Alaska Membership Certificate of Nonprofit or Non Stock Corporation

Description

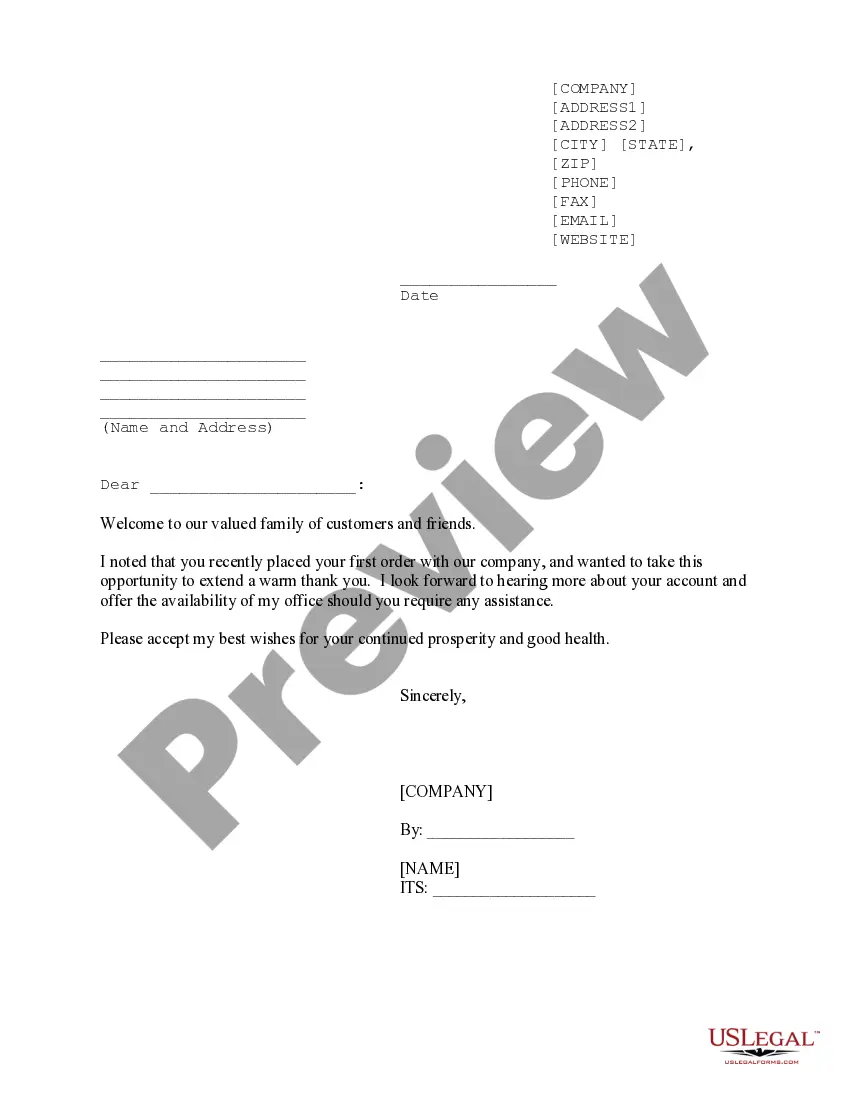

How to fill out Membership Certificate Of Nonprofit Or Non Stock Corporation?

US Legal Forms - among the biggest libraries of legal varieties in the USA - delivers a wide range of legal papers templates it is possible to obtain or print out. Making use of the internet site, you will get thousands of varieties for business and personal purposes, categorized by groups, states, or search phrases.You will discover the latest types of varieties like the Alaska Membership Certificate of Nonprofit or Non Stock Corporation in seconds.

If you have a registration, log in and obtain Alaska Membership Certificate of Nonprofit or Non Stock Corporation through the US Legal Forms catalogue. The Down load key can look on each type you look at. You have access to all formerly saved varieties from the My Forms tab of your own accounts.

If you wish to use US Legal Forms initially, listed below are straightforward directions to get you started:

- Ensure you have picked the proper type for your metropolis/area. Click the Preview key to examine the form`s information. Read the type information to actually have chosen the proper type.

- If the type does not suit your demands, take advantage of the Research field at the top of the display to discover the one that does.

- If you are pleased with the shape, affirm your choice by clicking the Purchase now key. Then, select the prices strategy you prefer and offer your accreditations to sign up for the accounts.

- Process the deal. Make use of your credit card or PayPal accounts to perform the deal.

- Choose the file format and obtain the shape on your own device.

- Make modifications. Load, edit and print out and signal the saved Alaska Membership Certificate of Nonprofit or Non Stock Corporation.

Every single web template you included with your account lacks an expiration day and is your own eternally. So, if you wish to obtain or print out an additional backup, just proceed to the My Forms portion and then click on the type you want.

Get access to the Alaska Membership Certificate of Nonprofit or Non Stock Corporation with US Legal Forms, by far the most extensive catalogue of legal papers templates. Use thousands of specialist and condition-specific templates that meet your company or personal demands and demands.

Form popularity

FAQ

Nonprofits can have a separate legal entity; not-for-profits cannot have a separate legal entity. Nonprofits run like a business and try to earn a profit, which does not support any single member; not-for-profits are considered ?recreational organizations? that do not operate with the business goal of earning revenue.

Another difference between non-profit corporations and benefit corporations is that the stock certificates of the latter must be clearly marked with the words ?Benefit Corporation.? A non-profit company has no shareholders and therefore no stock certificates.

Two words for the same type of organization, right? Well, not exactly. Nonprofits serve the public good and include charities and foundations, educational, religious, medical organizations. Not-for-profits serve their members, and all revenue helps run the organization.

Within the United States, you should find the 501(c)(3) tax code. When determining the nonprofit status of an organization, begin by using the IRS Select Check database. The IRS provides an Exempt Organization List on its website. You can also ask the nonprofit for proof of their status.

The most significant difference between nonprofits and for-profit organizations lies in their purpose: nonprofits have a social mission, while for-profits aim to offer products and services that are valuable to consumers and generate revenue. Nonprofits also receive certain tax breaks.

Since for-profit companies make profits for their own benefits, they have to pay taxes as required by the law. However, nonprofit organizations are exempted from paying taxes as they make profits to help society. In addition, individuals and businesses that donate to nonprofits can claim tax deductions.

Yes, your nonprofit will need to obtain a business license from the Alaska Division of Corporations, Business and Professional Licensing. You can get your license online at the Alaska Division of Corporations website. There is a $50 fee.

Membership Nonprofits In a membership nonprofit, individuals who support the nonprofit can join the organization as members and become part of the decision-making process. Nonprofit members can elect and vote for new board members and suggest changes to the nonprofit's bylaws.