A Wyoming Balloon Secured Note is a type of financial instrument that is commonly used for borrowing and lending purposes. It is typically issued by a borrower, known as the issuer, to a lender, known as the note holder, and is secured by specific collateral. The term "Wyoming" in the name refers to the state where the note is issued, signaling its legal validity and compliance with the laws and regulations of Wyoming. Wyoming is known for its favorable business environment and corporate laws, which make it an attractive jurisdiction for the formation and operation of various entities, including financial instruments like secured notes. The "Balloon" aspect of the note refers to the repayment structure. Unlike traditional installment loans where a borrower pays off the principal and interest over a fixed period, a balloon note requires the borrower to make periodic interest payments while deferring the principal amount. This deferral leads to a final payment, commonly referred to as the "balloon payment," which generally covers the remaining principal balance and is due at the end of the loan term. The principal feature of a Wyoming Balloon Secured Note is the presence of collateral, which provides security to the note holder in case of default by the borrower. The collateral can be in the form of real estate, personal property, or any other valuable asset that can be used to repay the note. In case of default, the lender has the right to seize and sell the collateral to recover the outstanding loan amount. It's important to note that there may be various types or variations of Wyoming Balloon Secured Notes, depending on the specific terms and conditions agreed upon by the parties involved. Different notes may vary in terms of interest rates, payment schedules, maturity dates, and the type of collateral used. For example, some common types of Wyoming Balloon Secured Notes include: 1. Real Estate Balloon Secured Note: In this case, the collateral provided is real estate property. The note holder gains a security interest in the property and has the right to foreclose and sell it if the borrower defaults. 2. Equipment Balloon Secured Note: Here, the collateral is typically valuable equipment or machinery owned by the borrower. The note holder retains the right to repossess and sell the equipment to recoup the loan amount in case of default. 3. Inventory Balloon Secured Note: This type of note is secured by the borrower's inventory, such as goods in stock or raw materials. The lender may have the right to take possession and liquidate the inventory in case of non-payment. Overall, a Wyoming Balloon Secured Note provides financial flexibility for both borrowers and lenders, allowing for customizable repayment structures and providing security through collateral. It is important for parties involved to carefully review and negotiate the terms and conditions of the note before entering into such an agreement.

Wyoming Balloon Secured Note

Category:

State:

Multi-State

Control #:

US-00601-E

Format:

Word;

