West Virginia Deed and Assignment from Trustee to Trust Beneficiaries

Description

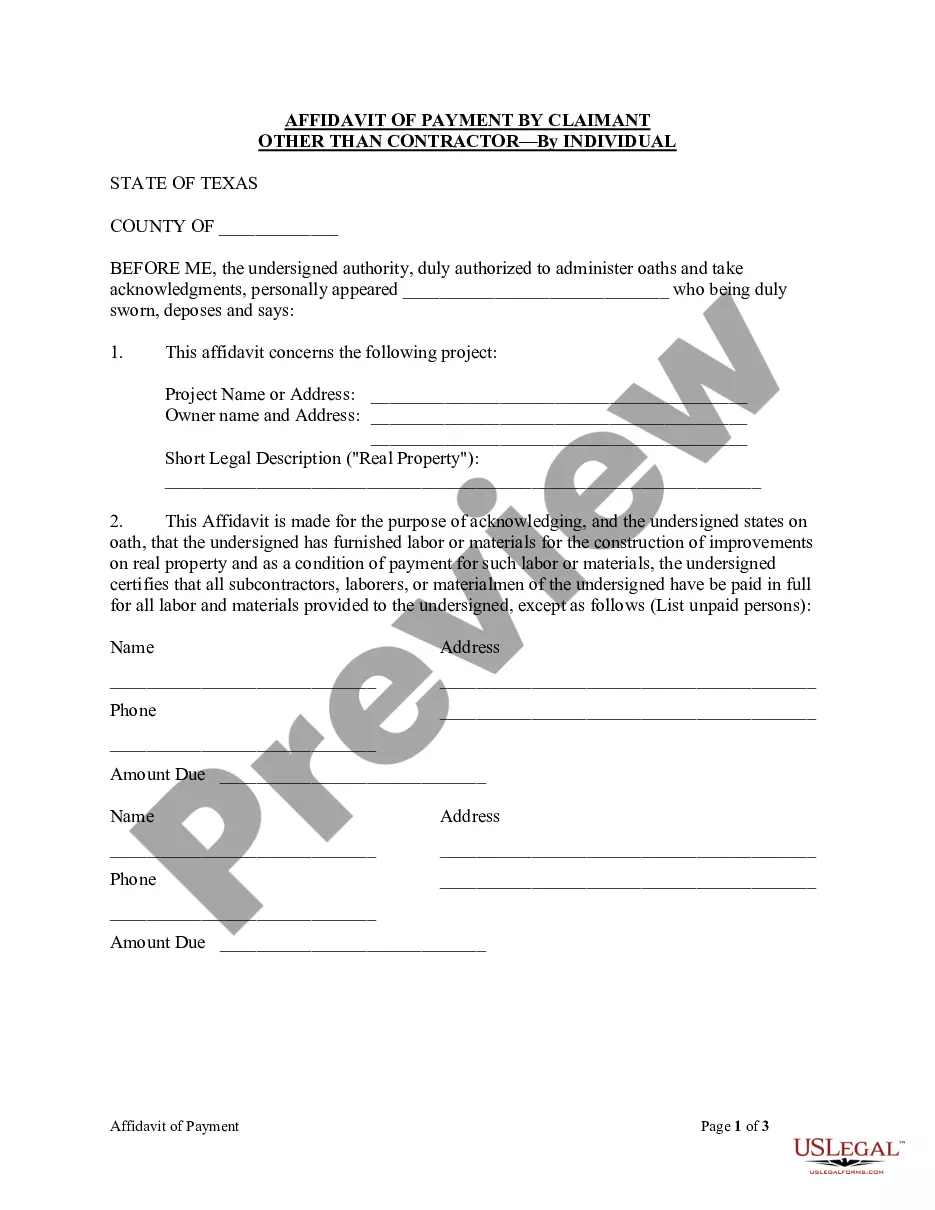

How to fill out Deed And Assignment From Trustee To Trust Beneficiaries?

US Legal Forms - one of many largest libraries of authorized forms in the USA - gives a wide array of authorized document themes you are able to download or print out. While using web site, you can get 1000s of forms for organization and specific purposes, categorized by classes, says, or keywords and phrases.You will discover the most up-to-date variations of forms such as the West Virginia Deed and Assignment from Trustee to Trust Beneficiaries in seconds.

If you have a membership, log in and download West Virginia Deed and Assignment from Trustee to Trust Beneficiaries in the US Legal Forms library. The Download key will show up on each and every kind you perspective. You gain access to all earlier saved forms within the My Forms tab of the account.

In order to use US Legal Forms the first time, here are straightforward directions to help you began:

- Be sure to have picked the proper kind for the metropolis/area. Go through the Review key to examine the form`s information. Browse the kind description to ensure that you have selected the proper kind.

- When the kind doesn`t match your demands, utilize the Research area towards the top of the screen to find the one which does.

- If you are pleased with the form, validate your selection by visiting the Acquire now key. Then, opt for the pricing strategy you like and provide your accreditations to sign up on an account.

- Method the transaction. Make use of your charge card or PayPal account to perform the transaction.

- Choose the formatting and download the form in your device.

- Make adjustments. Complete, edit and print out and signal the saved West Virginia Deed and Assignment from Trustee to Trust Beneficiaries.

Every format you put into your money lacks an expiration time and is also your own property eternally. So, if you would like download or print out an additional duplicate, just proceed to the My Forms segment and then click about the kind you need.

Gain access to the West Virginia Deed and Assignment from Trustee to Trust Beneficiaries with US Legal Forms, by far the most extensive library of authorized document themes. Use 1000s of expert and state-certain themes that meet your small business or specific requirements and demands.

Form popularity

FAQ

A trust deed ?also known as a deed of trust?is a document sometimes used in real estate transactions in the U.S. It is a document that comes into play when one party has taken out a loan from another party to purchase a property.

If you borrow from a commercial lender, it is most likely that the lender will determine the trustee, which is typically a title company, professional escrow company, or other company in the business of serving as a real estate trustee. Sometimes a real estate broker or an attorney serves in this role.

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.

A trustee is any person or organization that holds the legal title of an asset or group of assets for another person, called the grantor. A trustee is granted this legal title through a trust in which the they hold title to the assets held in trust for the benefit of others.

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

When property is ?held in trust,? there is a divided ownership of the property, ?generally with the trustee holding legal title and the beneficiary holding equitable title.? The trust itself owns nothing because it is not an entity capable of owning property.

What is a trustor vs trustee? In a deed of trust, a trustor is the borrower and the trustee is a third party that holds the property's title. The trustee is entrusted with the title and the right to sell the property if the trustor defaults on the loan.