West Virginia Self-Employed Window Washer Services Contract

Description

How to fill out Self-Employed Window Washer Services Contract?

US Legal Forms - one of the largest collections of legal forms in the United States - provides a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the most recent versions of forms like the West Virginia Self-Employed Window Washer Services Contract in moments.

If you have an account, Log In and download the West Virginia Self-Employed Window Washer Services Contract from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms in the My documents section of your profile.

Complete the transaction. Use your credit card or PayPal account to finish the transaction.

Choose the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded West Virginia Self-Employed Window Washer Services Contract. Every template you saved to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the West Virginia Self-Employed Window Washer Services Contract with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your locality/county.

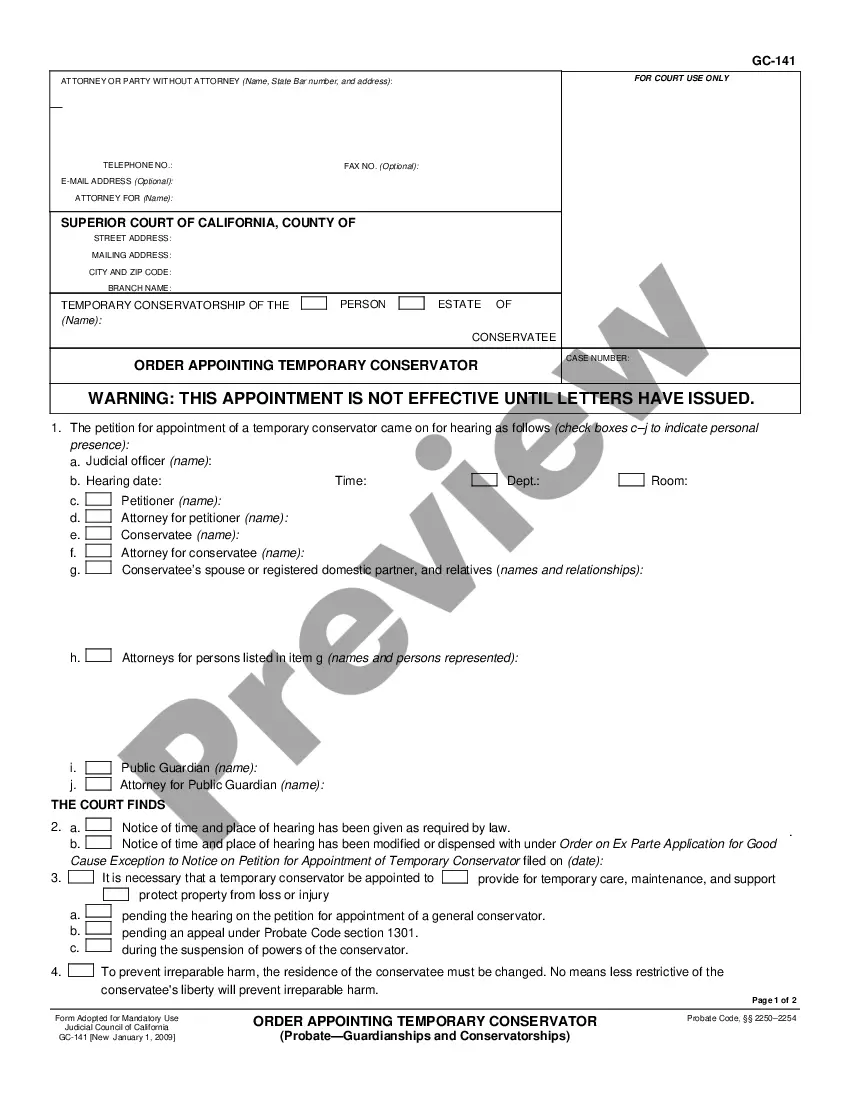

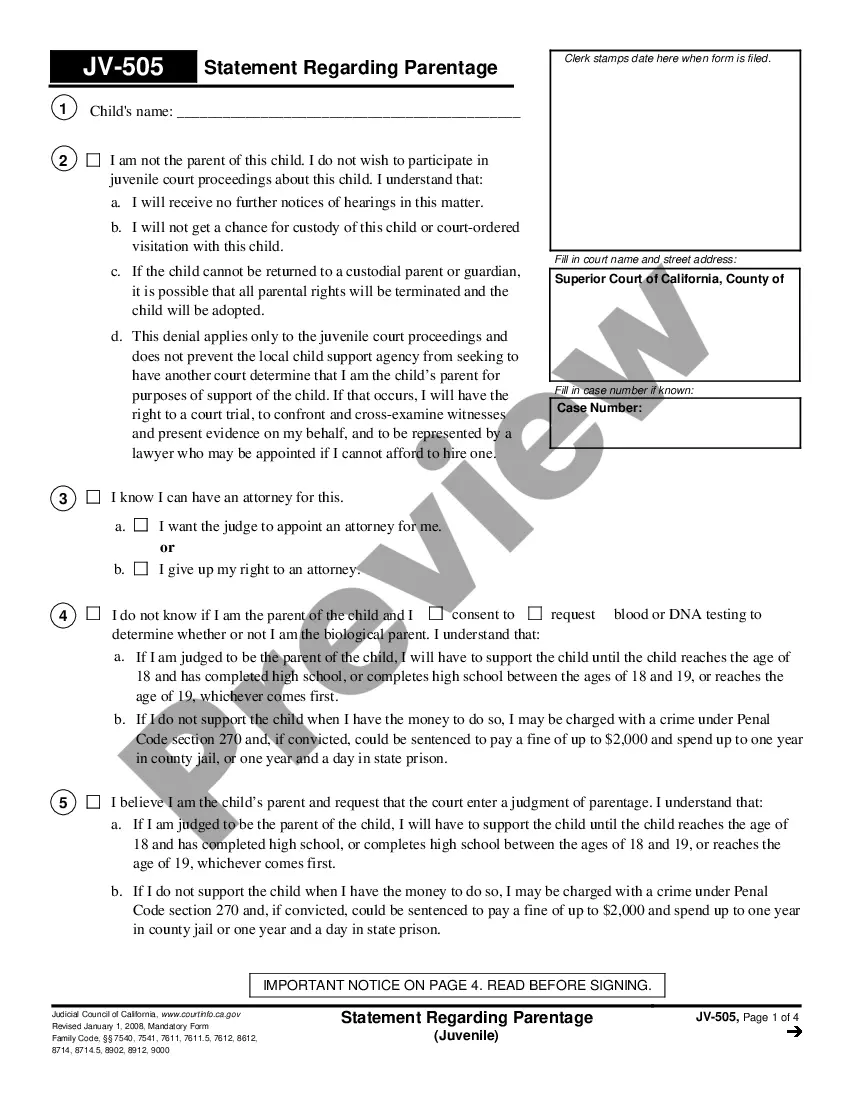

- Click on the Review option to evaluate the form's content.

- Read the form description to make sure you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- If you are happy with the form, confirm your choice by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

To secure a cleaning services contract, start by defining your services clearly. You will need to outline the specific tasks you offer as part of your West Virginia Self-Employed Window Washer Services Contract. Next, connect with local businesses, property managers, or homeowners to present your services. Additionally, using platforms like US Legal Forms can help you create a professional contract that meets legal standards, ensuring both parties understand their obligations.

To start a window cleaning business in West Virginia, you need a general business license, as well as any specific permits required by your local governing body. Understanding the licensing requirements will help you avoid legal complications as you begin your work. A well-structured West Virginia Self-Employed Window Washer Services Contract can guide you in maintaining compliance with these regulations.

employed window cleaner in West Virginia can earn varying amounts depending on factors such as client base and services offered. On average, window cleaners can make between $50 to $100 per hour. Establishing a solid West Virginia SelfEmployed Window Washer Services Contract can also add credibility and potentially increase your earning potential.

