Wyoming Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

How to fill out Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

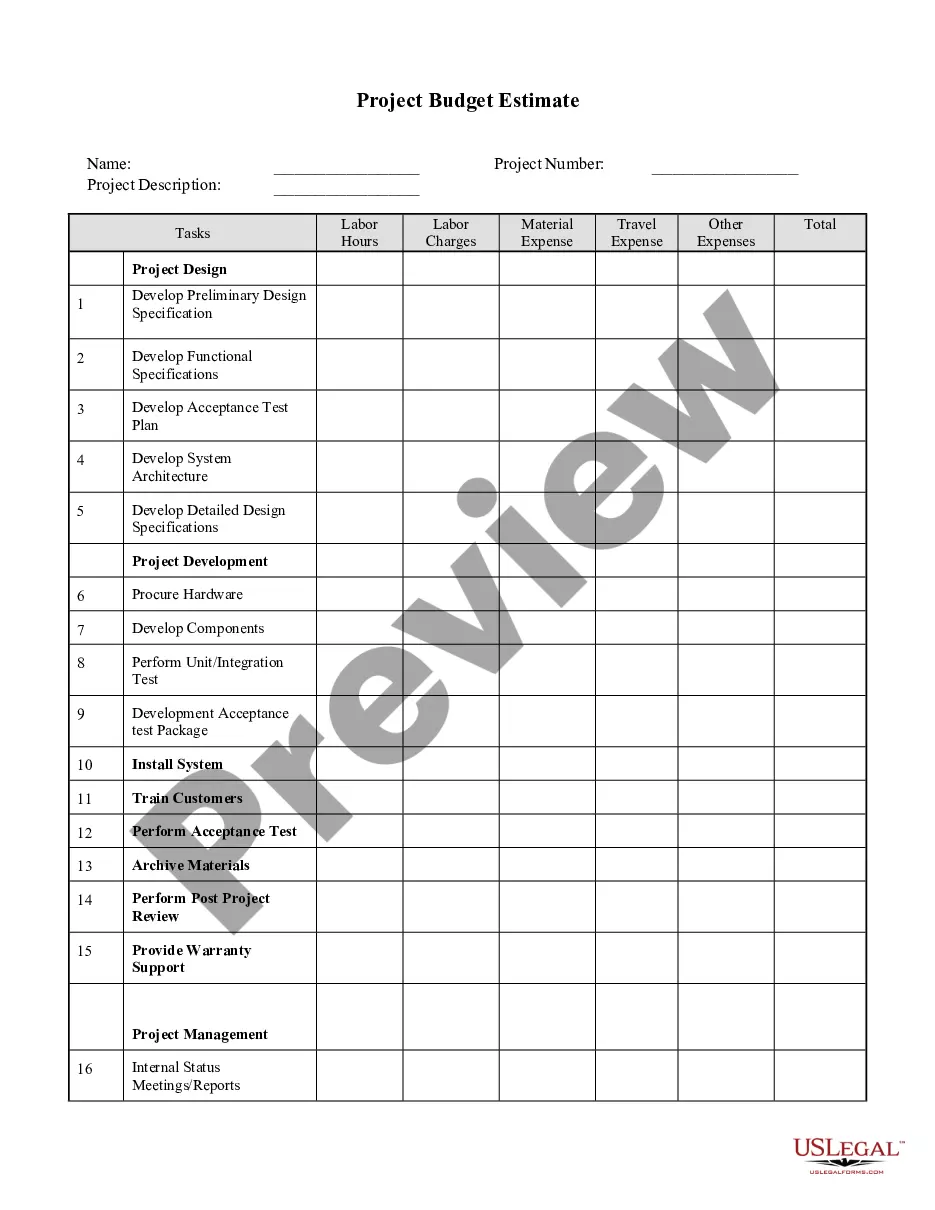

US Legal Forms - one of the largest collections of lawful templates in the country - provides a vast selection of legal document samples that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You can find the latest editions of forms such as the Wyoming Letter to Creditors Notifying Them of Identity Theft for New Accounts in no time.

If you already have a membership, Log In and download the Wyoming Letter to Creditors Notifying Them of Identity Theft for New Accounts from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously acquired forms in the My documents section of your account.

Complete the purchase. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, and print and sign the downloaded Wyoming Letter to Creditors Notifying Them of Identity Theft for New Accounts. Every template you add to your account does not have an expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Wyoming Letter to Creditors Notifying Them of Identity Theft for New Accounts with US Legal Forms, the most extensive collection of lawful document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs.

- Ensure you have selected the correct form for your city/state.

