West Virginia Fuel Delivery And Storage Services - Self-Employed

Description

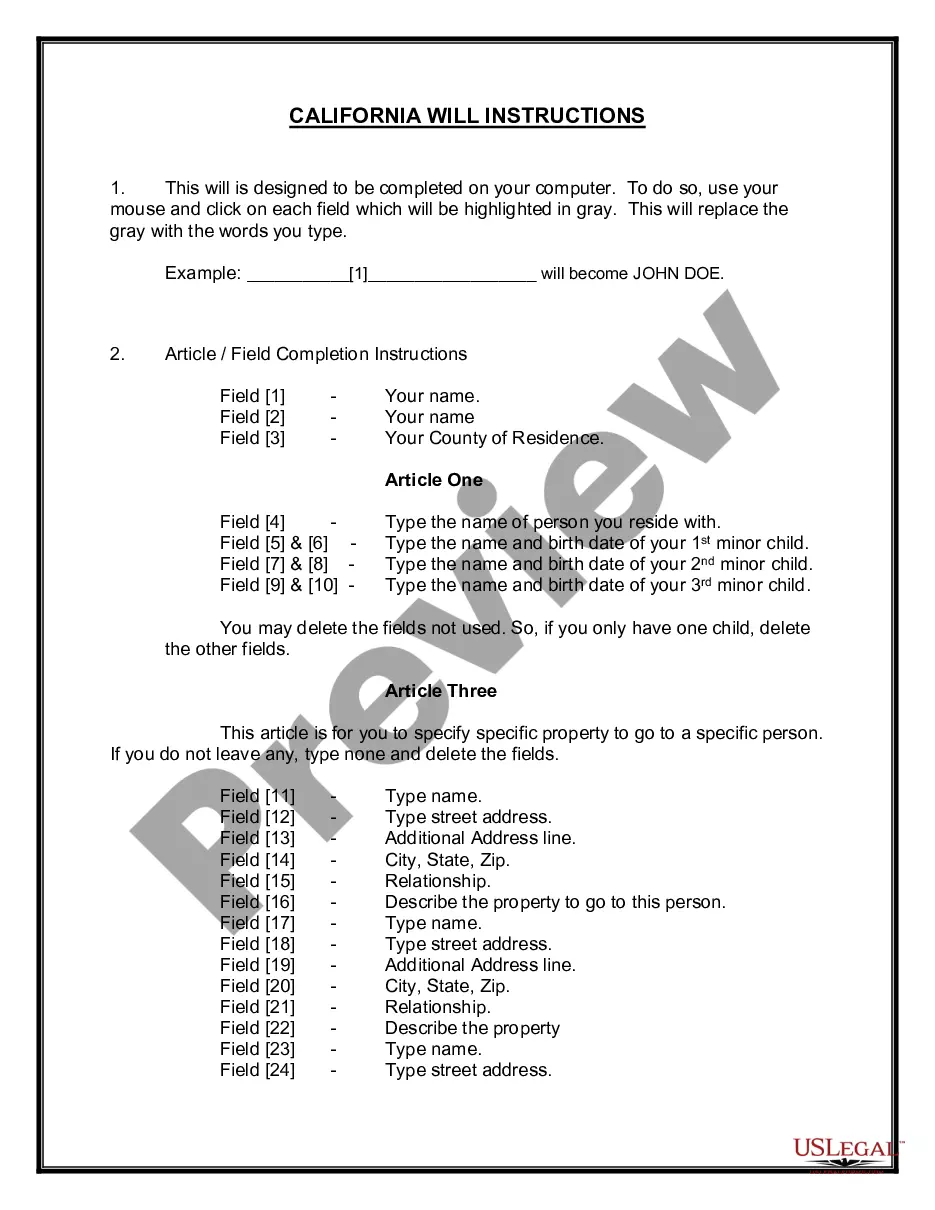

How to fill out Fuel Delivery And Storage Services - Self-Employed?

