This provision provides for the assignor to except from this assignment and reserve an overriding royalty interest of all oil, gas, casinghead gas, and other minerals that may be produced from the lands under the terms of the Leases that are the subject of this assignment.

West Virginia Reservation of Overriding Royalty Interest

Description

How to fill out Reservation Of Overriding Royalty Interest?

If you need to full, obtain, or print out legal document web templates, use US Legal Forms, the largest assortment of legal types, which can be found on the Internet. Take advantage of the site`s simple and practical research to discover the documents you need. Different web templates for business and personal uses are sorted by classes and claims, or search phrases. Use US Legal Forms to discover the West Virginia Reservation of Overriding Royalty Interest in just a number of mouse clicks.

When you are already a US Legal Forms consumer, log in to the bank account and click on the Down load key to obtain the West Virginia Reservation of Overriding Royalty Interest. You can also accessibility types you previously saved within the My Forms tab of your bank account.

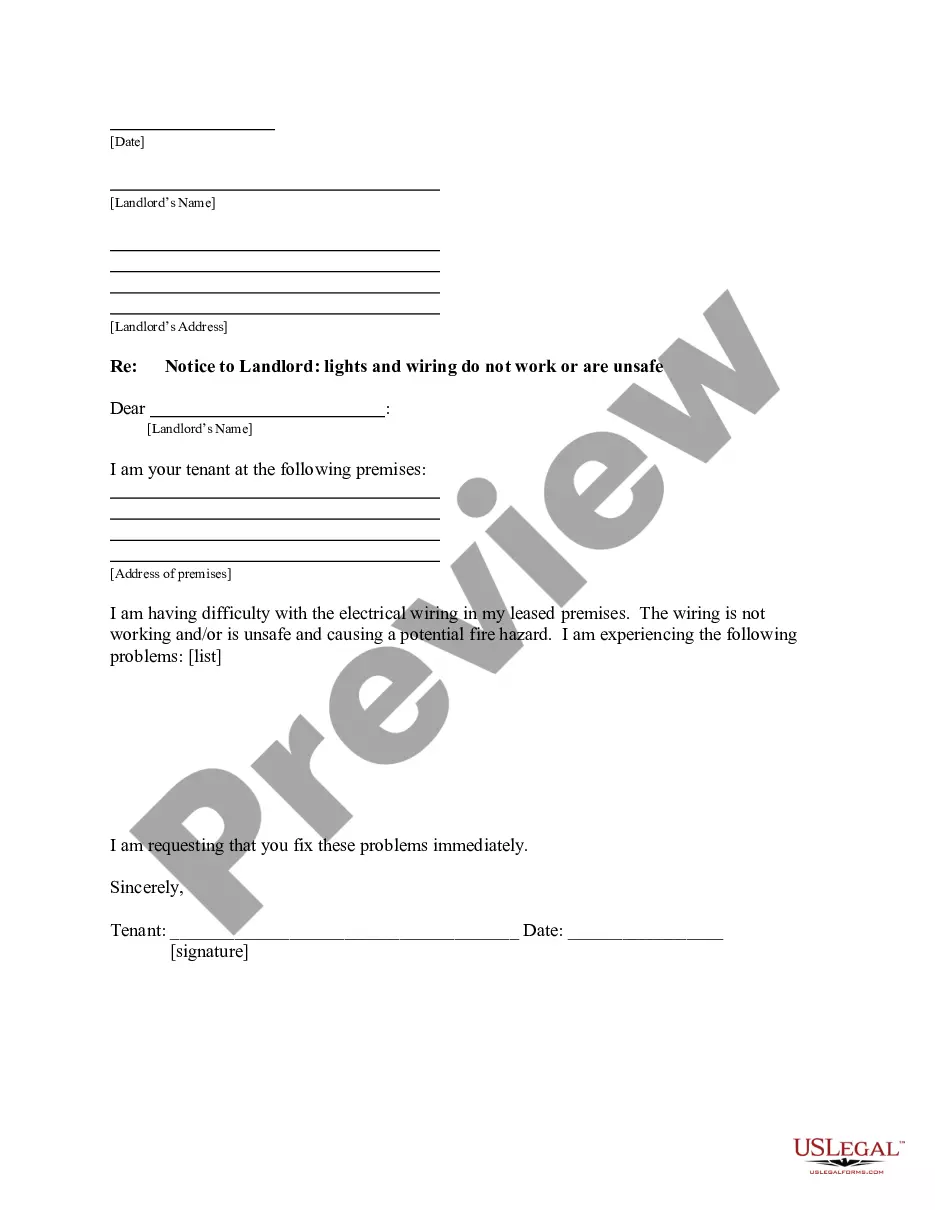

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for your right town/region.

- Step 2. Make use of the Preview method to look through the form`s articles. Don`t overlook to learn the description.

- Step 3. When you are unhappy with the kind, utilize the Lookup industry towards the top of the screen to find other models of your legal kind web template.

- Step 4. When you have discovered the shape you need, click on the Purchase now key. Opt for the rates prepare you choose and add your accreditations to sign up for the bank account.

- Step 5. Procedure the deal. You may use your credit card or PayPal bank account to finish the deal.

- Step 6. Find the file format of your legal kind and obtain it on the device.

- Step 7. Full, modify and print out or indication the West Virginia Reservation of Overriding Royalty Interest.

Every single legal document web template you purchase is yours eternally. You might have acces to every single kind you saved with your acccount. Go through the My Forms area and pick a kind to print out or obtain again.

Be competitive and obtain, and print out the West Virginia Reservation of Overriding Royalty Interest with US Legal Forms. There are millions of skilled and express-specific types you can use for your personal business or personal needs.

Form popularity

FAQ

§37B-1-4. Lawful use and development by cotenants; election of interests; reporting and remitting of interests of unknown or unlocatable cotenants; establishment of terms and provisions for development; and merging of surface and oil and gas.

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

Whether you have an offer on the table or not, you may have good reasons to sell your mineral rights: To pursue other opportunities. If you have a nonproducing property, you might have to wait years for anything to happen ? and nothing may ever happen, even after multiple leases.

In many families, there's debate over the owners of mineral rights or surface rights. You can use the local authority website to find the general information in the state and county records.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

The West Virginia ?Co-Tenancy? statute (W.Va. Code § 37-1-4) permits oil and gas producers to drill on property with unleased mineral owners.

In many families, there's debate over the owners of mineral rights or surface rights. You can use the local authority website to find the general information in the state and county records.

Mineral interests in WV are taxed the same as your home. You will pay 60% of the appraised value on the minerals at the levy rate for your county. The value of these minerals in based on WV Code procedures and is the same for all counties in WV. Minerals are taxed at a minimum value until production begins.