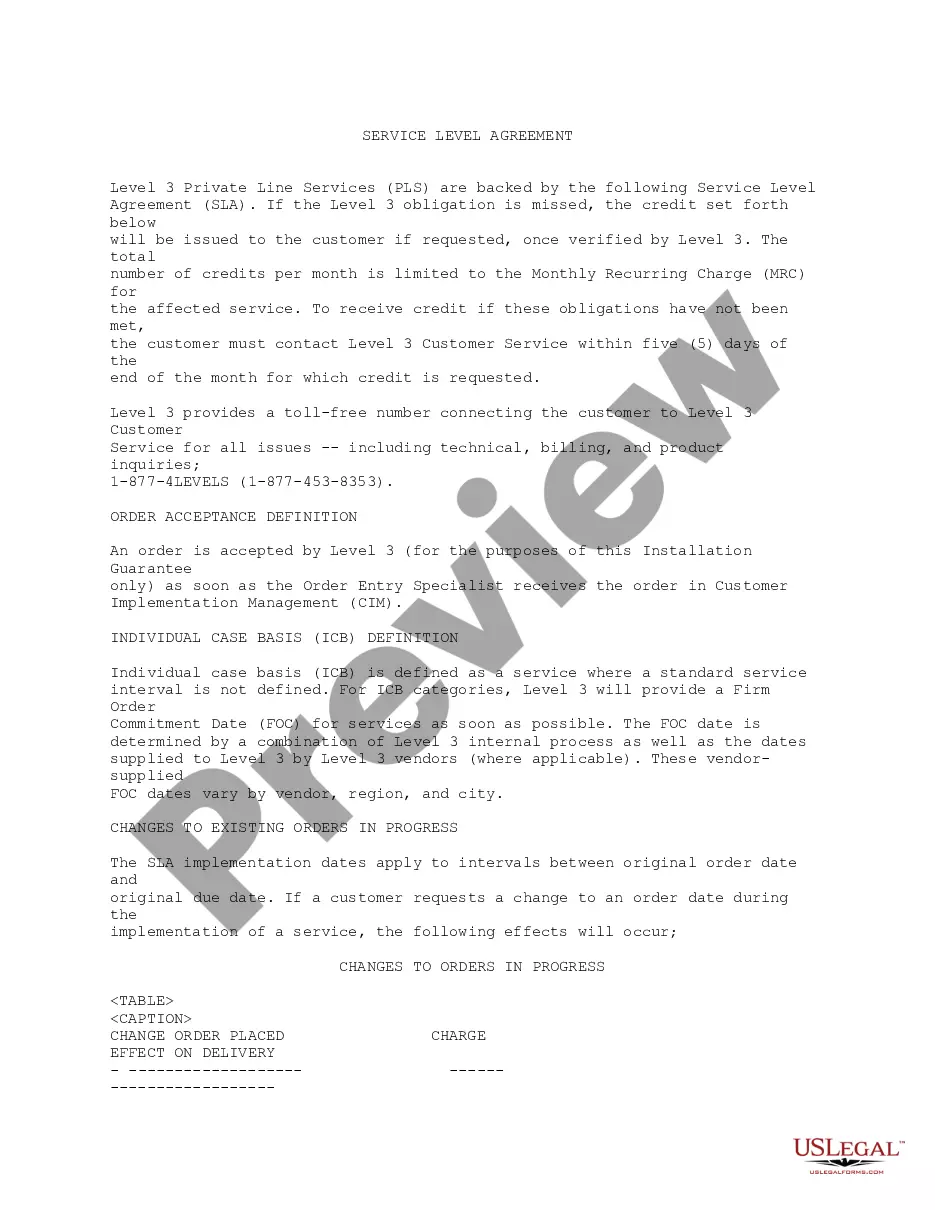

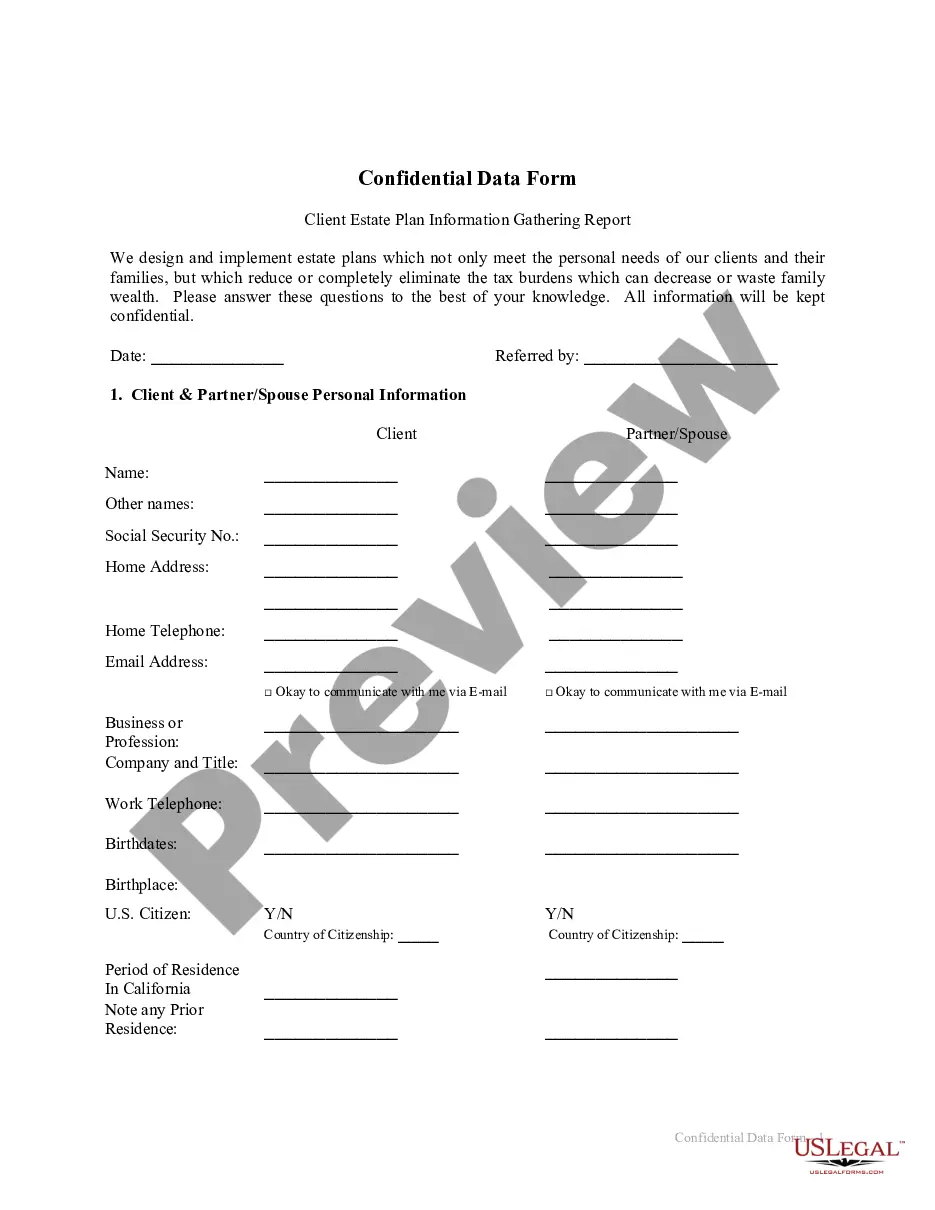

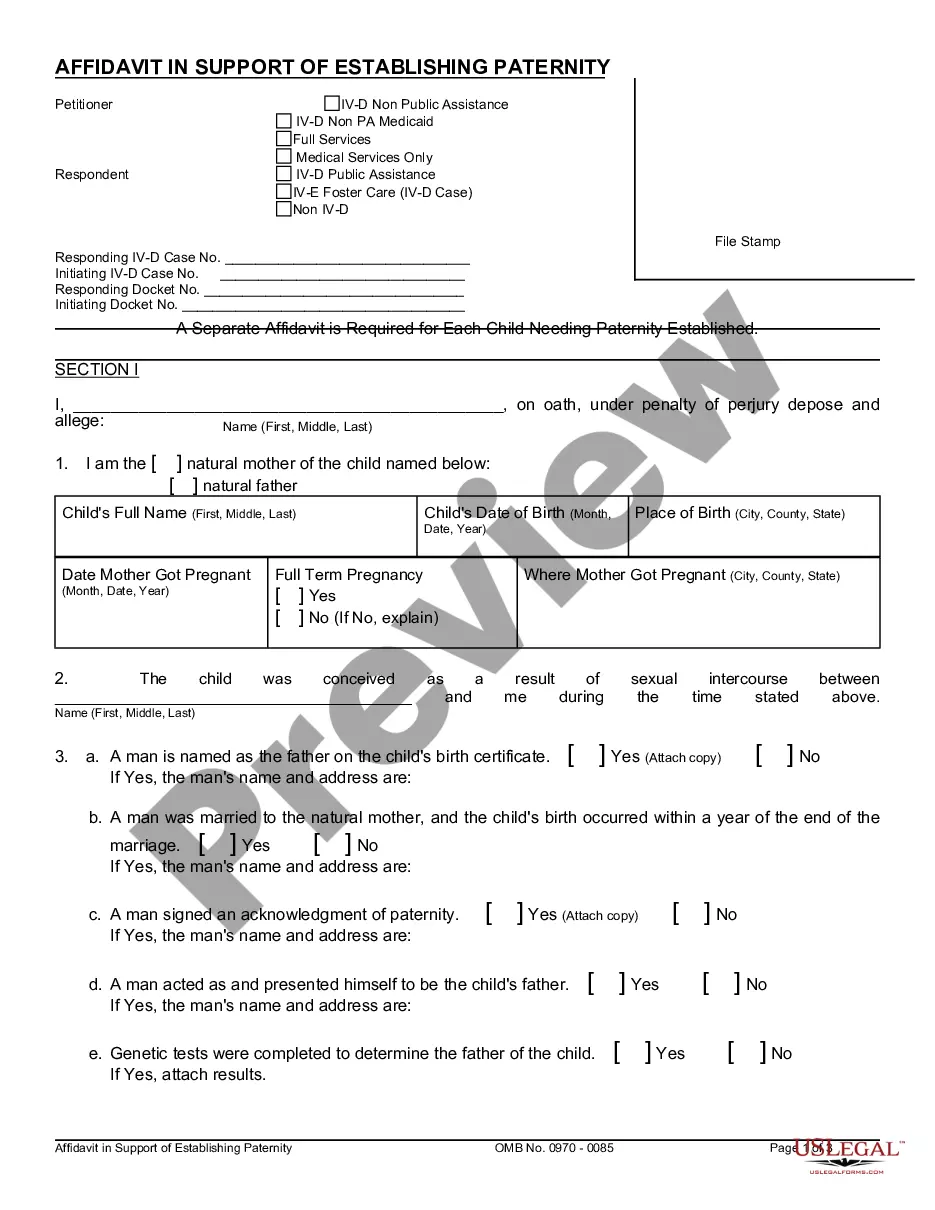

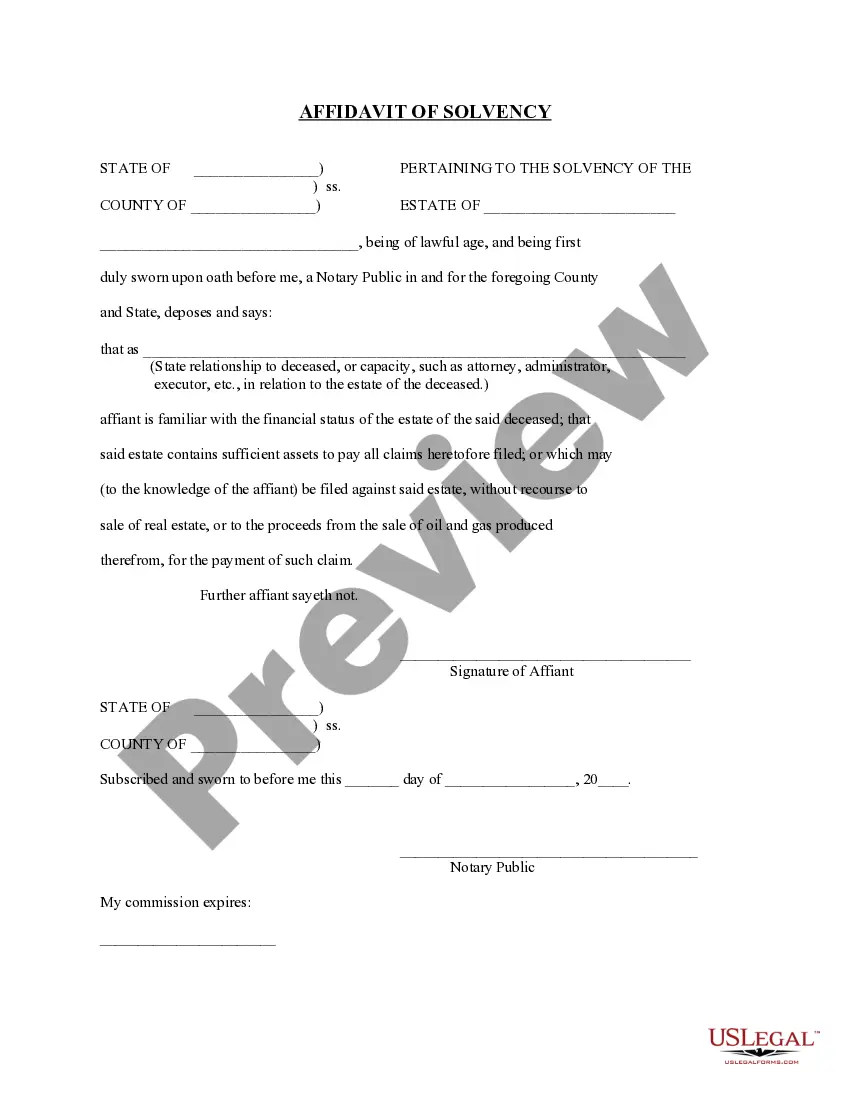

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wyoming Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty

Description

How to fill out Continuing Guaranty Of Payment And Performance Of All Obligations And Liabilities Due To Lessor From Lessee Under Lease With Mortgage Securing Guaranty?

Have you been in the place in which you will need documents for sometimes organization or person purposes almost every day? There are a lot of legitimate record web templates available online, but finding types you can rely isn`t simple. US Legal Forms delivers a large number of kind web templates, like the Wyoming Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty, that are created to fulfill state and federal demands.

Should you be presently acquainted with US Legal Forms site and also have a free account, merely log in. Afterward, you may acquire the Wyoming Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty design.

