West Virginia Internal Revenue Service Ruling Letter

Description

How to fill out Internal Revenue Service Ruling Letter?

Discovering the right lawful document format could be a struggle. Naturally, there are a lot of templates available online, but how do you get the lawful type you need? Utilize the US Legal Forms web site. The service provides a huge number of templates, including the West Virginia Internal Revenue Service Ruling Letter, that can be used for business and personal demands. All the types are checked out by pros and meet federal and state requirements.

When you are presently authorized, log in to your profile and then click the Down load switch to obtain the West Virginia Internal Revenue Service Ruling Letter. Use your profile to search throughout the lawful types you might have acquired previously. Visit the My Forms tab of the profile and obtain yet another copy from the document you need.

When you are a new user of US Legal Forms, listed here are simple recommendations for you to follow:

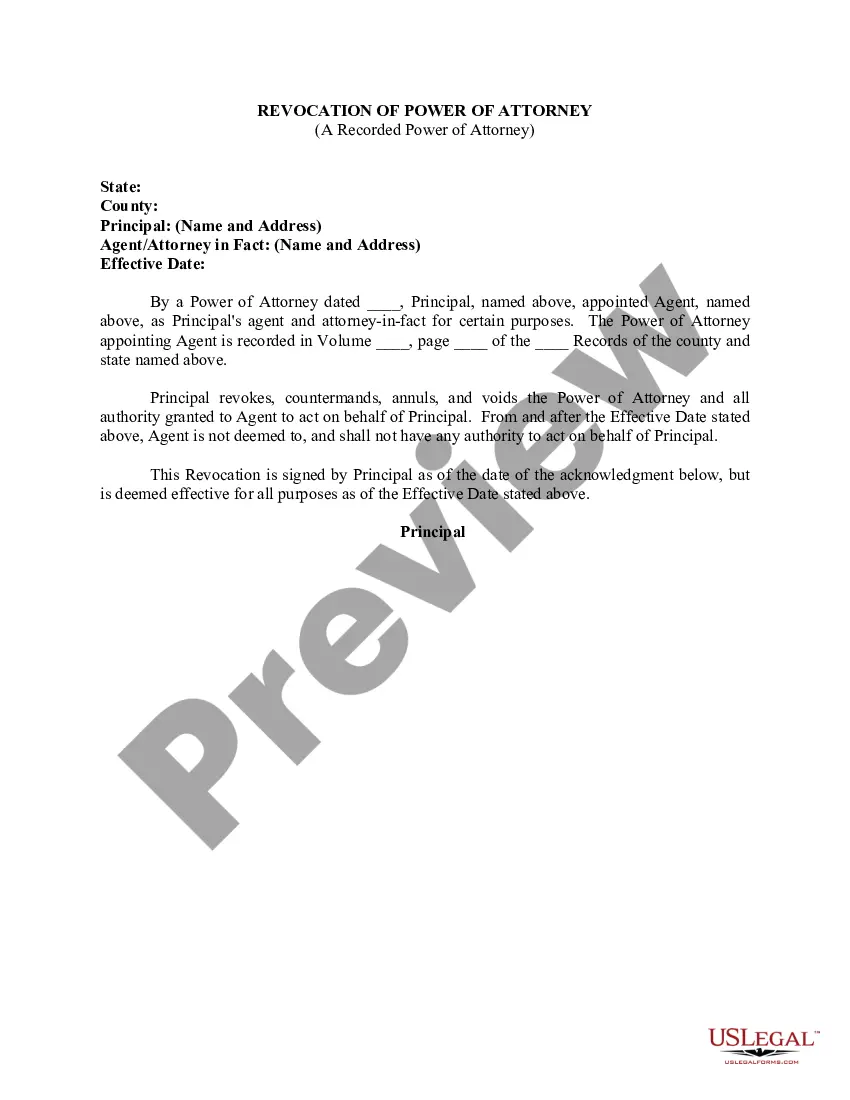

- Initially, be sure you have selected the appropriate type to your metropolis/county. You can examine the form while using Preview switch and read the form explanation to ensure it will be the right one for you.

- If the type will not meet your preferences, use the Seach discipline to discover the correct type.

- When you are positive that the form would work, click the Get now switch to obtain the type.

- Choose the pricing plan you desire and enter the needed details. Create your profile and pay for your order making use of your PayPal profile or Visa or Mastercard.

- Choose the document formatting and down load the lawful document format to your product.

- Full, change and printing and signal the obtained West Virginia Internal Revenue Service Ruling Letter.

US Legal Forms will be the biggest collection of lawful types that you can see numerous document templates. Utilize the company to down load skillfully-produced documents that follow state requirements.

Form popularity

FAQ

A Letter 5071C will ask you to complete an online identity verification process to confirm your identity. If you haven't filed and you received a 5071C letter, someone may have filed a fraudulent tax return using your name and Social Security Number or Individual Identification Number.

After your identity is confirmed, the department will process your tax return. If you answered the questions incorrectly, a message will appear stating that additional information is required. The department will send you a separate letter detailing what is needed to complete the process of your tax return.

The Illinois Department of Revenue (IDOR) sends letters and notices to request additional information and support for information you report on your tax return, or to inform you of a change made to your return, balance due or overpayment amount.

If your tax return is under audit, you will receive written correspondence in the mail from an LDR tax auditor with detailed information concerning your audit. An auditor may call you first to verify contact information. I have received a letter stating my tax return is under audit.

You are considered a resident of West Virginia if you spend more than 30 days in West Virginia with the intent of West Virginia becoming your permanent residence, or if you are a domiciliary resident of Pennsylvania or Virginia and you maintain a physical presence in West Virginia for more than 183 days of the taxable ...

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

If the West Virginia Tax Division needs to verify information reported on your return or request additional information, the process will take longer. Math errors in your return or other adjustments. You used more than one form type to complete your return. Your return was missing information or incomplete.

Declaration of consideration or value. The declaration states the property's value or the payment, called consideration, made for the property. The current owner, new owner, or another responsible party must sign the declaration. The West Virginia Code suggests language for a declaration of consideration or value.