West Virginia Separation Notice for Independent Contractor

Description

How to fill out Separation Notice For Independent Contractor?

Are you presently in a situation where you need documentation for either organizational or individual reasons almost every day.

There are numerous authentic document templates accessible online, but finding ones you can trust isn’t easy.

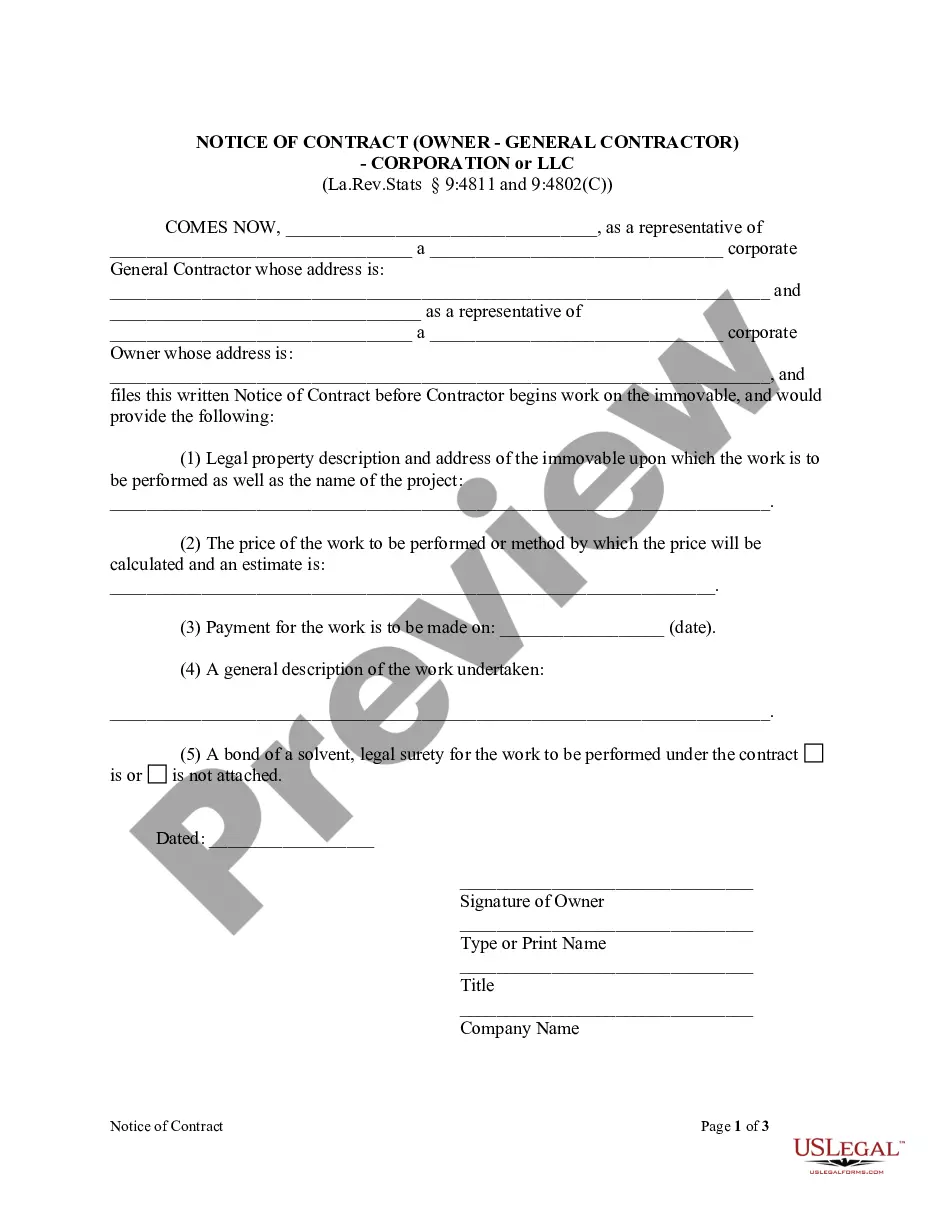

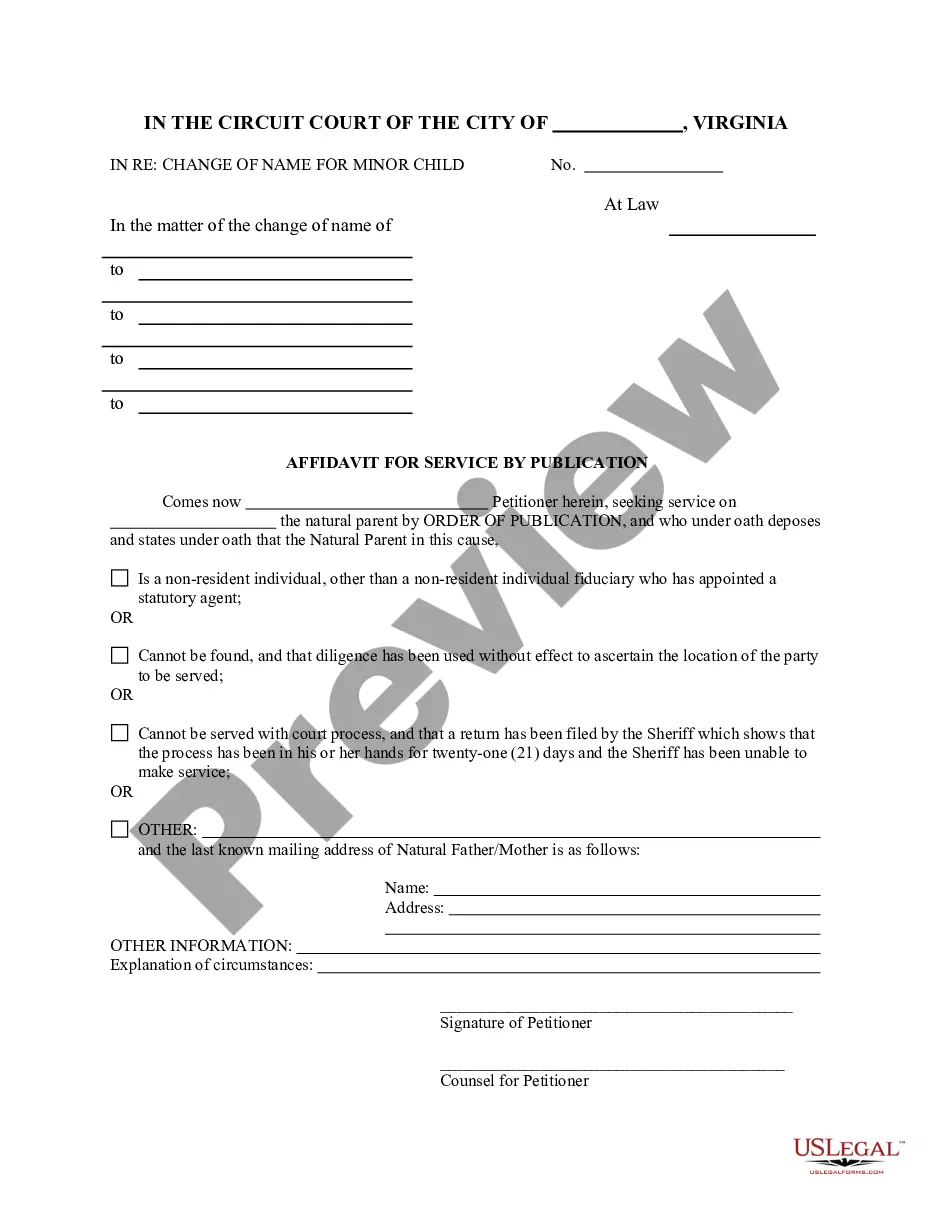

US Legal Forms provides thousands of form templates, such as the West Virginia Separation Notice for Independent Contractor, designed to meet federal and state requirements.

If you find the correct form, click Get now.

Choose the pricing plan you want, fill out the required information to create your account, and pay for the transaction using your PayPal or Visa/Mastercard. Pick a convenient file format and download your copy. Locate all the document templates you have purchased in the My documents section. You can access another copy of the West Virginia Separation Notice for Independent Contractor whenever needed, just go through the required form to download or print the document template. Use US Legal Forms, the largest collection of legal templates, to save time and avoid errors. The service offers professionally crafted legal document templates for various purposes. Create your account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the West Virginia Separation Notice for Independent Contractor template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and make sure it is for the correct city/region.

- Use the Review button to inspect the form.

- Check the information to confirm you have selected the right form.

- If the form isn’t what you’re looking for, utilize the Search area to find the form that suits your requirements.

Form popularity

FAQ

The IC Final Rule, issued during the previous administration, states that it seeks to lend clarity and uniformity to the analyses, while maintaining the same economic reality underpinnings of the analysis, that is, whether, as a matter of economic reality, the workers depend upon someone else's business for the

