West Virginia Employment Form

Description

How to fill out Employment Form?

Are you presently in a situation where you frequently require documents for either business or personal reasons.

There are numerous legitimate document templates accessible online, but finding ones you can trust is not straightforward.

US Legal Forms provides thousands of template forms, such as the West Virginia Employment Form, designed to comply with state and federal regulations.

Choose a convenient file format and download your copy.

Find all the document templates you have purchased in the My documents menu. You can obtain another copy of the West Virginia Employment Form anytime, if necessary. Just click the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid errors. The service offers professionally created legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the West Virginia Employment Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

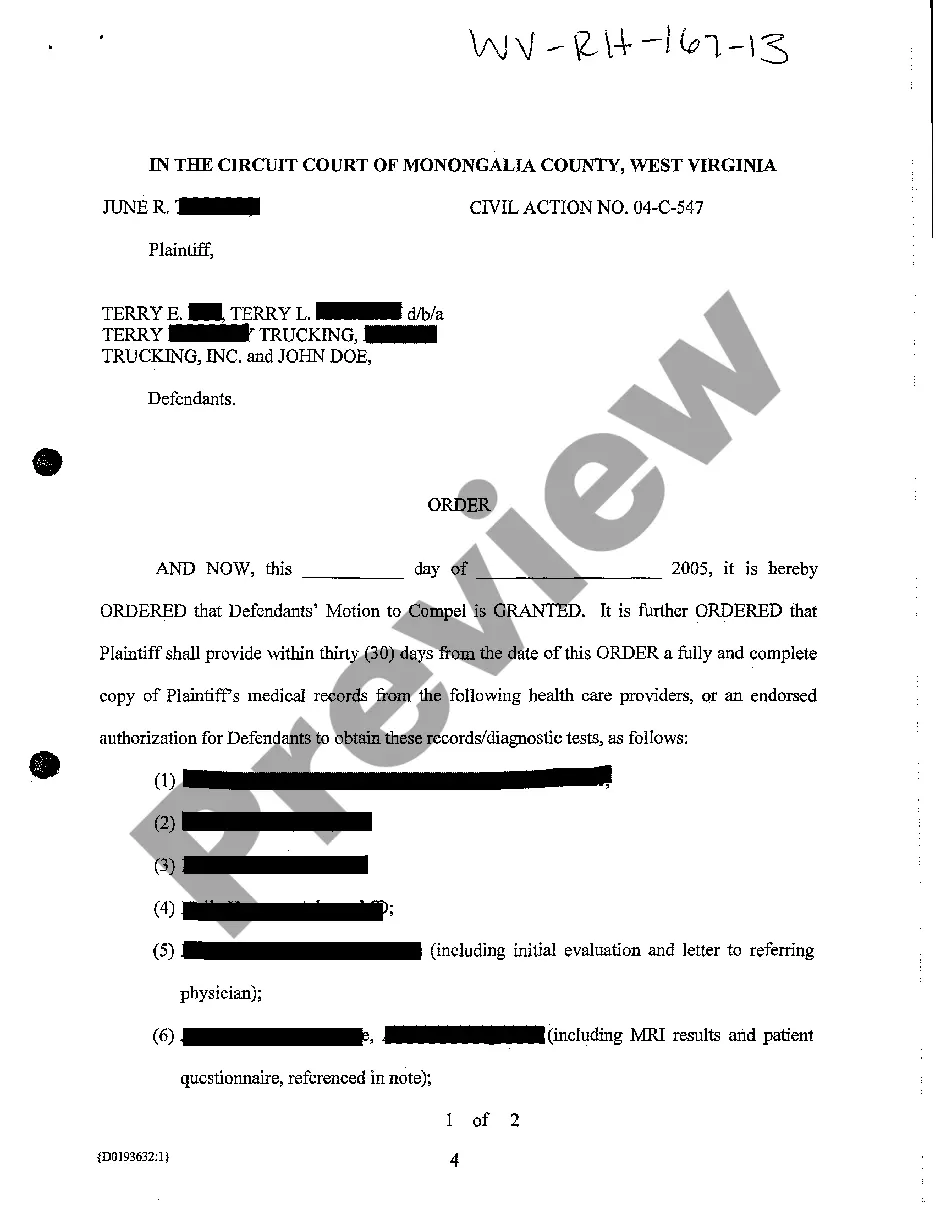

- Utilize the Review feature to examine the form.

- Check the summary to confirm you have selected the correct form.

- If the form does not match your requirements, use the Search section to find the form that suits your needs and specifications.

- Once you find the appropriate form, click on Purchase now.

- Select the pricing plan you choose, complete the necessary details to create your account, and finalize the order using PayPal or Visa or Mastercard.

Form popularity

FAQ

Compensation paid to residents of West Virginia for personal services is subject to withholding, whether the services were rendered within or without West Virginia. Employer payments of sick pay are also subject to withholding tax. Employees may request that State Income Tax be withheld from any third party sick pay.

WEST VIRGINIA EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE. Complete this form and present it to your employer to avoid any delay in adjusting the amount of state income tax to be withheld from your wages.

Go to and enroll as a jobseeker.

How do I file a claim? You must file your Initial Unemployment Compensation Application online at uc.workforcewv.org and select the radio button To file a new/additional Initial Unemployment Claim.

The new 2021 Form W-4 remains relatively unchanged after a major overhaul in December 2019. The only notable updates include a few adjustments to taxable wage & salary tables on page 4. For employers, this means that current employees won't face a learning curve when updating withholdings.

West Virginia State Tax Department.

In order to register a withholding only account, complete the Business Registration Application, Form WV/BUS-APP. This application is available on our website at . Click on Forms on the left-hand side of the screen. Then click on Business Registration or you can register online at .

Federal Form W-4 is normally used to determine West Virginia personal income tax withholding, but the state Form WV/IT-104 is used in certain circumstances. Certain nonresident employees must submit Form WV/IT-104NR to claim an exemption from withholding. See Employee Withholding Forms.

To quickly get a copy of your 1099-G or 1099-INT, simply go to our secure online portal, MyTaxes, at and click the Retrieve Electronic 1099 link. This is the fastest option to get your form.

To apply, contact us at 1-866-255-4370 or apply online.