West Virginia Flood Insurance Authorization

Description

How to fill out Flood Insurance Authorization?

US Legal Forms - one of many biggest libraries of legal kinds in America - provides an array of legal papers layouts you are able to down load or print. Making use of the website, you can find a huge number of kinds for business and specific reasons, sorted by types, states, or keywords and phrases.You will find the most up-to-date versions of kinds like the West Virginia Flood Insurance Authorization within minutes.

If you already possess a membership, log in and down load West Virginia Flood Insurance Authorization through the US Legal Forms library. The Acquire switch will appear on every form you perspective. You have access to all previously saved kinds inside the My Forms tab of your respective account.

If you wish to use US Legal Forms the very first time, listed below are straightforward directions to obtain started off:

- Be sure you have selected the proper form for your personal area/county. Select the Preview switch to review the form`s articles. Browse the form outline to ensure that you have selected the proper form.

- When the form does not match your requirements, take advantage of the Search field at the top of the screen to find the one who does.

- In case you are pleased with the shape, confirm your choice by simply clicking the Buy now switch. Then, choose the rates prepare you want and offer your credentials to register on an account.

- Procedure the deal. Make use of your bank card or PayPal account to accomplish the deal.

- Select the format and down load the shape on your own gadget.

- Make adjustments. Fill up, change and print and signal the saved West Virginia Flood Insurance Authorization.

Every single format you included in your bank account does not have an expiry day and it is the one you have for a long time. So, if you would like down load or print an additional backup, just proceed to the My Forms section and click on about the form you will need.

Obtain access to the West Virginia Flood Insurance Authorization with US Legal Forms, one of the most comprehensive library of legal papers layouts. Use a huge number of specialist and status-certain layouts that meet up with your small business or specific needs and requirements.

Form popularity

FAQ

Fannie Mae does not require evidence of a master flood insurance policy, provided the unit owner maintains an individual flood dwelling policy that meets the coverage requirements of this Guide for the following loans or project types: high LTV refinance loans, units in a two- to four-unit project, and.

All permits identifying a site as being in or out of the floodplain should allow for on site inspection of construction activities. Construction, installation, or renovation of a structure within the floodplain without a permit would be punishable by a fine of not less than $5,000 and removal of the structure.

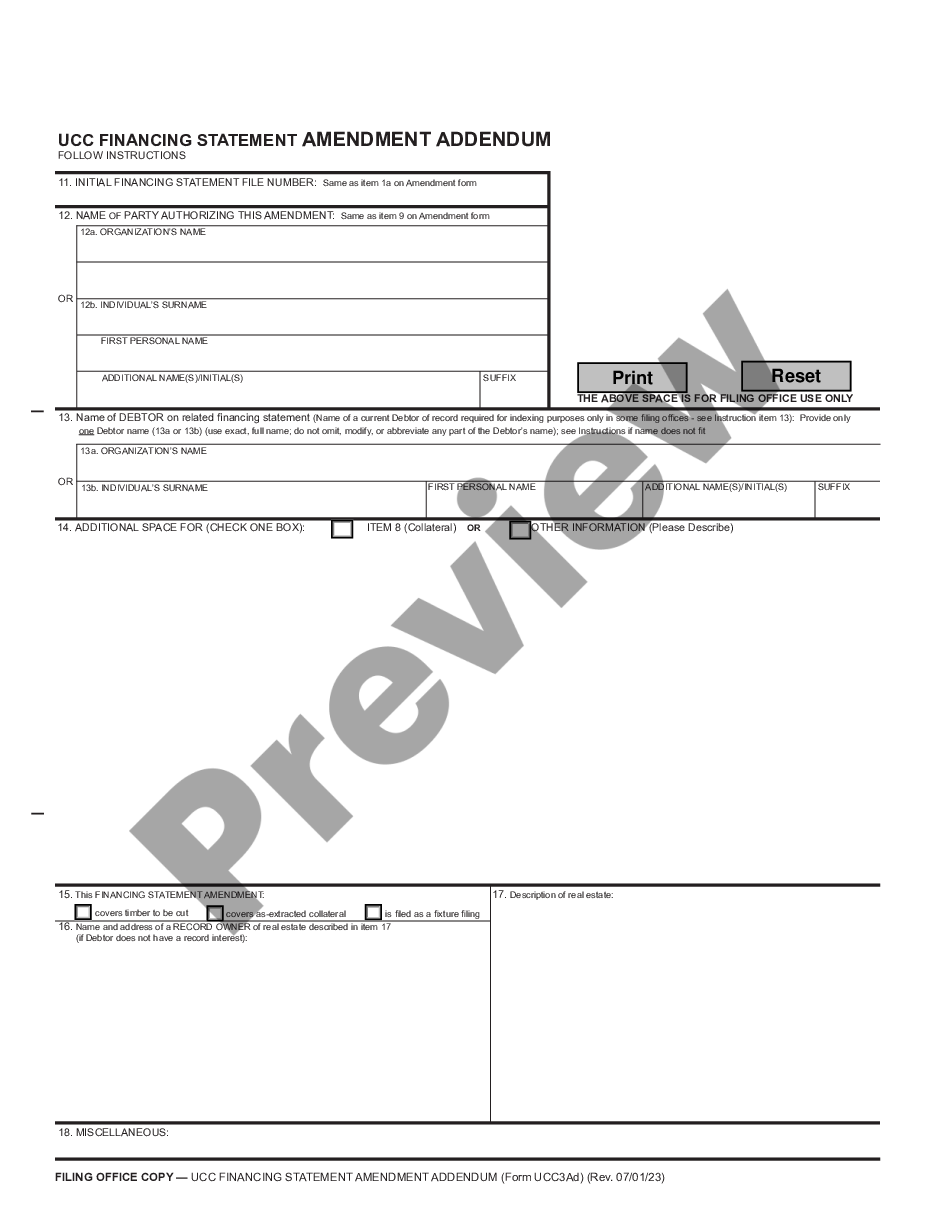

Federally-regulated lending institutions complete this form when making, increasing, extending, renewing or purchasing each loan for the purpose is of determining whether flood insurance is required and available.

Definitions. High-Risk Advisory Zones: : High-risk advisory zones ? Preliminary NFHL, Advisory A, or Updated AE ? are non-regulatory 1%-annual-chance flood zones represented as orange-colored flood zones in the WV Flood Tool.

The Standard Flood Hazard Determination Form is required for all federally backed loans and is used by lenders to determine the flood risk for their building loans. The form is authorized by the National Flood Insurance Reform Act of 1994 and is imposed on lenders by their regulatory entities, not by FEMA.

Declarations page which includes the policy number and certain information about the insurance company or agent.

All federally regulated and insured lenders must require flood insurance before extending a loan to a home in a high-risk flood zone. Mortgage lenders base their flood insurance requirements on Federal Emergency Management Agency (FEMA) flood maps.

Average Flood Insurance Cost and Coverage. West Virginia has more places at risk of flooding, which could be why the average cost of flood insurance is higher at $1,344 per year than it is nationwide at $767. Flood risk does determine the cost in West Virginia.