Rich Text

Instant download

Description

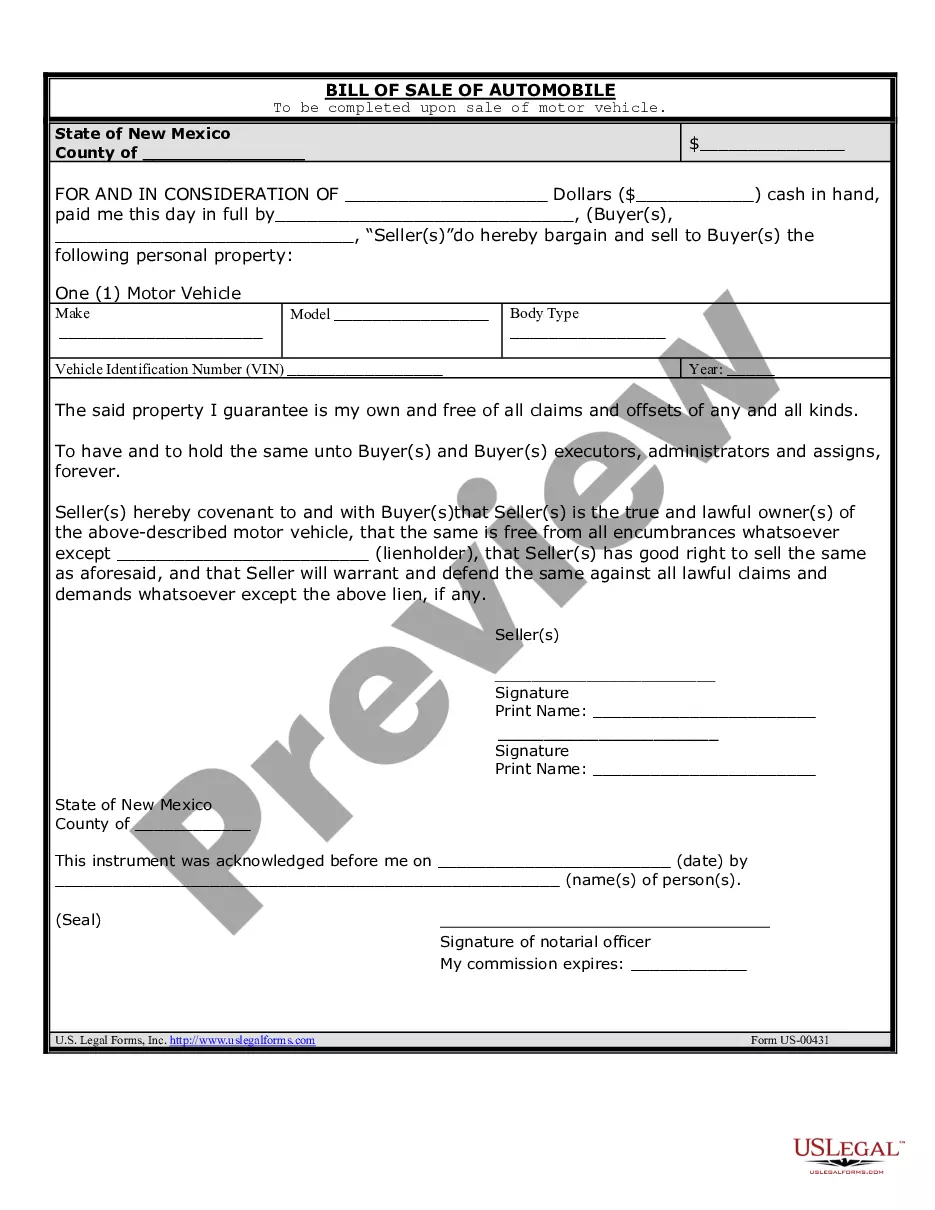

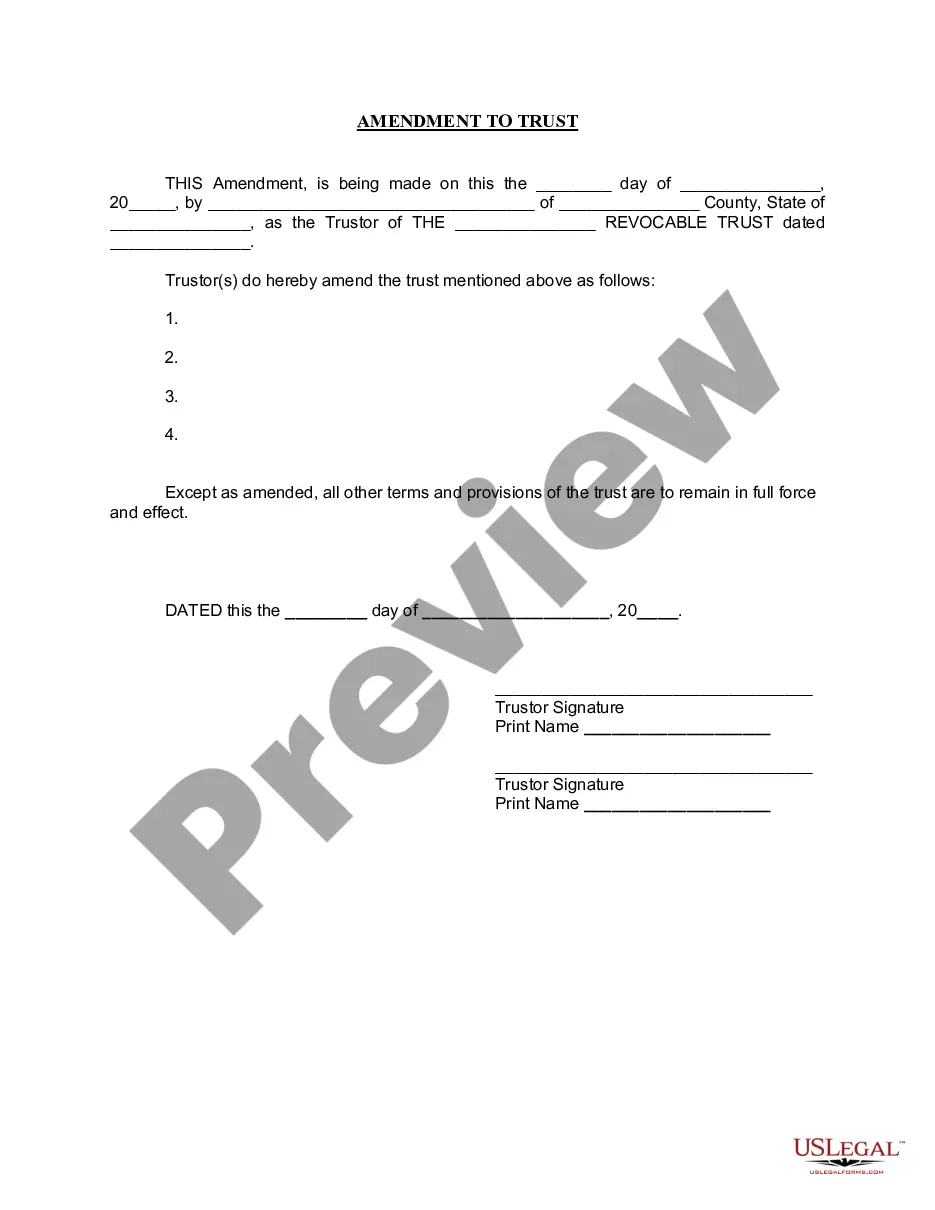

This form is a balloon promissory note, with security. A balloon note is structured such that a large payment is due at the end of the repayment period. Adapt to fit your specific circumstances.

Free preview

How to fill out Wyoming Balloon Secured Note?

It is feasible to dedicate time online attempting to locate the sanctioned document template that fulfills the state and federal requirements you desire.

US Legal Forms offers numerous legal forms that are evaluated by professionals.

You can download or print the Wyoming Balloon Secured Note from the service.

Browse the form description to ensure you have chosen the correct form. If available, utilize the Preview button to review the document template as well. If you want to find another version of your form, use the Search field to locate the template that suits your requirements and needs.

- If you possess a US Legal Forms account, you may Log In and then click the Download button.

- After that, you can complete, edit, print, or sign the Wyoming Balloon Secured Note.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document template for the area/town of your choice.

Form popularity

Interesting Questions

More info

