West Virginia Self-Employed Commercial Fisherman Services Contract

Description

How to fill out Self-Employed Commercial Fisherman Services Contract?

If you need to finalize, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, accessible online.

Employ the site's user-friendly and efficient search to locate the documents you require.

Numerous templates for both corporate and individual use are organized by categories and states, or keywords. Use US Legal Forms to locate the West Virginia Self-Employed Commercial Fisherman Services Contract with just a few clicks.

Every legal document template you obtain is yours permanently. You have access to all forms you saved in your account. Visit the My documents section and select a form to print or download again.

Act promptly and acquire, and print the West Virginia Self-Employed Commercial Fisherman Services Contract with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms customer, Log In to your account and click the Download option to retrieve the West Virginia Self-Employed Commercial Fisherman Services Contract.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

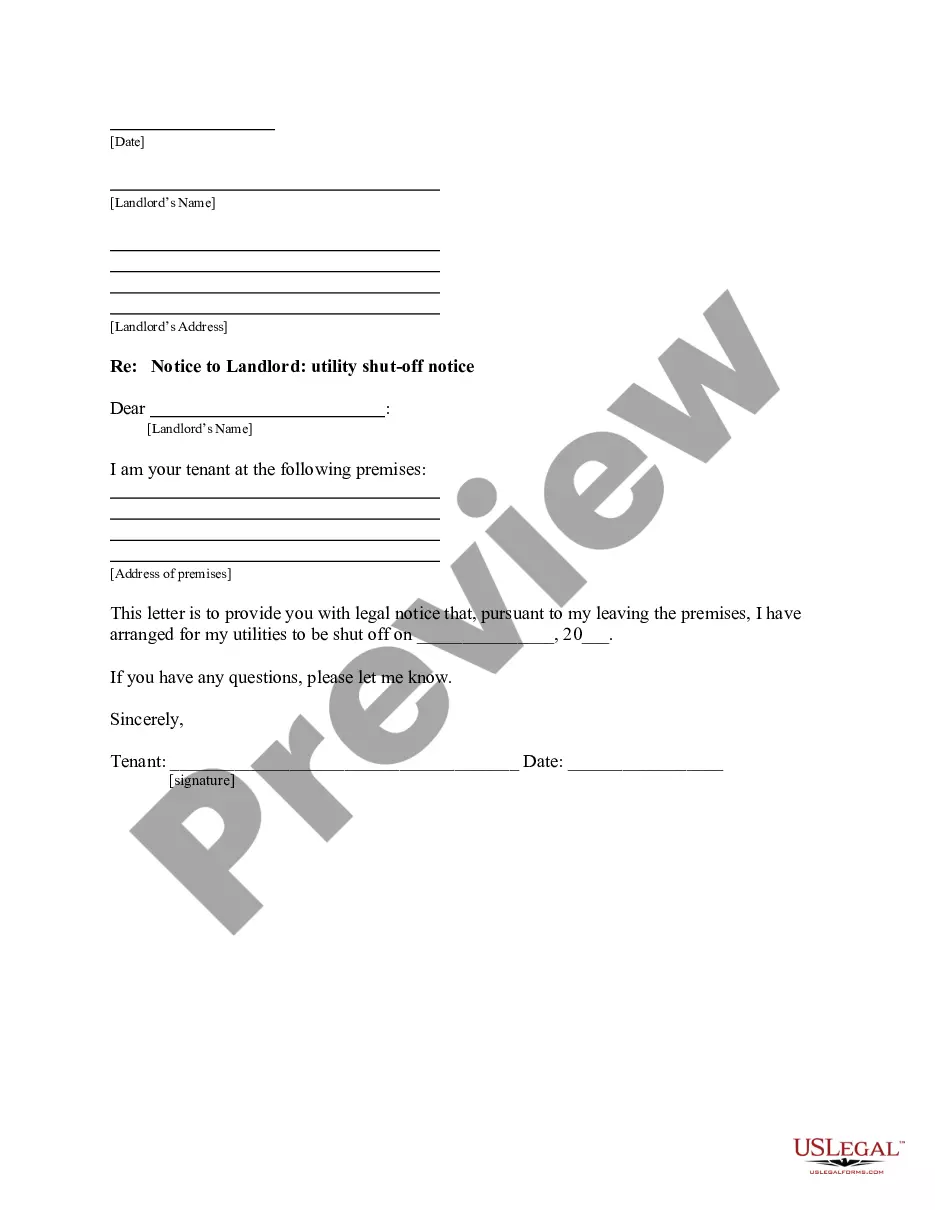

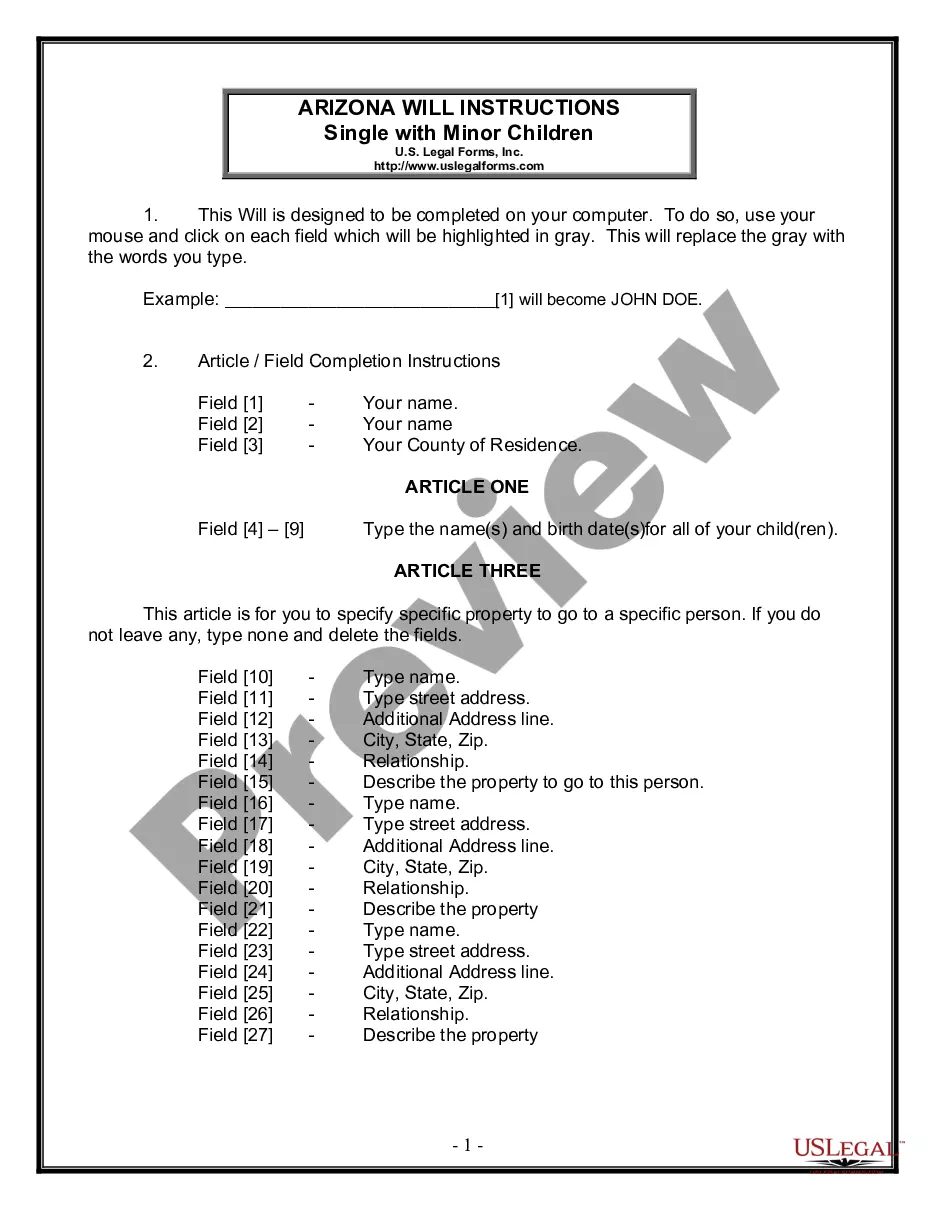

- Step 2. Use the Preview option to review the form’s content. Don’t forget to check the description.

- Step 3. If you are unsatisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and provide your information to create an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the West Virginia Self-Employed Commercial Fisherman Services Contract.

Form popularity

FAQ

In West Virginia, independent contractors must adhere to specific legal requirements to ensure compliance with state laws. First, they need to have a clear contract that outlines the terms of the West Virginia Self-Employed Commercial Fisherman Services Contract. This contract should detail the scope of work, payment terms, and any other obligations. Additionally, independent contractors must handle their taxes, obtain necessary permits, and maintain appropriate insurance to protect themselves and their business.

To obtain a contractor license in West Virginia, you must complete an application and provide proof of relevant experience and insurance. You will also need to pass an examination specific to your trade. Once you meet the requirements, submit your application along with the necessary fees. For assistance with the application process, consider using US Legal Forms, which offers tools and templates tailored for the West Virginia Self-Employed Commercial Fisherman Services Contract.