To become a window cleaner, you typically need to be physically fit and comfortable working at heights. While formal training is not always required, having experience in the field is beneficial. Completing a West Virginia Self-Employed Window Washer Services Contract can also help you understand the essentials of running a successful window cleaning business.

Yes, in West Virginia, you need a license to operate a window washing service. This ensures you adhere to safety regulations and provide quality services. Make sure to obtain the necessary licenses and permits before signing any West Virginia Self-Employed Window Washer Services Contract.

To secure a commercial window cleaning contract, start by networking with local businesses and showcasing your services. Create a professional proposal highlighting your skills, experience, and reliability. Additionally, having a solid West Virginia Self-Employed Window Washer Services Contract can help demonstrate your professionalism and commitment to quality service.

To legally operate a window cleaning business in West Virginia, you typically need a business license. Additionally, some local jurisdictions may require specific permits or registrations. It's important to check with your local city or county office to ensure compliance with local laws when establishing your West Virginia Self-Employed Window Washer Services Contract.

In West Virginia, the extent of work you can perform without a contractor's license depends on the type of services. While window washing generally does not require a license, major renovation or construction work does. When utilizing a West Virginia Self-Employed Window Washer Services Contract, make sure to adhere to local regulations. You can visit uslegalforms for templates and guidance to ensure compliance.

Yes, West Virginia allows independent contractors, and many window washers operate as self-employed professionals under a West Virginia Self-Employed Window Washer Services Contract. However, it's crucial to meet the state's requirements regarding licenses and taxes to ensure your business operates smoothly. Using platforms like uslegalforms can help you navigate the legal aspects effectively.

Self-employment tax in West Virginia is composed of Social Security and Medicare taxes. Typically, the rate is 15.3%, which applies to your net earnings from self-employment, including your income from a West Virginia Self-Employed Window Washer Services Contract. Understanding this tax is crucial for budget planning, as it can significantly impact your take-home income.