Wyoming Identity Theft Contact Table

Description

How to fill out Identity Theft Contact Table?

It is feasible to invest time online trying to locate the sanctioned document template that complies with the state and federal requirements you desire.

US Legal Forms provides a vast array of legal forms that can be reviewed by professionals.

You can download or print the Wyoming Identity Theft Contact Table from your support.

If available, use the Preview button to examine the document template as well. To get an additional version of the form, use the Research field to find the template that meets your needs and specifications. After you have found the template you desire, click Acquire now to proceed. Select the pricing plan you wish, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form. Choose the file format of the document and download it to your device. Make modifications to the document if necessary. You can complete, edit, sign, and print the Wyoming Identity Theft Contact Table. Download and print numerous document templates using the US Legal Forms site, which offers the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal requirements.

- If you possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Wyoming Identity Theft Contact Table.

- Every legal document template you acquire is your own asset indefinitely.

- To obtain an additional copy of a purchased type, navigate to the My documents tab and click on the appropriate button.

- If you are visiting the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the state/region of your choice.

- Review the type description to confirm you have chosen the right form.

Form popularity

FAQ

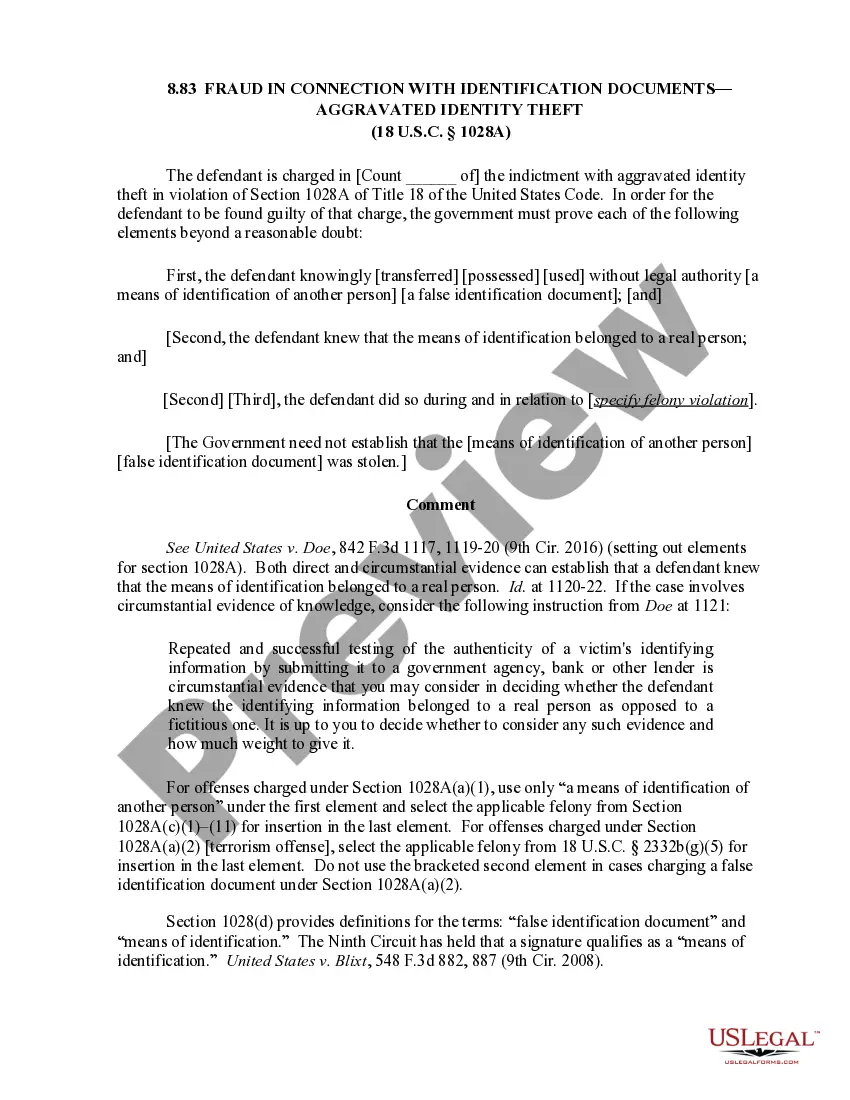

Warning signs of identity theft Bills for items you did not buy. Debt collection calls for accounts you did not open. Information on your credit report for accounts you did not open. Denials of loan applications. Mail stops coming to, or is missing from, your mailbox.

Collect mail frequently. You should collect your mail every day as soon as possible. ... Read credit and bank statements. Keep up with your financial statements, looking for signs of identity theft. Keep track of your bills. ... Read health insurance statements. ... Shred documents with PII. ... Review credit reports.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Section 6-3-402 - Theft; penalties (a) A person is guilty of theft if he knowingly takes, obtains, procures, retains or exercises control over or makes an unauthorized transfer of an interest in the property of another person without authorization or by threat or by deception, or he receives, loans money by pawn or ...

Checking your credit is one of the easiest ways to determine whether someone is using your identity. Your credit report shows any accounts in your name, as well as inquiries that are put on your report when someone requests credit in your name and lenders review your credit history.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Inform your bank, building society and credit card company of any unusual transactions on your statement. Request a copy of your credit file to check for any suspicious credit applications. Report the theft of personal documents and suspicious credit applications to the police and ask for a crime reference number.

Steps for Victims of Identity Theft or Fraud Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes. Order free credit reports annually from the three major credit bureaus (Equifax, Experian, and TransUnion).

If you think you might have been a victim of ID theft: Contact the companies where you think the fraud occurred and let them know what happened. Check your credit reports to find evidence of fraud. You can get free credit reports from annualcreditreport.com or directly from the credit bureaus.