Wyoming Internet Use Policy

Description

How to fill out Internet Use Policy?

You might spend numerous hours online trying to locate the legal document template that complies with the federal and state standards you require.

US Legal Forms offers a vast collection of legal forms that have been examined by experts.

It is easy to download or print the Wyoming Internet Use Policy from our platform.

If available, use the Preview button to review the document format as well.

- If you possess a US Legal Forms account, you can sign in and then click the Download button.

- Subsequently, you can complete, modify, print, or sign the Wyoming Internet Use Policy.

- Every legal document format you purchase is yours indefinitely.

- To retrieve another copy of any purchased form, navigate to the My documents section and click the respective button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions below.

- First, ensure you have selected the appropriate document format for the region/city of your choice.

- Review the form description to confirm you have chosen the correct template.

Form popularity

FAQ

Wyoming has no state income tax primarily due to its robust mineral and energy industries, which provide significant revenue to the state. This unique tax structure attracts many businesses and individuals seeking a favorable economic environment. Understanding how this relates to the Wyoming Internet Use Policy can help online businesses maximize their benefits while staying compliant. For authoritative information on this topic, check resources available on uslegalforms.

To obtain a sales tax license in Wyoming, you must apply through the Wyoming Department of Revenue. This license is necessary for businesses selling goods or services that are taxable. Being familiar with the Wyoming Internet Use Policy can assist you in making sure your application is compliant. Uslegalforms can provide templates and information to streamline the application process.

Since Wyoming does not impose a state income tax, if you earn $70,000, you will retain most of your earnings. Nonetheless, you may still need to consider federal taxes and any local taxes that may apply. This information can be relevant under the Wyoming Internet Use Policy, especially for online businesses. To understand your total tax obligations, it may be beneficial to consult with tax professionals or use uslegalforms for insightful resources.

Filing taxes in Wyoming involves collecting all necessary financial documents and selecting the appropriate forms based on your business type. While Wyoming doesn’t have a state income tax, other taxes may apply depending on your operations. Awareness of the Wyoming Internet Use Policy can aid in ensuring proper tax practices. Uslegalforms offers detailed resources that can assist you with the filing process.

The tax ID number, also known as the Employer Identification Number (EIN), is essential for businesses operating in Wyoming. You can obtain this number from the IRS, and it is necessary for tax purposes, including under the Wyoming Internet Use Policy. Understanding how this number works can enhance your business operations. Using platforms like uslegalforms can help you navigate this process smoothly.

To file a Wyoming annual report, you will need to complete the required forms and submit them to the state's Secretary of State office. This report includes various details about your business and helps maintain your good standing. Familiarizing yourself with the Wyoming Internet Use Policy can simplify the process, ensuring you are up to date on any compliance requirements. Platforms like uslegalforms can provide templates and guidance for this task.

In Wyoming, the use tax is a tax on goods that are purchased outside the state but used within it. This tax ensures that local businesses are not disadvantaged by out-of-state shopping. It's important for residents to understand their obligations under the Wyoming Internet Use Policy, as this helps maintain fair competition within the state. You can find more information and resources on platforms like uslegalforms to assist with compliance.

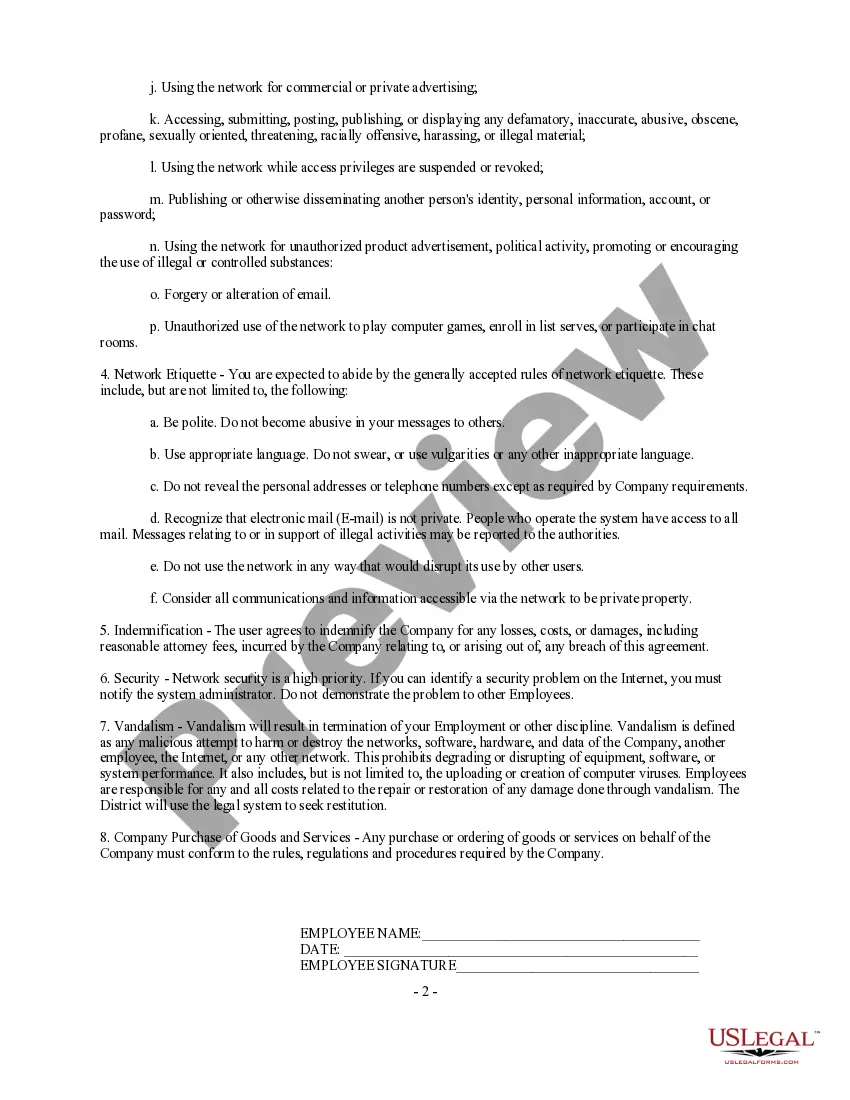

The internet use policy is a statement that defines acceptable behaviors related to internet access and usage in various settings. It serves to inform users about what is permitted and what is not, thereby ensuring a safe online environment. By incorporating the Wyoming Internet Use Policy into your organization, you can maintain compliance and protect both users and organizational integrity.

An internet use policy is a document outlining the rules and regulations concerning how individuals should use the internet within an organization. This policy addresses issues such as security, privacy, and the responsible use of digital resources. Adopting the Wyoming Internet Use Policy can safeguard your organization while promoting efficient internet usage.

The intranet use policy governs how employees can interact with internal network resources, applications, and data within an organization. It is designed to protect sensitive information and ensure efficient communication. A well-defined intranet use policy complements the Wyoming Internet Use Policy by clarifying expectations for both internet and intranet activities.