West Virginia Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co.

Description

How to fill out Plan And Agreement Of Merger By Wheeling Pittsburgh Corp, WHX Corp, And WP Merger Co.?

It is possible to invest hrs online looking for the legal record template that suits the state and federal requirements you need. US Legal Forms provides 1000s of legal kinds which can be analyzed by professionals. It is simple to obtain or print out the West Virginia Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co. from your support.

If you already have a US Legal Forms account, it is possible to log in and click the Down load switch. Afterward, it is possible to total, edit, print out, or indication the West Virginia Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co.. Every single legal record template you buy is your own permanently. To acquire one more duplicate for any acquired kind, visit the My Forms tab and click the corresponding switch.

If you use the US Legal Forms website the very first time, follow the basic recommendations below:

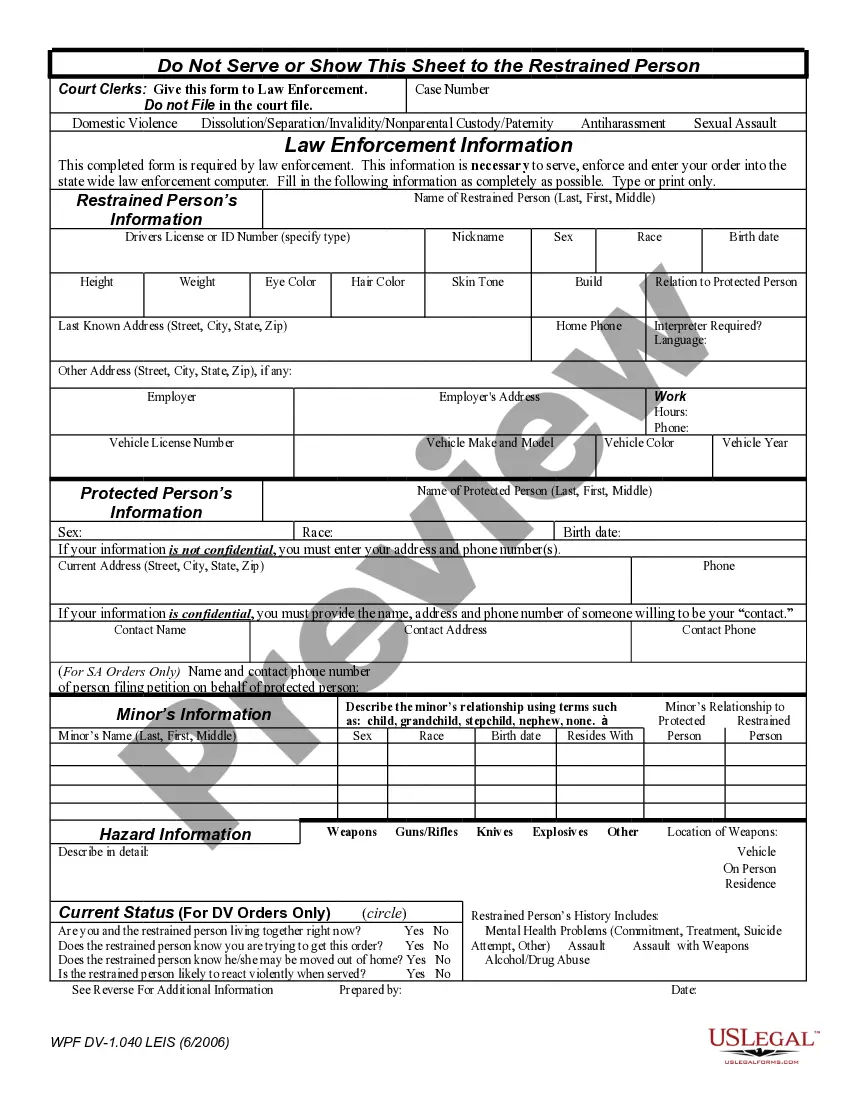

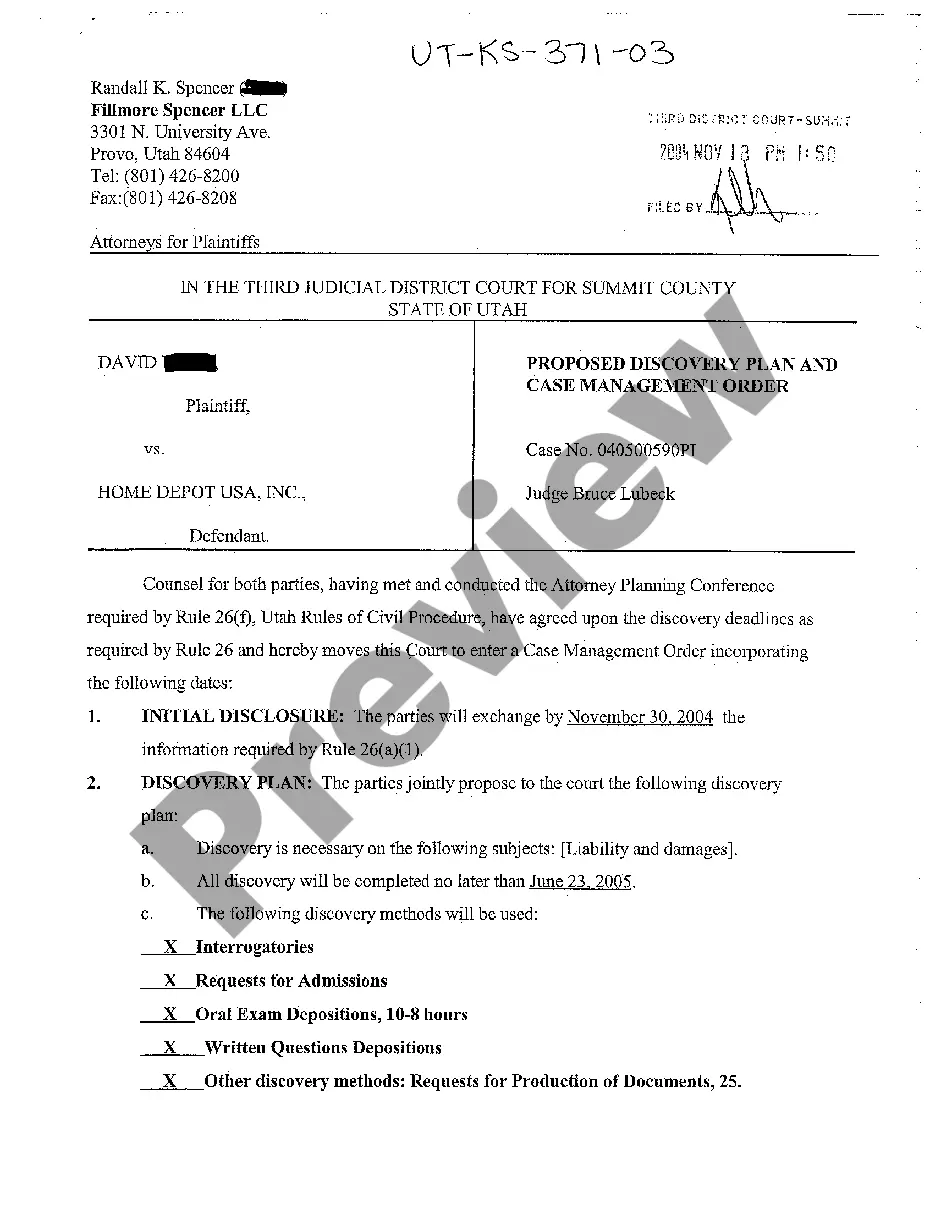

- First, be sure that you have selected the correct record template for your county/city of your choosing. See the kind information to make sure you have picked out the right kind. If available, use the Review switch to search through the record template at the same time.

- If you would like locate one more model from the kind, use the Search field to find the template that suits you and requirements.

- When you have identified the template you need, simply click Acquire now to move forward.

- Pick the rates plan you need, type your qualifications, and sign up for an account on US Legal Forms.