In West Virginia, you can perform up to $1,000 worth of work without needing a contractor's license. However, this threshold applies to various types of work, including services related to the West Virginia Self-Employed Commercial Fisherman Services Contract. If you plan to exceed this limit, you must obtain the appropriate license to ensure compliance with state regulations. Consulting resources like US Legal Forms can help clarify requirements and save time.

To become a vendor for the state of West Virginia, you need to register your business with the state's purchasing division. Begin by completing the vendor registration form on the state's official website. Once registered, you can submit bids for various contracts, including those related to the West Virginia Self-Employed Commercial Fisherman Services Contract. Utilizing platforms like US Legal Forms can streamline the process of preparing necessary documents.

In West Virginia, many professional services are subject to sales tax, though there are exceptions. For those operating under a West Virginia Self-Employed Commercial Fisherman Services Contract, understanding your tax obligations is crucial. Using platforms like uslegalforms can provide you with the necessary tools and resources to ensure compliance with tax regulations and help you manage your business effectively.

Yes, in West Virginia, you typically need a fishing license even to fish on private property, unless the property owner has specific exemptions. If you are a self-employed commercial fisherman, using a West Virginia Self-Employed Commercial Fisherman Services Contract can help you navigate licensing and legal requirements. This contract can also ensure that you are compliant with state fishing regulations, protecting your business.

Yes, West Virginia allows independent contractors to operate legally within the state. Many commercial fishermen utilize a West Virginia Self-Employed Commercial Fisherman Services Contract to formalize their independent status. This contract can help clarify the relationship between the contractor and any clients, ensuring both parties understand their rights and responsibilities.

In West Virginia, the self-employment tax is generally 15.3% of your net earnings, which includes both Social Security and Medicare taxes. This tax applies to individuals who operate as self-employed, such as those using a West Virginia Self-Employed Commercial Fisherman Services Contract. It's essential to keep accurate records of your earnings and expenses to calculate your tax accurately and to ensure compliance with state regulations.