A balloon payment is a lump sum paid at the end of a loan's term that isWhile balloon car loans help secure lower monthly payments, ... Step 1 ? Start off the template by entering the current date, the names and addresses of the borrower and lender, the balance of the note, and the note's ...Secured promissory note: This document is used when a borrower agrees to give upfor a promissory note to be paid in installments with a final ?balloon? ... When the loan amount is paid in full, the assets are no longer deemed as collateral. Typically, Loans secured by collateral tend to have lower interest rates. Uniform Instruments are the Fannie Mae/Freddie Mac and Freddie Mac Notes, Riders, and Security Instruments (Deeds of Trust and Mortgages) used when ... Loaning money to family members and friends can be a delicate subject. Always protect yourself by putting the terms of the loan or interest ... If you are looking at a CMBS loan, find out more information here.What Are CMBS (Commercial Mortgage-Backed Securities) Loans? Lender must require consumer to fill out a loan application and provide a pay stub or other evidence of income at least once in each 12-month period.93 pages

Lender must require consumer to fill out a loan application and provide a pay stub or other evidence of income at least once in each 12-month period. By CS Bjerre · Cited by 107 ? Carl S. Bjerre, Secured Transactions Inside Out: Negative Pledgebasis, the proceeds of the resulting secured loan.In First Wyoming Bank v. A home equity loan ? sometimes called a second mortgage ? is a loan that's secured by your home. You get the loan for a specific amount of money and it must be ...