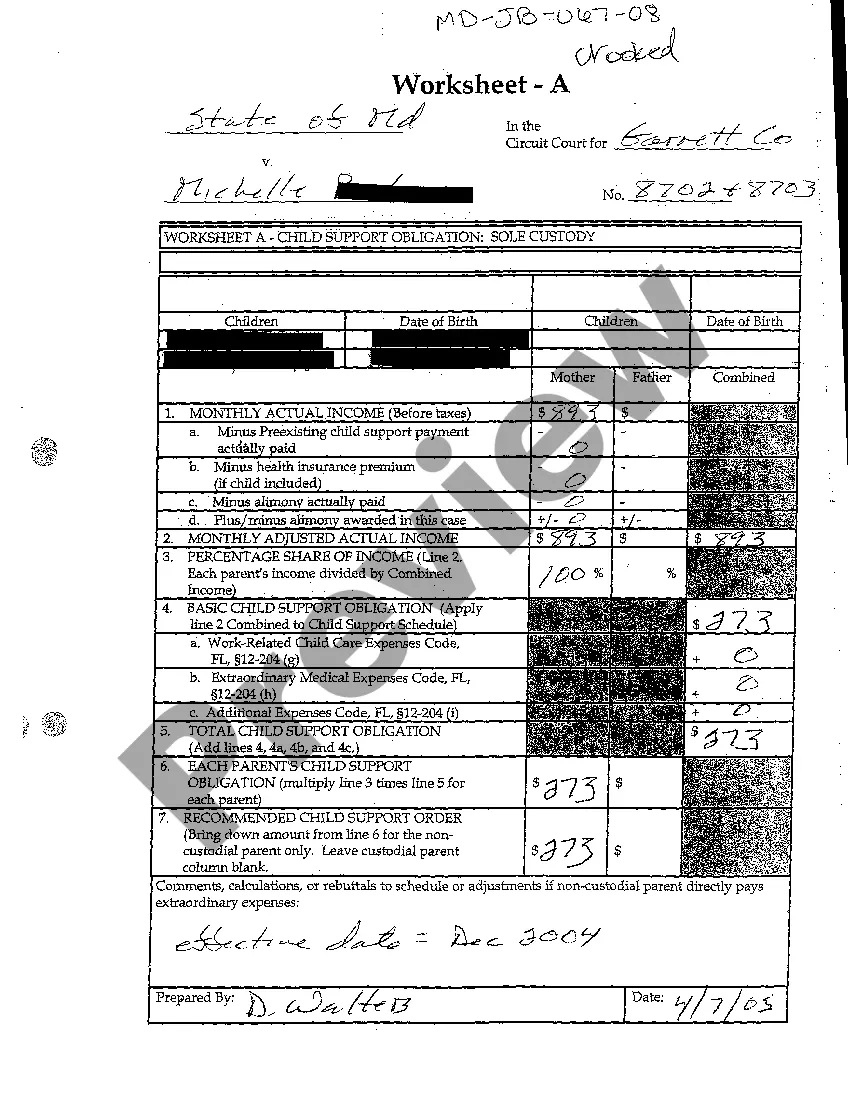

In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Wyoming Security Agreement with Farm Products as Collateral

Description

How to fill out Security Agreement With Farm Products As Collateral?

If you wish to be thorough, download, or print legal document templates, make use of US Legal Forms, the largest array of legal forms that are available online.

Employ the site's simple and straightforward search functionality to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

- Use US Legal Forms to acquire the Wyoming Security Agreement with Farm Products as Collateral with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to access the Wyoming Security Agreement with Farm Products as Collateral.

- You can also find forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have chosen the form for your specific city/state.

- Step 2. Utilize the Preview option to review the content of the form. Remember to read the description.

Form popularity

FAQ

Statute 29-10-101 in Wyoming pertains to the laws governing property liens and security interests. This law outlines how creditors can secure their claims against property, including agricultural products. Understanding this statute is particularly vital when dealing with a Wyoming Security Agreement with Farm Products as Collateral, as it provides insight into how your assets are protected and what obligations you may have. Legal services like those offered by uslegalforms can assist you in navigating these regulations.

A collateral security agreement is a legal document that specifies the terms under which an asset is pledged as security for a debt. In the context of a Wyoming Security Agreement with Farm Products as Collateral, this agreement allows farmers to use their crops or livestock as collateral for loans. This framework strengthens the ability of lenders to recover their investments while providing farmers with necessary financing. It is essential to understand the details involved in such agreements to protect your interests.

Collateral descriptions often include an after-acquired property clause to include within the scope of the collateral certain property that was not in the debtor's possession when the security agreement was executed but which may come into the debtor's possession afterward.

A security interest in many types of collateral, including "negotiable documents, goods, instruments, money, or tangible chattel paper," may be perfected by the secured party possessing the collateral. However, so-called "intangible" collateral, such as accounts receivable, cannot be perfected by possession.

Perfected Collateral means all Collateral, including without limitation Eligible Collateral in which the Bank has attempted in good faith to perfect its security interest by giving constructive notice to third parties through taking possession of the Collateral, filing a financing statement describing the Collateral,

Certain types of collateral must be perfected through possession: Money. The only way that a secured party may perfect its security interest in money is by possession.

Certain specific requirements are required for the security agreement to form the foundation for a valid security interest, namely 1) it must be signed, 2) it must clearly state that a security interest is intended, and 3) it must contain a sufficient description of the collateral subject to the security interest.

The security agreement must: be signed (or authenticated) by the debtor and the owner of the property, contain a description of the collateral and. make it clear that a security interest is intended.

Purchase money security interests are super-priority security interests in consumer goods in favor of the creditor who has financed the purchase price of the consumer goods. 37 It is considered perfected automatically except when it is inventory or equipment.

However, generally speaking, the primary ways for a secured party to perfect a security interest are:by filing a financing statement with the appropriate public office.by possessing the collateral.by "controlling" the collateral; or.it's done automatically upon attachment of the security interest.