A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

Wyoming Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability

Description

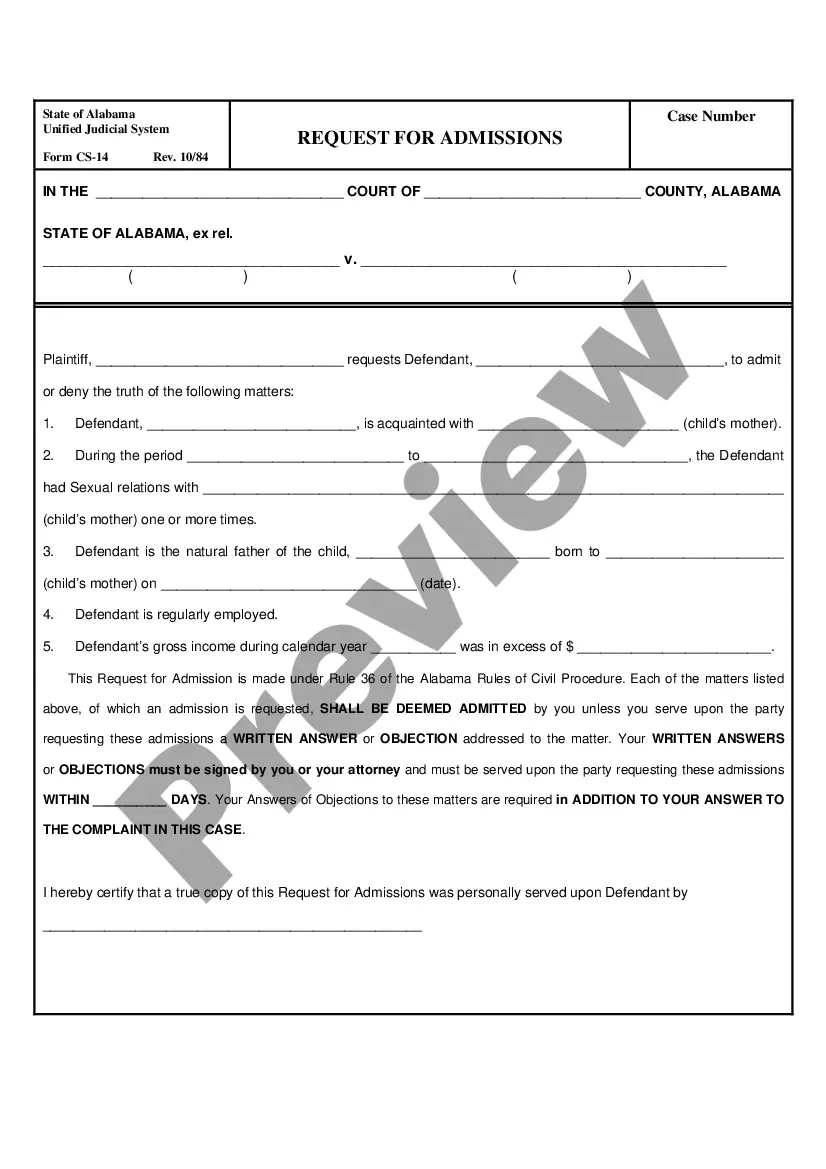

How to fill out Continuing Guaranty Of Business Indebtedness With Guarantor Having Limited Liability?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse array of legal templates that you can obtain or print.

By using the website, you can access many forms for both business and personal purposes, organized by categories, states, or keywords. You can quickly find the latest versions of forms such as the Wyoming Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability.

If you already have a subscription, Log In and obtain the Wyoming Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability from your US Legal Forms collection. The Download button appears on each document you view. You can access all previously acquired forms in the My documents section of your account.

Select the format and download the document to your device.

Make changes. Fill out, edit, print, and sign the downloaded Wyoming Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. Each template you add to your account has no expiration date, meaning it is yours to keep forever. If you wish to download or print another copy, simply go to the My documents section and click on the document you need.

- If you are using US Legal Forms for the first time, here are some simple instructions to get you started.

- Ensure you have selected the correct document for your city/state. Press the Preview button to review the document's content.

- Check the document's description to confirm you have the right one.

- If the document does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the document, confirm your choice by clicking the Buy now button. Then, choose the payment plan you prefer and provide your details to create an account.

- Process the payment. Use a credit card or a PayPal account to complete the transaction.

Form popularity

FAQ

A 'guaranty' refers to the promise made to fulfill a debt obligation, while a 'guarantor' is the individual or entity that provides that promise. Understanding these roles is crucial when entering financial agreements. The guarantor takes on potential responsibility, making this role significant in transactions involving the Wyoming Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability.

A limited warranty might cover specific parts of a product rather than the entire item. For example, a 1-year limited warranty could promise to replace defective parts but not the full product. This limitation encourages businesses to offer assurance to consumers while controlling costs. Similarly, the Wyoming Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability provides a structured way for businesses to secure loans.

A limited guarantee is a commitment from a guarantor to cover only a portion of a debt if the main borrower defaults. This type of guarantee sets a cap on the total liability, providing some protection for the guarantor. It is a valuable tool for businesses in Wyoming seeking to manage their financial exposure. With the Wyoming Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, companies can navigate their obligations effectively.

While Wyoming LLCs offer numerous benefits, there are some disadvantages to consider. Higher formation and maintenance costs compared to other states, along with potential complexities in operating out-of-state, can be challenging. It's crucial to evaluate these factors alongside the advantages, such as the Wyoming Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, to make an informed decision about your business structure.

The close limited liability company supplement in Wyoming provides specific provisions for a more private management structure. This format allows for a limited number of members and restricts ownership transfer, creating a controlled environment. By combining this structure with the Wyoming Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, members can ensure stability and protection for their investment.

Many individuals choose to set up LLCs in Wyoming due to its favorable tax structure, which includes no state income tax. The state's business-friendly regulations and strong protection for limited liability companies attract entrepreneurs. Utilizing the Wyoming Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability further enhances the appeal for those looking to safeguard personal assets while conducting business.

A limited personal guarantee restricts the guarantor's liability to a predefined amount, making it a preferable choice for many individuals. This type of guarantee protects personal assets, providing peace of mind while maintaining creditworthiness. When exploring options like a Wyoming Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, a limited personal guarantee often offers an optimal balance of security and risk management.

A guarantor takes full responsibility for the debt, without limitations, while a limited guarantor's obligation is capped at a specific amount. This distinction is crucial when considering financial agreements or loans. In a Wyoming Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, understanding these roles can help mitigate exposure to excessive debt.

A continuing guarantee covers a series of transactions rather than a single debt. This means that the guarantor remains liable for future obligations, enhancing the creditor’s confidence during ongoing business relationships. When utilizing a Wyoming Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, ensure you understand the extended liability associated with these guarantees.

An unlimited continuing guaranty commits the guarantor to cover any amount owed under the terms of the agreement. There is no cap on the liability, which exposes the guarantor to substantial risk. As a business owner, it's vital to fully comprehend this type of guarantee and consider its implications on your financial responsibilities.