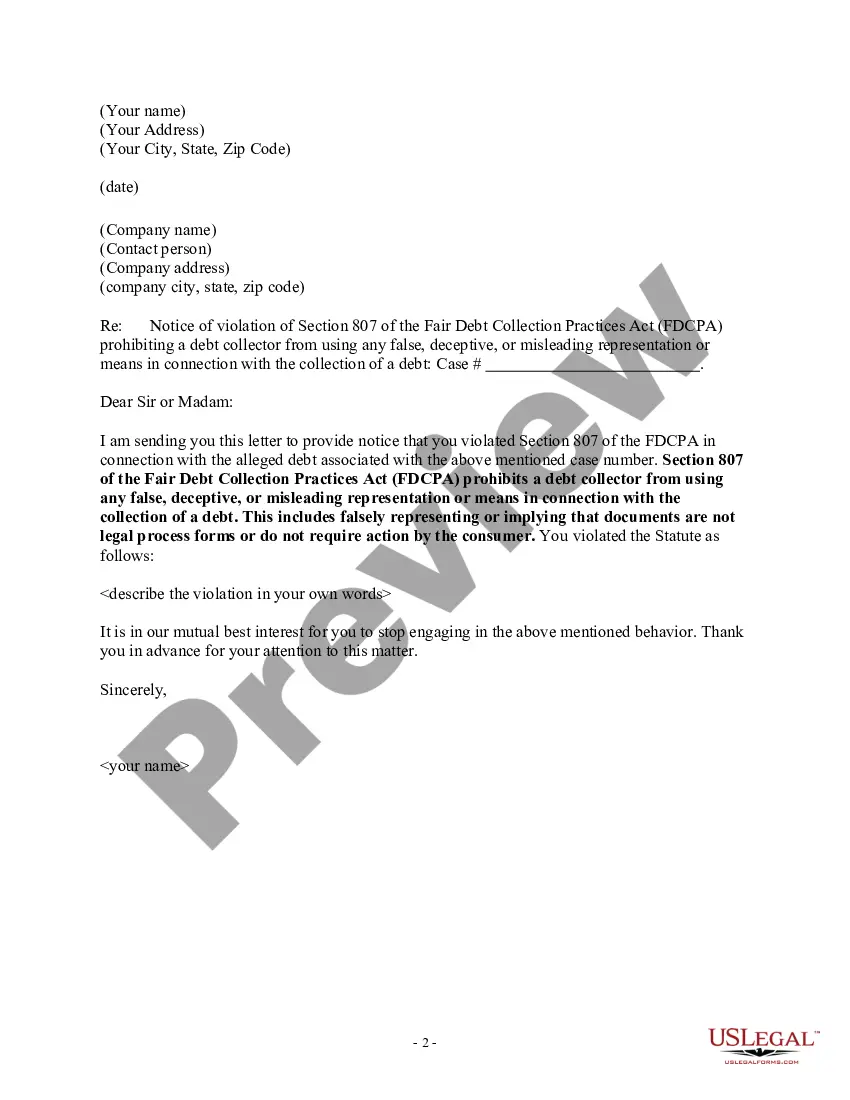

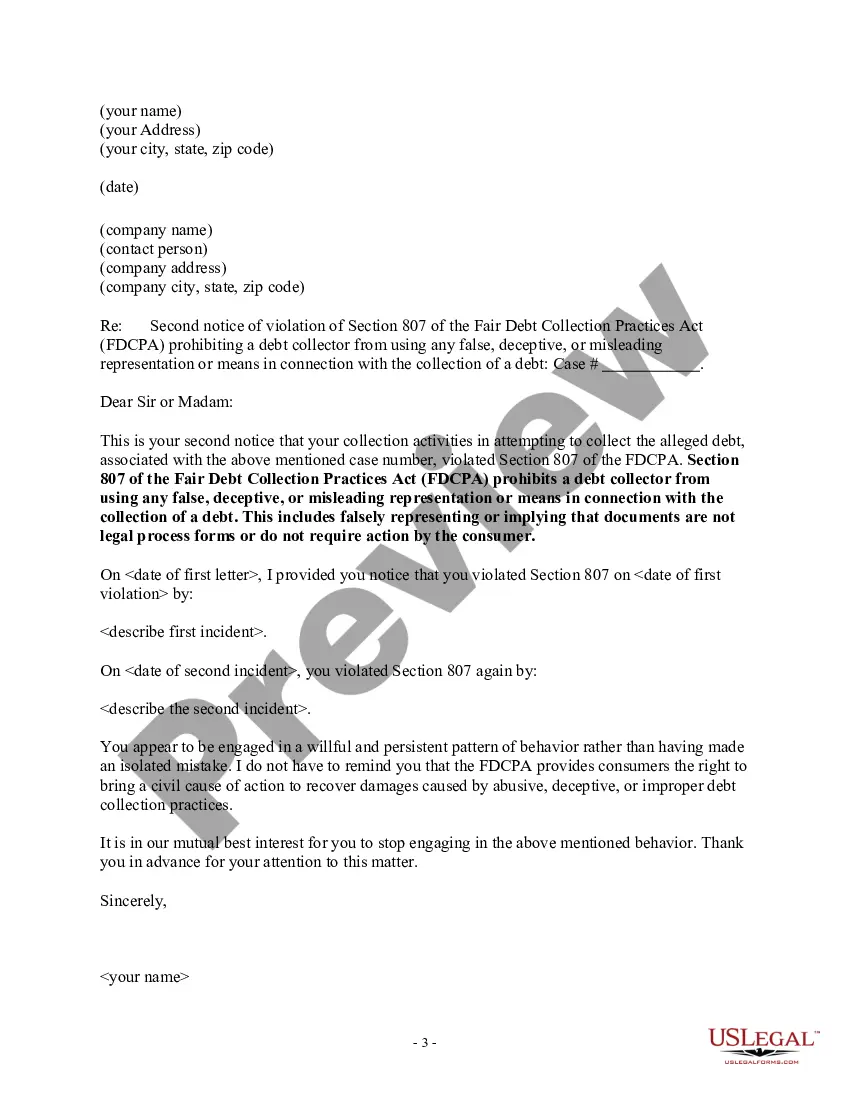

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

West Virginia Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

If you require to obtain, download, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's simple and convenient search to find the documents you need.

A variety of templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to sign up for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to find the West Virginia Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action within just a few clicks.

- If you are already a US Legal Forms subscriber, Log In to your account and click on the Download button to obtain the West Virginia Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search section at the top of the screen to find alternate versions of the legal form template.

Form popularity

FAQ

To take legal action to collect a debt, the creditor (the person or company owed money) files a lawsuit against the debtor (the person who owes the money). Once a debt collection lawsuit is filed with the court, the creditor must give the debtor notice of the lawsuit (service).

Action your creditor can takeBailiffs.If you're being taken to court for debt.Changing a court order for debt.How a creditor can get information about your finances.Creditor takes money from your bank account.If a creditor takes money from your wages.Charging orders.Harassment by creditors.More items...

The short and simple answer is that no, you cannot be held responsible for another person's debts. This analysis changes, however, if you have signed as a responsible party, either as a co-signer or guarantor on the debt.

The goodwill deletion request letter is based on the age-old principle that everyone makes mistakes. It is, simply put, the practice of admitting a mistake to a lender and asking them not to penalize you for it. Obviously, this usually works only with one-time, low-level items like 30-day late payments.

Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt. If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

If you're struggling with debt, you might have received calls from collection agencies threatening to sue you if you don't pay your debt quickly. You may be wondering: Can a collection agency sue you in Canada? The answer is yes, but the process is not as simple as collection agencies make it seem.

Verification of a debt involves nothing more than the debt collector confirming in writing that the amount being demanded is what the creditor is claiming is owed; the debt collector is not required to keep detailed files of the alleged debt.

Many people are surprised to learn that debt collectors can sue debtors for the balance of any outstanding debt. Many times, debt collection agencies will bring a lawsuit for breach of contract because when individuals don't pay the debt they agreed to pay.

If you're sure the debt isn't yours, you don't need to worry about clearing it, but you can get it removed from your credit file if it's recorded there. You can raise any issues with the credit reference agencies, and tell anyone chasing for these debts to update their records.

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.