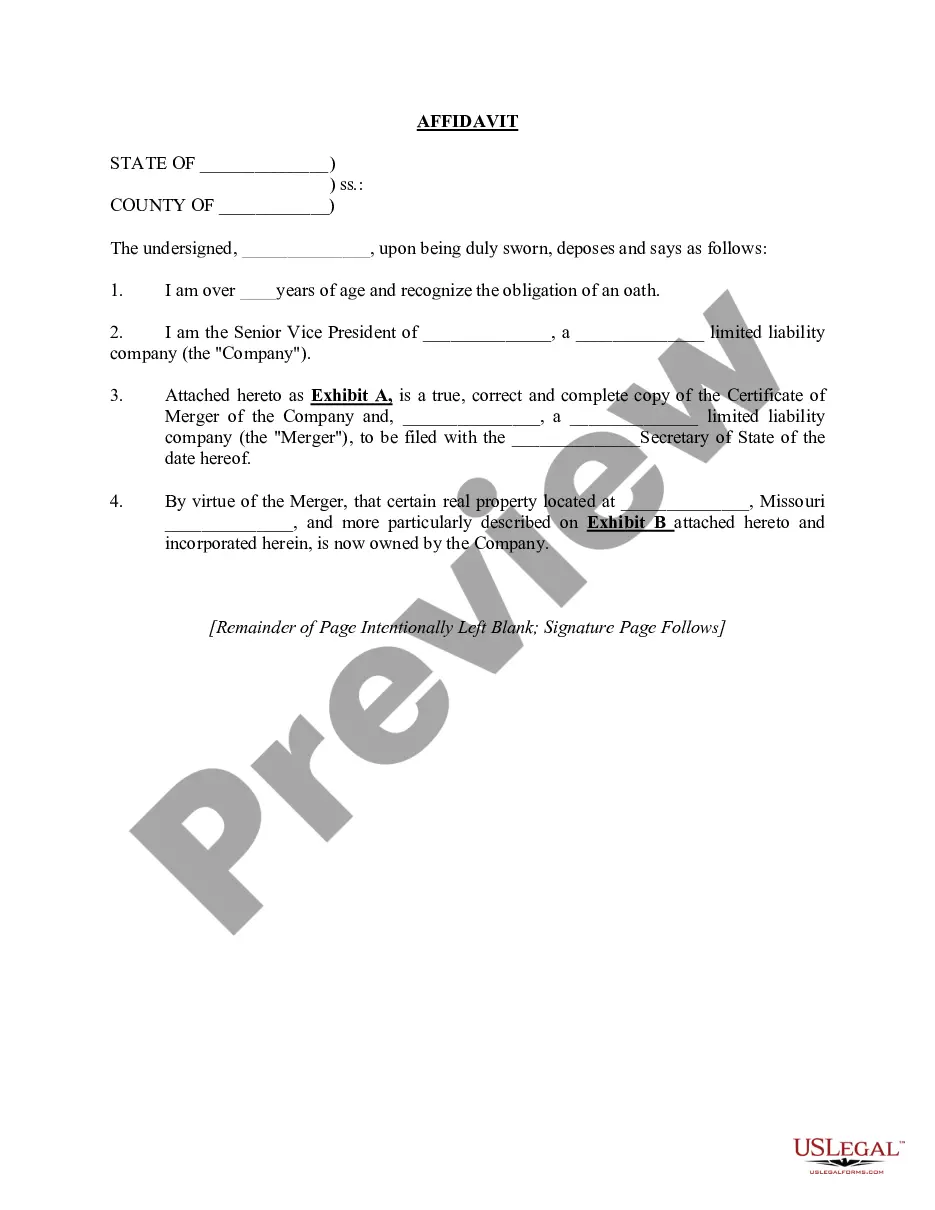

This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

West Virginia Use of Produced Oil Or Gas by Lessor

Description

How to fill out Use Of Produced Oil Or Gas By Lessor?

Finding the right authorized document web template could be a have difficulties. Naturally, there are tons of web templates available online, but how will you find the authorized type you require? Make use of the US Legal Forms web site. The services offers thousands of web templates, for example the West Virginia Use of Produced Oil Or Gas by Lessor, which you can use for enterprise and private requires. Every one of the kinds are checked out by specialists and fulfill state and federal demands.

Should you be presently signed up, log in in your accounts and then click the Obtain button to obtain the West Virginia Use of Produced Oil Or Gas by Lessor. Use your accounts to appear with the authorized kinds you may have acquired earlier. Visit the My Forms tab of your respective accounts and have an additional backup of your document you require.

Should you be a new user of US Legal Forms, listed below are basic recommendations so that you can comply with:

- First, make sure you have chosen the correct type for the area/state. You can look through the shape making use of the Review button and look at the shape description to make sure this is the best for you.

- In case the type will not fulfill your requirements, utilize the Seach industry to get the right type.

- When you are certain that the shape is suitable, go through the Buy now button to obtain the type.

- Select the costs program you would like and enter in the required information and facts. Create your accounts and pay for an order with your PayPal accounts or Visa or Mastercard.

- Select the data file structure and obtain the authorized document web template in your device.

- Comprehensive, edit and print out and indication the obtained West Virginia Use of Produced Oil Or Gas by Lessor.

US Legal Forms is definitely the largest catalogue of authorized kinds in which you can discover various document web templates. Make use of the service to obtain skillfully-created paperwork that comply with condition demands.

Form popularity

FAQ

Gasoline is the most-consumed petroleum product in the United States. In 2022, consumption of finished motor gasoline averaged about 8.78 million b/d (369 million gallons per day), which was about 43% of total U.S. petroleum consumption.

The refined products are used in a variety of applications, including compounding motor oils, gear oils, greases, pharmaceutical and agricultural spray oils, food-grade applications, and high-temperature rubber applications.

How does West Virginia rank in the nation for oil and gas production? West Virginia currently ranks #9 in the nation based on barrels of oil equivalent (BOE) production. How many wells were drilled in West Virginia so far this year? West Virginia has had 114,642 wells drilled this year.

The West Virginia Geological and Economic Survey provides an interactive map of over 144,000 oil and gas wells in West Virginia.

West Virginia has 31 underground natural gas storage fields with a combined storage capacity of about 531 billion cubic feet of natural gas. That is almost 6% of the nation's total underground natural gas storage capacity.

The major uses for petroleum products are gasoline, diesel fuel, fuel oil (often used for heating homes), propane, aviation fuel, petrochemical feedstocks, kerosene, lubricants, waxes, and asphalt.

About 45 percent of a typical barrel of crude oil is refined into gasoline. An additional 29 percent is refined to diesel fuel. The remaining oil is used to make plastics and other products (see image Products made from a barrel of crude oil, 2016).

West Virginia is one of several states that is home to the Marcellus Shale (also known as The Marcellus Formation). The Marcellus Shale is a geologic formation of sedimentary (shale) rock that contains natural gas, and is one of the largest onshore natural gas fields in North America..