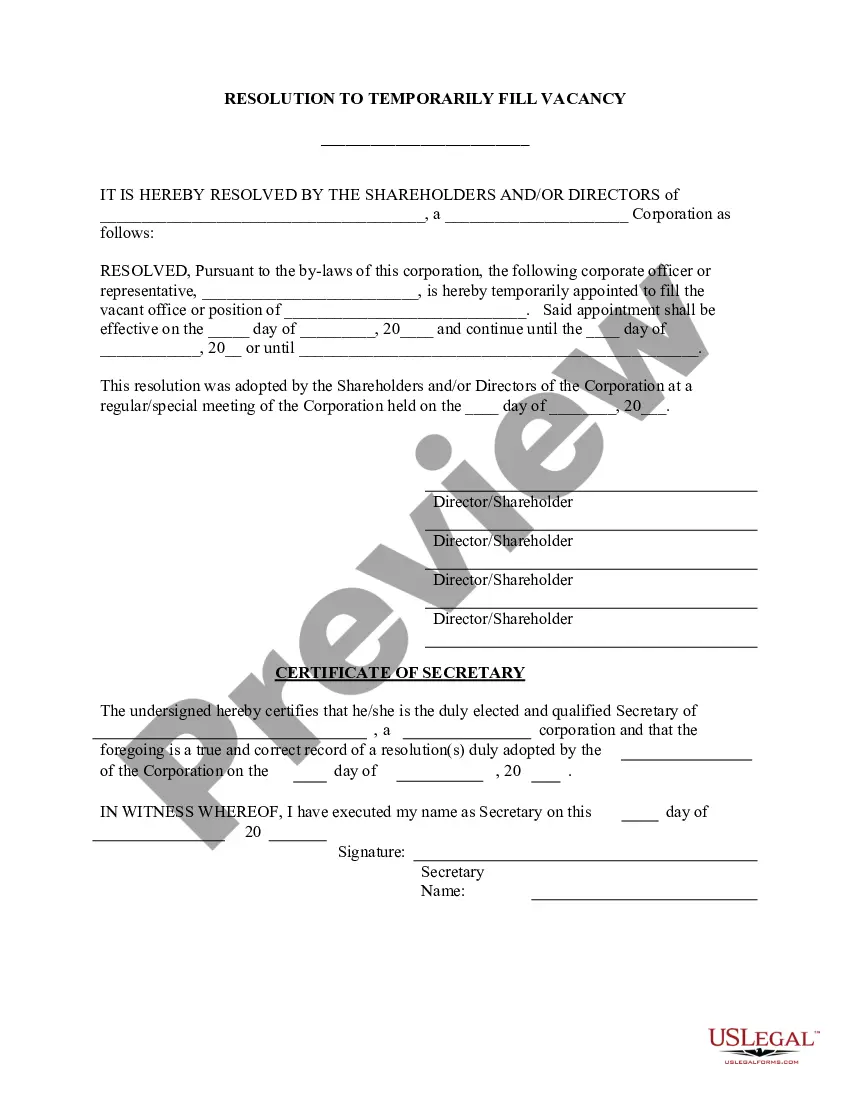

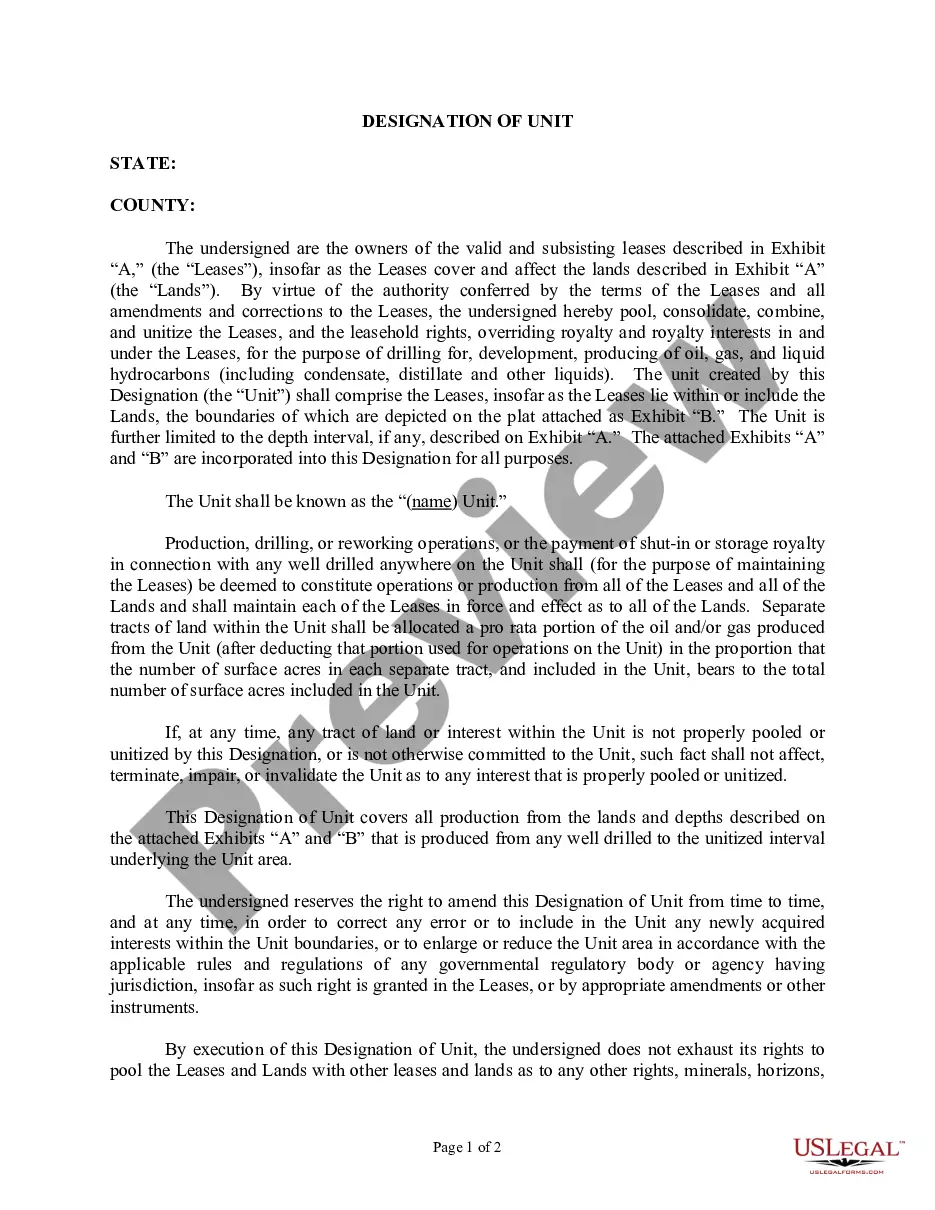

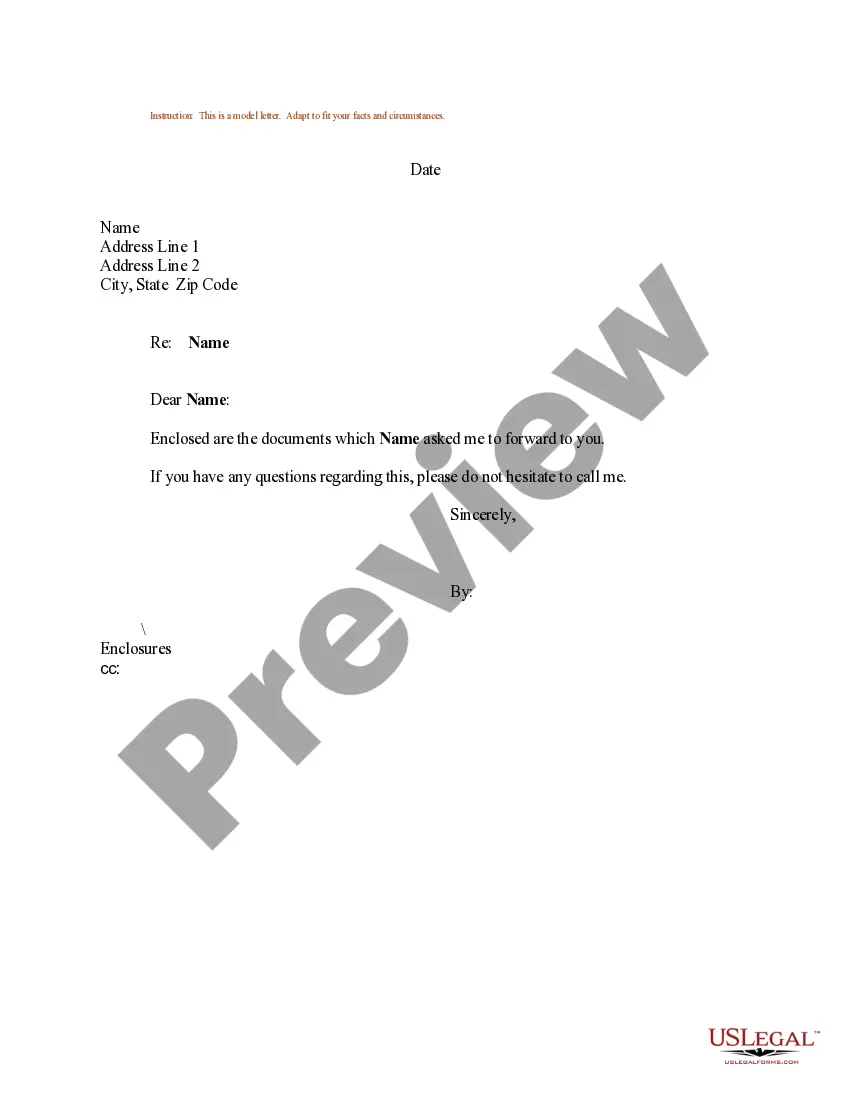

- Click the Preview button to review the form's contents.

- Read the form description to confirm you have chosen the right form.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- Once satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

If you've been the victim of identity theft, you can take steps to reclaim your good name and restore your credit. To make certain that you do not become responsible for any debts incurred in your name by an identity thief, you must prove that you didn't create the debt.

Steps for Victims of Identity Theft or Fraud Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

If you report your identity theft to the FTC within two business days of discovering it, you will only be liable to pay $50 of any unauthorized use of your bank and credit accounts (under federal law). The longer you leave it, the more that financial liability falls on your shoulders.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

Identity theft happens when someone takes your name and personal information (like your social security number) and uses it without your permission to do things like open new accounts, use your existing accounts, or obtain medical services.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).