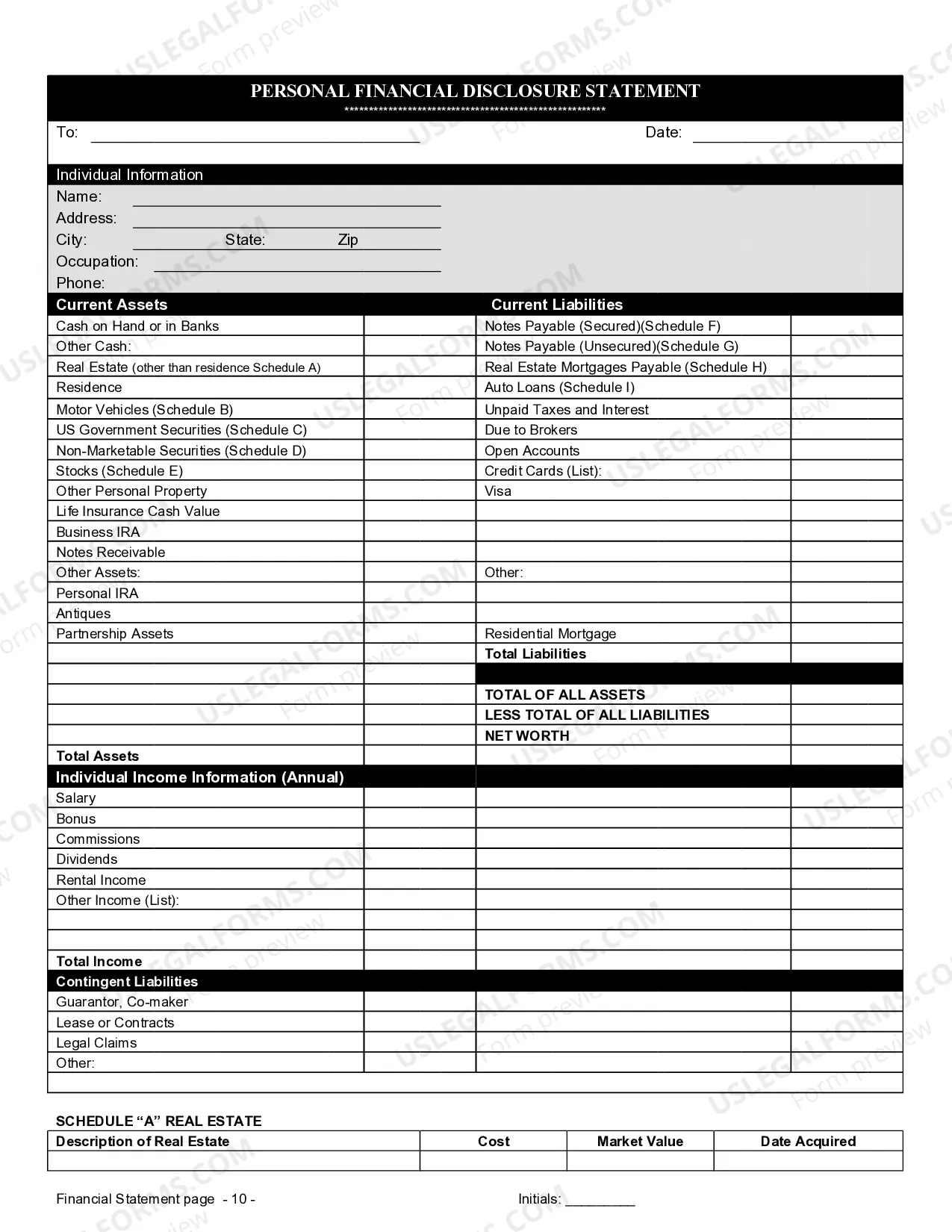

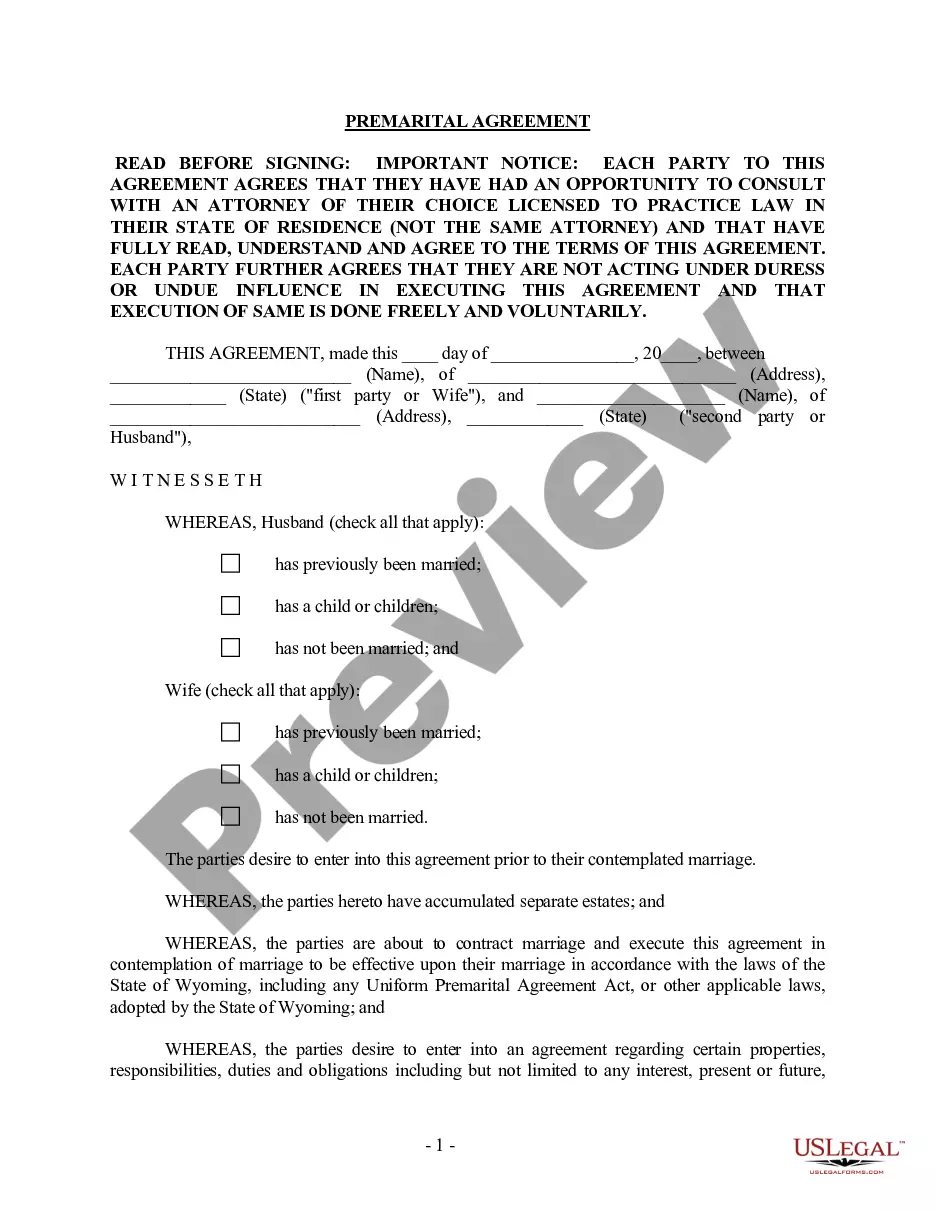

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

Wyoming Prenuptial Premarital Agreement with Financial Statements

Description

How to fill out Wyoming Prenuptial Premarital Agreement With Financial Statements?

Out of the multitude of services that provide legal samples, US Legal Forms provides the most user-friendly experience and customer journey while previewing forms before buying them. Its complete library of 85,000 templates is grouped by state and use for simplicity. All of the forms available on the service have already been drafted to meet individual state requirements by accredited legal professionals.

If you already have a US Legal Forms subscription, just log in, look for the form, press Download and access your Form name from the My Forms; the My Forms tab keeps all of your downloaded documents.

Stick to the tips listed below to obtain the document:

- Once you find a Form name, ensure it’s the one for the state you really need it to file in.

- Preview the template and read the document description prior to downloading the sample.

- Look for a new template through the Search field in case the one you’ve already found is not proper.

- Just click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the template.

When you have downloaded your Form name, you are able to edit it, fill it out and sign it with an web-based editor of your choice. Any form you add to your My Forms tab might be reused multiple times, or for as long as it continues to be the most updated version in your state. Our service offers easy and fast access to samples that suit both legal professionals as well as their customers.

Form popularity

FAQ

Couples may choose to use trusts rather than prenuptial agreements because there is less stigma attached to them. Couples who have received inheritance or couples who have earned money prior to the marriage may choose to set up individual trusts for each partner to clarify who owns what.