Unless you provide an account and need to begin using US Legal Forms, abide by these steps:

- Find the kind you want and ensure it is for that correct area/region.

- Use the Review button to review the shape.

- Browse the information to ensure that you have selected the appropriate kind.

- In case the kind isn`t what you are trying to find, use the Look for area to obtain the kind that fits your needs and demands.

- Whenever you obtain the correct kind, just click Buy now.

- Pick the rates plan you desire, complete the specified details to generate your account, and purchase your order utilizing your PayPal or bank card.

- Select a convenient data file structure and acquire your copy.

Get all the record web templates you might have bought in the My Forms menus. You can obtain a more copy of Wyoming Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty whenever, if needed. Just go through the required kind to acquire or print the record design.

Use US Legal Forms, one of the most substantial selection of legitimate forms, to conserve time as well as stay away from errors. The service delivers expertly made legitimate record web templates that can be used for a range of purposes. Make a free account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

Operating lease characteristics include: Ownership: Retained by the lessor during and after the lease term. Bargain purchase options: Operating leases cannot contain a bargain purchase option. Terms: Less than 75% of the asset's estimated economic life.

Lease payments work like rental fees you pay for the right to use the owner's asset under specified terms. The lease payment amount includes costs for monthly depreciation, finance charges, and applicable taxes.

Characteristics of leasing Financing is always approved for a particular object. The procurement of the asset is executed by the Lessor, and not the Lessee. Lessor is the owner of the asset during the entire term of the Leasing Agreement. The Leasing Subject is at the same time the collateral.

Capital Lease, Operating Lease, Sale and Leaseback and Leveraged Leasing are the four primary types of leases. In a capital lease, the lessor commits to hand over ownership of the leased asset to the lessee at the end of the lease term. Long-term and non-cancelable in nature, capital or finance leases.

The two main types of leases are operating and financing leases. Operating leases are shorter-term agreements where the lessor maintains maintenance and insurance responsibilities. Financing leases last for the asset's economic life, during which you, as the lessee, make regular payments to the lessor.

There are different types of leases, but the most common types are absolute net lease, triple net lease, modified gross lease, and full-service lease.

A lease guaranty is a contract between an individual or entity (guarantor) that is typically related to the tenant. The guarantor promises to pay the landlord any and all payments due under the lease in the event the tenant defaults under its lease obligations and otherwise cure the tenant's defaults.

In a lease agreement, the lessor is the person or party that issues the lease (allows the property to be rented), and the lessee is the person that the lease is granted to (the person paying rent to use the property).