West Virginia Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

You can spend several hours online looking for the legal document template that fulfills the federal and state requirements you need.

US Legal Forms offers a wide variety of legal forms that are examined by professionals.

You can easily download or print the West Virginia Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company from our service.

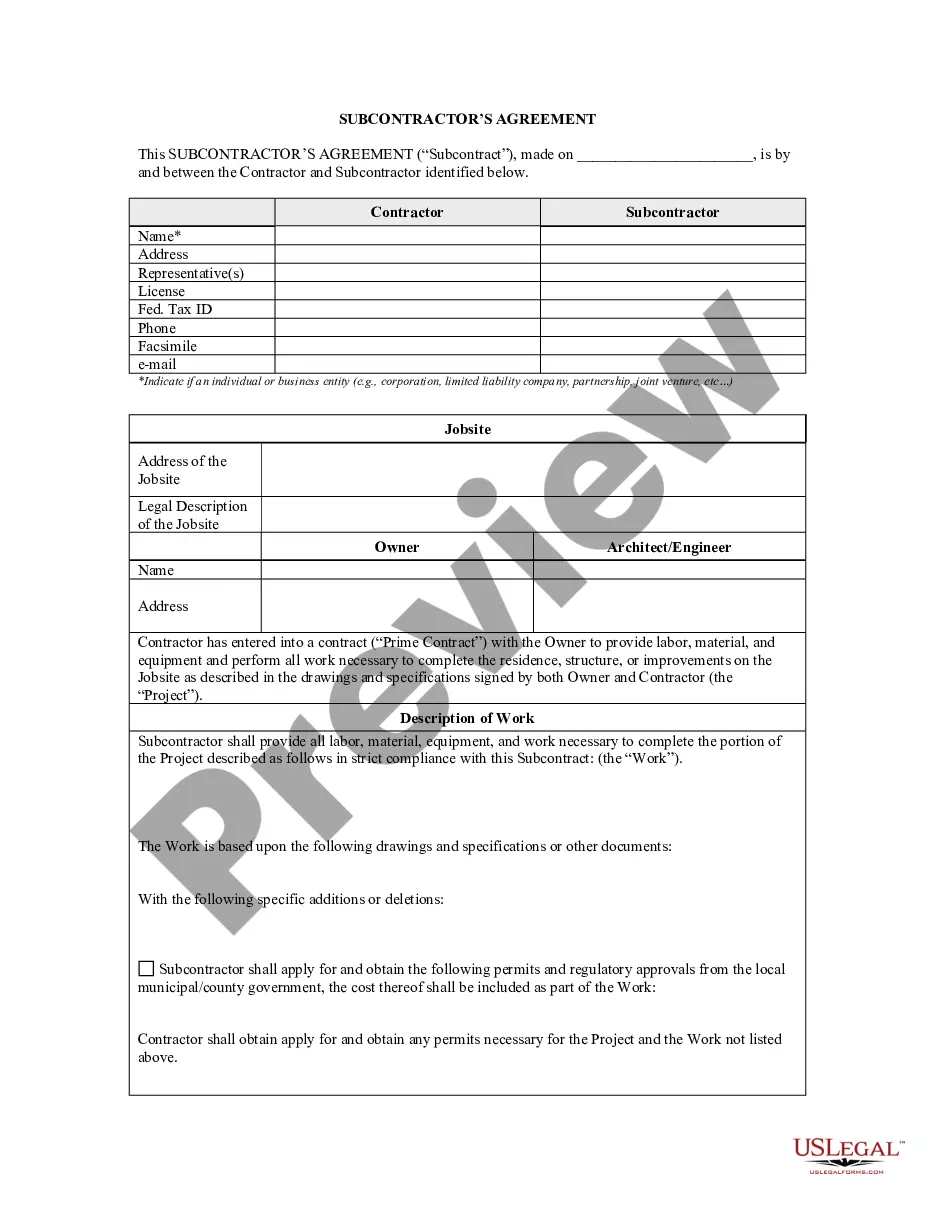

If available, use the Preview button to look through the template as well.

- If you have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can fill out, edit, print, or sign the West Virginia Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

- Every legal template you obtain is yours permanently.

- To get another copy of the retrieved form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct template for the location you choose.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

A corporation is an independent legal entity that is formed under state law and exists separately from its shareholders. Limited liability protects shareholders, directors, officers and employees against personal liability for actions taken in the name of the corporation and corporate debts.

A member of a member-managed LLC or a manager of a manager-managed LLC is liable to the LLC for any damages the LLC incurs because of such conduct. this duty is a limited duty of care because it does not include ordinary negligence.

LLC members and managers are generally not liable for the LLC's debts and other liabilities. However, California Corporations Code Section 17703.04 establishes specific instances in which members or managers may be held personally liable for company debts and other liabilities.

Your EIN confirmation letter does show LLC ownership. This is a document sent directly from the IRS (Internal Revenue Service). It will show your EIN, LLC name and the member of the LLC who is the authorized responsible member!

The owners of an LLC are called Members. An LLC can be managed by a Manager or its Members. A key aspect of an LLC lies within the name itself: limited liability. In essence, the Members of an LLC are not liable for the debts, obligations, and actions of the company itself.

Those LLC members who operate the business owe the fiduciary duties of loyalty and reasonable care to the non-managing LLC owners. Depending upon your state, LLC members may be able to revise, broaden, or eliminate these fiduciary duties by contract or under the conditions of their LLC operating agreement.

A Statement of Organizer is a document that states the initial members or managers of an LLC. The authorized person/organizer at IncNow prepares this document. While the Operating Agreement should be sufficient proof of ownership, some banks require further assurance.

LLC members, in their capacity as members, are not liable for the LLC's obligations. This is effectively the same liability shield that corporate shareholders have.

By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers. However, the limited liability provided by an LLC is not perfect and, in some cases, depends on what state your LLC is in. 4) the LLC's liability for other members' personal debts.

Find InformationChecking a company's letterhead.Visiting a secretary of state website to find out where an LLC conducts business.Searching articles of organization records.