form’s content. Don’t forget to review the summary.

- Step 3. If you are dissatisfied with the form, utilize the Lookup field at the top of the screen to find alternative models of the legal form template.

Form popularity

FAQ

Yes, there are circumstances where buying land may not be wise. For instance, if the land does not have clear access to utilities or zoning restrictions prevent your intended use, the investment could become problematic. Ensure you conduct thorough research and consider legal assistance like uslegalforms to help navigate these complexities.

One of the highlights of looking to purchase land in Wyoming can definitely be attributed to the many tax benefits. No income, estate, inheritance, real estate, excise tax, and low property taxes make this investment a no-brainer for most. When comparing Wyoming's taxes with other states, the value will be undeniable.

One of the highlights of looking to purchase land in Wyoming can definitely be attributed to the many tax benefits. No income, estate, inheritance, real estate, excise tax, and low property taxes make this investment a no-brainer for most. When comparing Wyoming's taxes with other states, the value will be undeniable.

Turning to the average value of cropland, Wyoming's figure stood at $1,350 per acre for 2017, according to the latest report from the USDA National Agricultural Statistics Service. This is down 1.5% from 2016. The other states in the Western Farmer-Stockman region all saw a boost in per-acre cropland values.

Raw land in Wyoming is typically a highly sought after real estate investment. A piece of land can be on the market for years. Making an impulsive decision to purchase may lead buyer's remorse once the excitement has worn off. To avoid this, take time to mull the purchase decision over.

For each of the last three years the value has held steady at $660 per acre. Cropland values in Wyoming declined in 2017. The average value of cropland is $1,350, a 1.5% decline from 2016.

One of the highlights of looking to purchase land in Wyoming can definitely be attributed to the many tax benefits. No income, estate, inheritance, real estate, excise tax, and low property taxes make this investment a no-brainer for most. When comparing Wyoming's taxes with other states, the value will be undeniable.

Below is a long list of the reasons why:Wyoming has no income tax or corporate tax.Wyoming has no estate or inheritance tax.Wyoming does not tax out- of -state retirement income.Wyoming has no excise tax.Wyoming has no real estate tax.Wyoming has no tax on mineral ownership.Wyoming has no State gift tax.More items...?

The Great Plains covers the southern 2/3rds of eastern Wyoming and offers a lot of grazing land as well as some opportunities to grow crops. The best area in Wyoming for cropland is in Goshen county, which is aptly named after the most fertile, desirable land in Egypt in the Biblical story of Joseph.

According to the 2019 USDA Land Values Summary, Wyoming has some of the cheapest dollar-per-acre land value in both pasture and cropland in the country. Finally, having a lot of space implies fewer inhabitants. Wyoming has the lowest population of any state in the in the country with less than 600,000 people.