Finding the appropriate legal document template can be quite a challenge. Naturally, there are numerous templates available online, but how do you locate the legal form you need? Utilize the US Legal Forms website. The platform offers thousands of templates, including the West Virginia Fuel Delivery And Storage Services - Self-Employed, which can be utilized for business and personal purposes. All of the forms are verified by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to acquire the West Virginia Fuel Delivery And Storage Services - Self-Employed. Use your account to review the legal forms you have previously purchased. Navigate to the My documents section of your account and obtain an additional copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/region. You can browse the form using the Preview button and read the form description to confirm it is the right one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are certain that the form is suitable, click the Get now button to download the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received West Virginia Fuel Delivery And Storage Services - Self-Employed.

- US Legal Forms is the largest collection of legal documents where you can find various document templates.

- Utilize the service to download properly crafted papers that comply with state regulations.

- Access a wide range of templates for different legal needs.

- Ensure that all documents meet the required legal standards.

- Efficiently handle your legal paperwork with ease.

- Take advantage of the user-friendly platform to manage your forms.

Form popularity

FAQ

In West Virginia, the minimum income threshold for filing taxes varies based on your filing status and age. Generally, if you earn over $10,000 as a self-employed individual in West Virginia Fuel Delivery And Storage Services, you must file a tax return. However, it is wise to file even if you fall below this threshold, as you may be eligible for refunds or credits. Always check the latest requirements to ensure compliance with state regulations.

Self-employment tax in West Virginia typically consists of Social Security and Medicare taxes, which total approximately 15.3% on your net earnings. As a self-employed individual in West Virginia Fuel Delivery And Storage Services, it's essential to set aside this tax to avoid surprises during tax season. You can deduct half of this self-employment tax when calculating your taxable income. This deduction can help lower your overall tax liability.

The small seller exception in West Virginia allows qualifying businesses to avoid certain licensing and regulatory requirements. This exception is particularly beneficial for self-employed individuals in West Virginia Fuel Delivery And Storage Services. If your annual gross sales remain below a specific threshold, you can operate without the full burden of compliance. Understanding this exception can help streamline your business operations and save costs.

Starting a fuel delivery business in West Virginia requires a solid business plan, the right permits, and a suitable vehicle equipped for fuel transport. You will need fuel tanks, pumps, and safety equipment to comply with regulations. Additionally, utilizing resources from platforms like US Legal Forms can help you streamline documentation and ensure you meet legal standards. Planning thoroughly sets the foundation for your venture's success.

To operate a mobile fuel delivery business in West Virginia, you typically need a business license, a special fuel distribution license, and possibly an environmental permit. It is essential to comply with both state and federal regulations regarding safety and transport of fuel. It’s recommended to consult legal resources or platforms like US Legal Forms to ensure you meet all necessary requirements. Proper licensing not only protects your business but also ensures you provide safe and reliable services.

The business income tax rate in West Virginia is set at 6.5%. This tax applies to corporations and businesses operating in the state, including those offering West Virginia Fuel Delivery and Storage Services - Self-Employed. Understanding this tax is beneficial for financial planning and ensuring that your business remains profitable while meeting state obligations.

To start a business in West Virginia, you need to register your business with the Secretary of State, obtain necessary permits, and consider any local zoning laws. It's also advisable to outline your business plan, particularly if you are offering West Virginia Fuel Delivery and Storage Services - Self-Employed. Utilizing platforms like uslegalforms can help streamline your registration and compliance processes.

The motor fuel excise tax in West Virginia is currently set at 20.5 cents per gallon. This tax helps support road construction and maintenance throughout the state. As a self-employed individual in West Virginia Fuel Delivery and Storage Services, being aware of this tax ensures you can manage your expenses effectively and stay compliant.

A mobile fuel delivery business can indeed be profitable, particularly in regions like West Virginia where there is a consistent demand for fuel delivery and storage services. As a self-employed individual, excellent customer service and reliable delivery can set your business apart. By leveraging efficient logistics and a strong marketing strategy, you can tap into the growing market for convenient fuel solutions, ultimately increasing your income. Remember to consider your target audience and their specific needs when developing your business plan.

Yes, there are several apps available that provide on-demand fuel delivery, catering specifically to users in West Virginia. These applications connect customers with local fuel providers, making it easier than ever to access efficient fuel delivery and storage services. By utilizing such technology, you can streamline your self-employed fuel delivery business and ensure customer satisfaction. Explore options that integrate well with your operational needs to enhance service delivery.