- Total the financial transaction. You should use your bank card or PayPal account to fund the legal kind.

- Pick the format from the record and obtain it to your gadget.

- Make modifications to your record if necessary. It is possible to total, edit and indication and print out West Virginia Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co..

Down load and print out 1000s of record themes making use of the US Legal Forms Internet site, which provides the greatest assortment of legal kinds. Use skilled and express-specific themes to deal with your company or person requires.

Form popularity

FAQ

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

?parties? means Parent, Merger Sub and the Company.

If the merger or acquisition requires a vote by shareholders, the agreement will be available in the proxy document, Schedule 14A (or sometimes an information statement, Schedule 14C). The proxy will include the terms of the merger and what shareholders can expect to receive as proceeds.

There are two basic merger structures: direct and indirect. In a direct merger, the target company and the buying company directly merge with each other. In an indirect merger, the target company will merge with a subsidiary company of the buyer.

Every M&A transaction involves at least one purchaser, or buyer, the party that will be making the acquisition. This is the person (i.e., individual or company) that signs the purchase agreement, pays the purchase price and which, after closing, directly or indirectly, owns or controls the target company or its assets.

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

In a merger, two separate legal entities come together to form a new joint legal entity. In an acquisition, one company (the acquirer) buys another company (the target) and takes control of its assets and operations.