Wyoming General Guaranty and Indemnification Agreement

Description

How to fill out General Guaranty And Indemnification Agreement?

Are you presently in a role where you require documents for potential corporate or personal activities almost every business day.

There are numerous authorized document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of document templates, such as the Wyoming General Guaranty and Indemnification Agreement, that are designed to meet state and federal standards.

Select the pricing plan you need, fill in the necessary information to set up your account, and pay for the transaction using your PayPal or credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Wyoming General Guaranty and Indemnification Agreement anytime, if required. Click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wyoming General Guaranty and Indemnification Agreement template.

- If you do not possess an account and want to start using US Legal Forms, follow these steps.

- Find the document you require and ensure it is for the correct state/region.

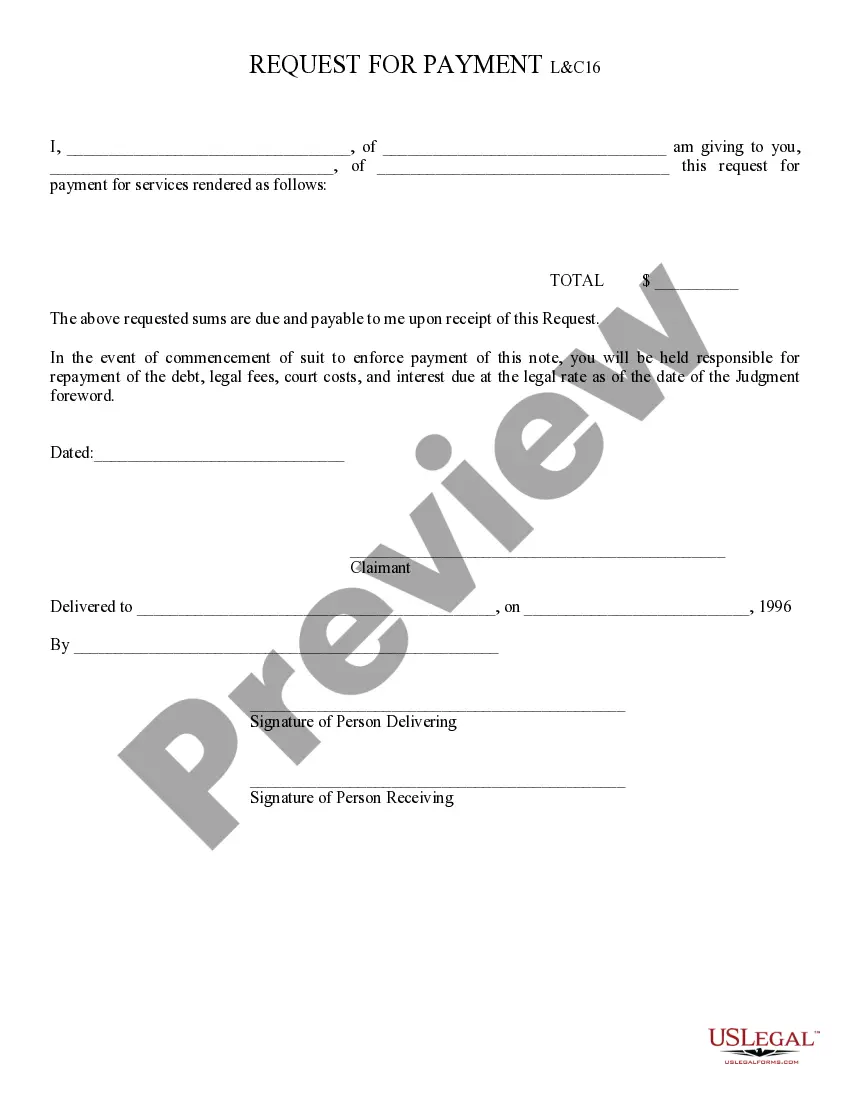

- Utilize the Review button to examine the form.

- Read the description to confirm you have chosen the right template.

- If the document is not what you’re looking for, use the Search field to find a form that fits your needs and requirements.

- When you locate the correct document, click Get now.

Form popularity

FAQ

General Indemnity Clause a hold harmless agreement that refers exclusively to fault or negligence of the indemnitor, without explicitly mentioning how it will respond with respect to fault of the indemnitee.

The key differences between guarantees and indemnities include: a guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

The key differences between guarantees and indemnities include: a guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

An indemnity is a primary obligation; it does not depend on having to prove a breach of a contractual obligation. This offers a number of advantages over bringing a damages claim for a breach of contract: An indemnity will typically be triggered by losses being incurred, without the need to prove any "fault".

At their core, indemnification provisions transfer liabilities related to a claim from one party to another party, generally in the event of a breach of contract or a party's negligence or misconduct in the performance of the agreement.

In order for a guarantee to be valid it must meet certain requirements. There are no formal requirements for creating a valid indemnity, so it could be oral, or in writing but not signed.

Indemnification provisions are generally enforceable. There are certain exceptions however. Indemnifications that require a party to indemnify another party for any claim irrespective of fault ('broad form' or 'no fault' indemnities) generally have been found to violate public policy.

A guarantee is an agreement to meet someone else's agreement to do something usually to make a payment. An indemnity is an agreement to pay for a cost or reimburse a loss incurred by someone else.

Causes of action.The indemnifying party becomes responsible for a cause of action when the indemnified party'sor a third party'sright to seek relief, as the case may be, accrues.

Tips for Enforcing Indemnification ProvisionsIdentify Time Periods for Asserting Indemnification Rights.Provide Notice in a Timely Fashion.Notify All Concerned Parties.Understand Limitations on Recovery.Exclusive Remedy.Scope of Damages.Claims Process/Dispute Resolution.