Yes, but it is not advisable. Prenuptial agreements are more enforceable than ever as a result of recent amendments to the law in 2006 and 2013, but there remain strict statutory requirements for enforceability.

Under California law, a marriage automatically invalidates any pre-existing will or trust as to the new spouse's inheritance rights, unless the documents provide for a new spouse, or clearly indicate a new spouse will receive nothing.

The average cost of a prenup ranges from about $1,200 for low-cost, simple agreements to $10,000 for more complicated situations.

When a prenuptial agreement and a last will and testament are in conflict, the prenuptial agreement often takes precedence, but the decision is in the hands of a probate court.A last will and testament states a deceased person's wishes for their estate after their death.

The legal advice website Avvo.com suggests that you'll likely pay $600 to $800 for an attorney to draft a prenup. You can certainly pay much more. Generally, the more money you have to protect, and the more complicated your and your beloved's finances are, the more you will spend on a prenup.

Aside from being used as an estate planning tool, trusts can be used for asset protection in divorce.If a spouse established a trust prior to the marriage, the assets placed in that trust are typically considered separate property as long as the funds are not combined with marital funds at any point.

Couples may choose to use trusts rather than prenuptial agreements because there is less stigma attached to them.If you put any money into the trust after you get married, your partner could have a claim on the trust should you get divorced. This is where a prenuptial agreement can help clarify matters.

2. Prenups make you think less of your spouse. And at their root, prenups show a lack of commitment to the marriage and a lack of faith in the partnership.Ironically, the marriage becomes more concerned with money after a prenup than it would have been without the prenup.