In the October 28, 2021 final rule, the DOL has declared that a tipped employee's work duties must be divided into three categories: (1) tip-producing work; (2) directly supporting work; and (3) work that is not part of a tipped occupation.

The IC Final Rule, issued during the previous administration, states that it seeks to lend clarity and uniformity to the analyses, while maintaining the same economic reality underpinnings of the analysis, that is, whether, as a matter of economic reality, the workers depend upon someone else's business for the

During President Donald Trump's administration, the DOL issued a final rule clarifying when workers are independent contractors versus employees. The rule applied an economic-reality test that primarily considers whether the worker operates his or her own business or is economically dependent on the hiring entity.

The new law was effective on January 1, 2020. AB 5 requires companies to reclassify independent contractors as employees with a few exceptions to the rule. The bill was designed to increase regulation over companies that hire gig workers in large numbers, including DoorDash, Shipt, Postmates, Uber, and Lyft.

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

During President Donald Trump's administration, the DOL issued a final rule clarifying when workers are independent contractors versus employees. The rule applied an economic-reality test that primarily considers whether the worker operates his or her own business or is economically dependent on the hiring entity.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The contract states further that "as an Independent contractor, you are not entitled to paid annual leave, or paid sick leave, paid responsibility leave, and you are not entitled to be paid for overtime worked and you're not entitled to be paid for public holidays or Sundays worked."

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.