West Virginia Delivery Driver Services Contract - Self-Employed

Description

How to fill out Delivery Driver Services Contract - Self-Employed?

Are you currently in a situation where you need documents for either professional or personal purposes on a daily basis.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, such as the West Virginia Delivery Driver Services Contract - Self-Employed, designed to comply with federal and state regulations.

Once you find the correct form, click Purchase now.

Select the pricing plan you want, provide the required information to create your account, and complete your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the West Virginia Delivery Driver Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Choose the form you need and verify it is for the correct city/state.

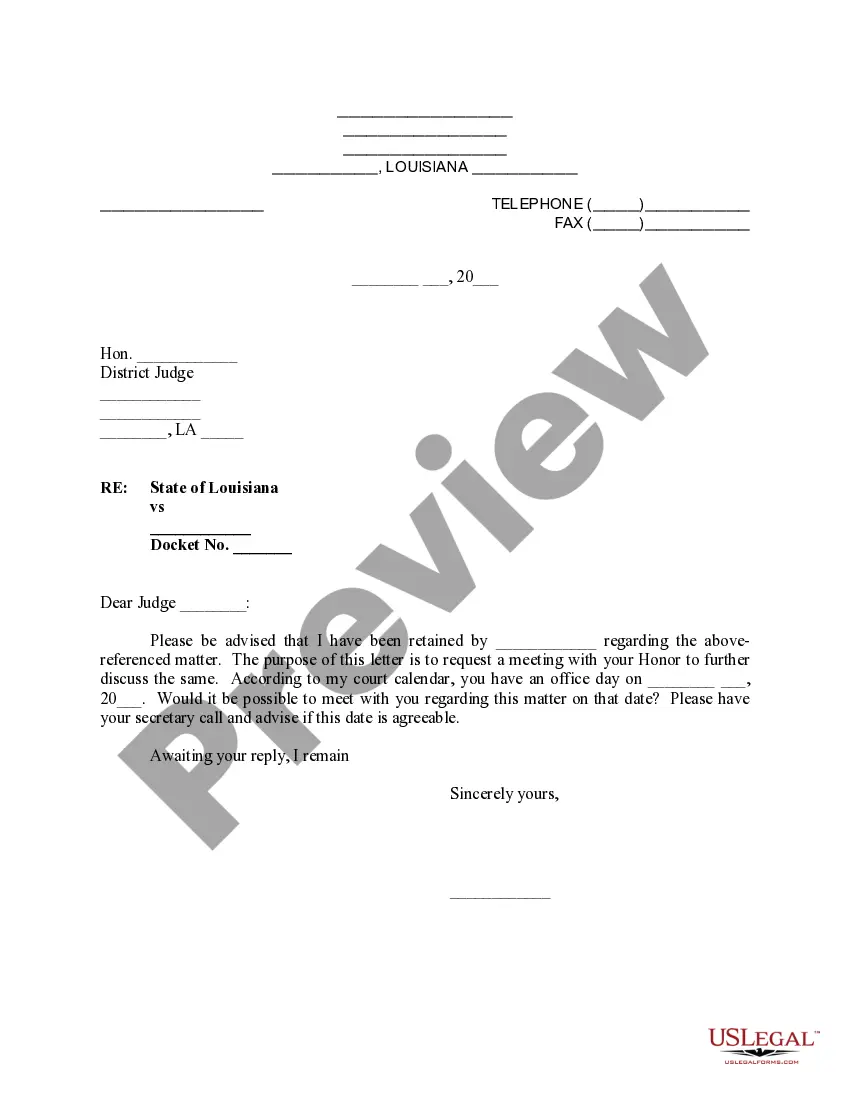

- Utilize the Review button to examine the form.

- Check the description to ensure you have selected the right form.

- If the form is not what you're looking for, use the Search section to find the form that meets your needs.

Form popularity

FAQ

Filing taxes as an independent delivery driver involves several steps to ensure compliance. You'll need to report your income and expenses on Schedule C of your tax return, detailing earnings from your delivery activity. It is crucial to maintain accurate records throughout the year for easy reference when filing. Utilizing resources such as a West Virginia Delivery Driver Services Contract - Self-Employed can help clarify your financial obligations and streamline your tax process.

As a self-employed delivery driver, you can claim various expenses to reduce your taxable income. Common deductible expenses include vehicle maintenance, fuel, insurance, and mileage. Additionally, you can also deduct expenses related to your delivery gear and communication costs. To effectively manage these deductions, consider utilizing a West Virginia Delivery Driver Services Contract - Self-Employed that outlines your operational costs and income.

Writing a self-employed contract involves detailing essential elements such as the scope of work, payment structure, and terms of service. Start by clearly defining the relationship between you and your client, ensuring it complies with West Virginia Delivery Driver Services Contract - Self-Employed guidelines. Utilizing platforms like uslegalforms can simplify the process, providing templates that ensure all necessary clauses are included for both parties' protection.

As a self-employed delivery driver, you operate under a contract that outlines your responsibilities and payment terms. You manage your own schedule, choose the deliveries you want to accept, and have the freedom to work with multiple clients. A well-drafted West Virginia Delivery Driver Services Contract - Self-Employed ensures both parties understand their obligations, making the process smoother and more efficient.

As a self-employed delivery driver in West Virginia, your earnings can vary based on several factors, including the number of deliveries you complete and the delivery rates in your area. Many drivers see earnings between $15 to $25 per hour, especially when using a West Virginia Delivery Driver Services Contract - Self-Employed. Moreover, leveraging platforms like US Legal Forms can help you establish the necessary contracts, ensuring you maximize your income while adhering to legal requirements. Overall, your earning potential is significant, especially with effective planning and sourcing of delivery opportunities.

Yes, West Virginia allows independent contractors, including delivery drivers. There are specific laws and regulations that govern this employment status, making it crucial to understand the implications of a West Virginia Delivery Driver Services Contract - Self-Employed. Proper documentation ensures compliance and lays a solid foundation for your self-employment journey.

A delivery driver can certainly be an independent contractor. This classification offers them the freedom to choose when and how much to work. As they engage in a West Virginia Delivery Driver Services Contract - Self-Employed, they benefit from the autonomy of working independently while still meeting the necessary legal obligations.

Yes, DoorDash drivers are considered independent contractors. They operate under a similar framework to other self-employed delivery drivers and are subject to the terms of a West Virginia Delivery Driver Services Contract - Self-Employed. This arrangement provides them with flexibility while also requiring them to manage their expenses and taxes.

To obtain a delivery driver contract, you can start by checking various platforms that connect drivers with delivery opportunities. It is also advisable to create a professional profile showcasing your qualifications. Consider drafting a West Virginia Delivery Driver Services Contract - Self-Employed that meets your needs and aligns with local regulations, which can be facilitated through services like uslegalforms.

Yes, you can absolutely be a self-employed delivery driver in West Virginia. This option allows you greater flexibility with your schedule and work conditions. However, it's essential to have a well-structured West Virginia Delivery Driver Services Contract - Self-Employed to protect your rights and responsibilities.