Wyoming Withdrawal of Registration is a process whereby a business or entity that has previously registered with the Wyoming Secretary of State can withdraw its registration. This process may be used when a business or entity has ceased operations, has been dissolved, or has been acquired by another business. There are two types of Wyoming Withdrawal of Registration: voluntary and involuntary. A voluntary withdrawal is initiated by the entity itself, while an involuntary withdrawal is initiated by the Secretary of State. In both cases, the process requires the filing of a Certificate of Withdrawal along with an appropriate filing fee. Upon completion of the withdrawal process, the entity's registration with the Secretary of State will be terminated.

Wyoming Withdrawal of Registration

Description

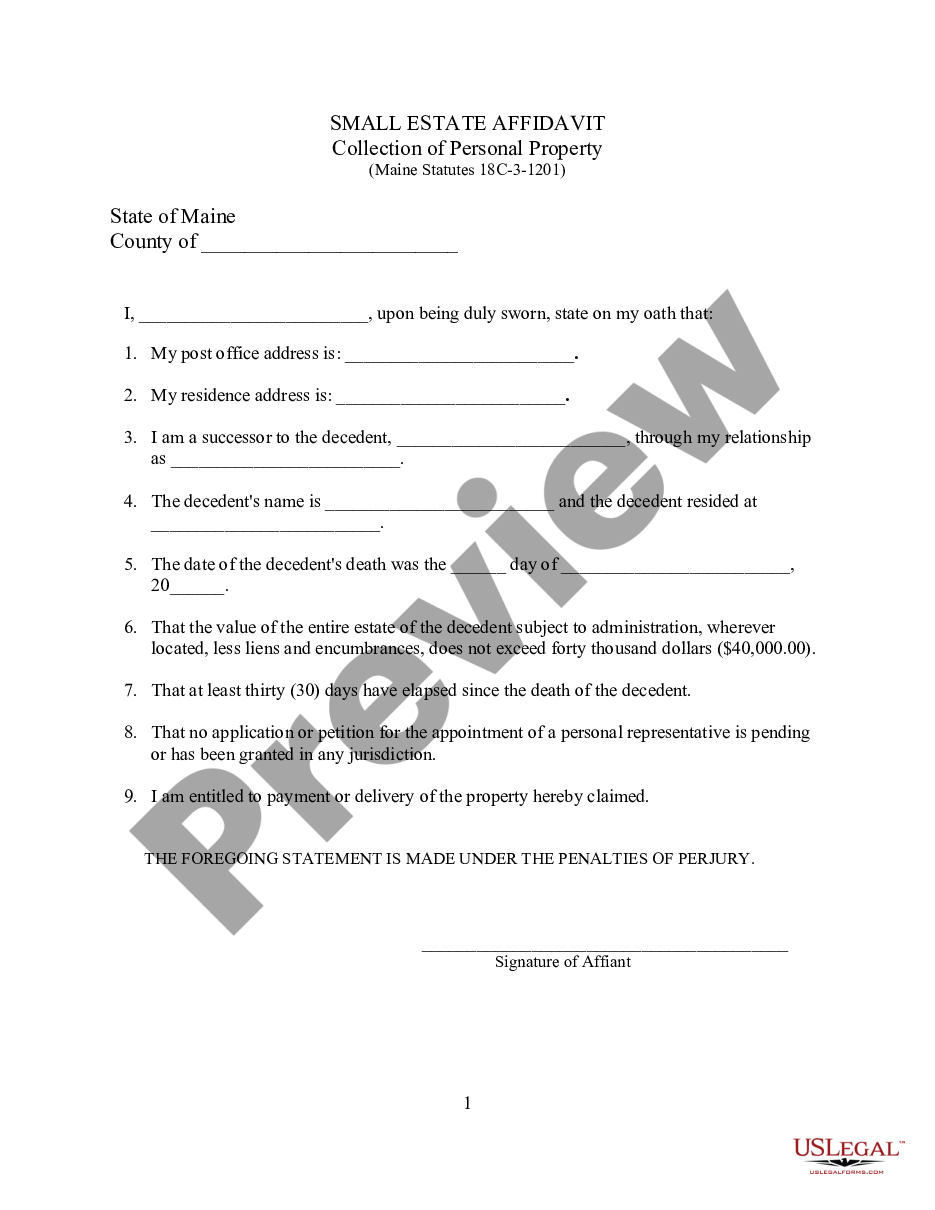

How to fill out Wyoming Withdrawal Of Registration?

If you’re searching for a way to properly prepare the Wyoming Withdrawal of Registration without hiring a legal professional, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every personal and business situation. Every piece of paperwork you find on our web service is designed in accordance with nationwide and state laws, so you can be sure that your documents are in order.

Follow these simple instructions on how to obtain the ready-to-use Wyoming Withdrawal of Registration:

- Ensure the document you see on the page meets your legal situation and state laws by checking its text description or looking through the Preview mode.

- Enter the form title in the Search tab on the top of the page and select your state from the dropdown to locate an alternative template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your Wyoming Withdrawal of Registration and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

You can form a Wyoming LLC even if you don't live in Wyoming. Residency in the state, or the USA, is not required to form a company. A majority of LLCs are formed by non-residents. Forming an LLC in Wyoming as a non-resident is the same process as for a resident.

A Wyoming LLC costs $100 to file with the Secretary of State, plus any registered agent and handling charges. We charge $199 which includes the Secretary's fee. Wyoming requires an annual report for LLCs to be filed on the first day of the month in which the company is formed.

Wyoming LLCs are taxed as pass-through entities by default. This means that revenue from the business passes from the LLC to the tax returns of the LLC members. Members are then responsible for paying federal income taxes and the 15.3% self-employment tax (12.4% social security and 2.9% Medicare).

Starting an LLC in Wyoming. Decide on a name for your business. Assign a registered agent for service of process. Get an Employer Identification Number (EIN) from the IRS. Create an operating agreement. Pay the license tax. Familiarize yourself with the LLC's continuing legal obligations, specifically annual reports.

Starting an LLC in Wyoming. Decide on a name for your business. Assign a registered agent for service of process. Get an Employer Identification Number (EIN) from the IRS. Create an operating agreement. Pay the license tax. Familiarize yourself with the LLC's continuing legal obligations, specifically annual reports.

We'll walk you through the steps. Step 1: Choose a new LLC name.Step 2: Pass a member resolution.Step 3: File a Wyoming LLC Amendment to Articles of Organization.Step 4: Amend your Wyoming operating agreement.Step 5: Change your LLC name with the IRS.