West Virginia Employment Statement

Description

How to fill out Employment Statement?

It is feasible to spend time online trying to locate the valid document format that fulfills the federal and state prerequisites you will require.

US Legal Forms offers thousands of valid templates that are examined by specialists.

It is possible to obtain or print the West Virginia Employment Statement from my service.

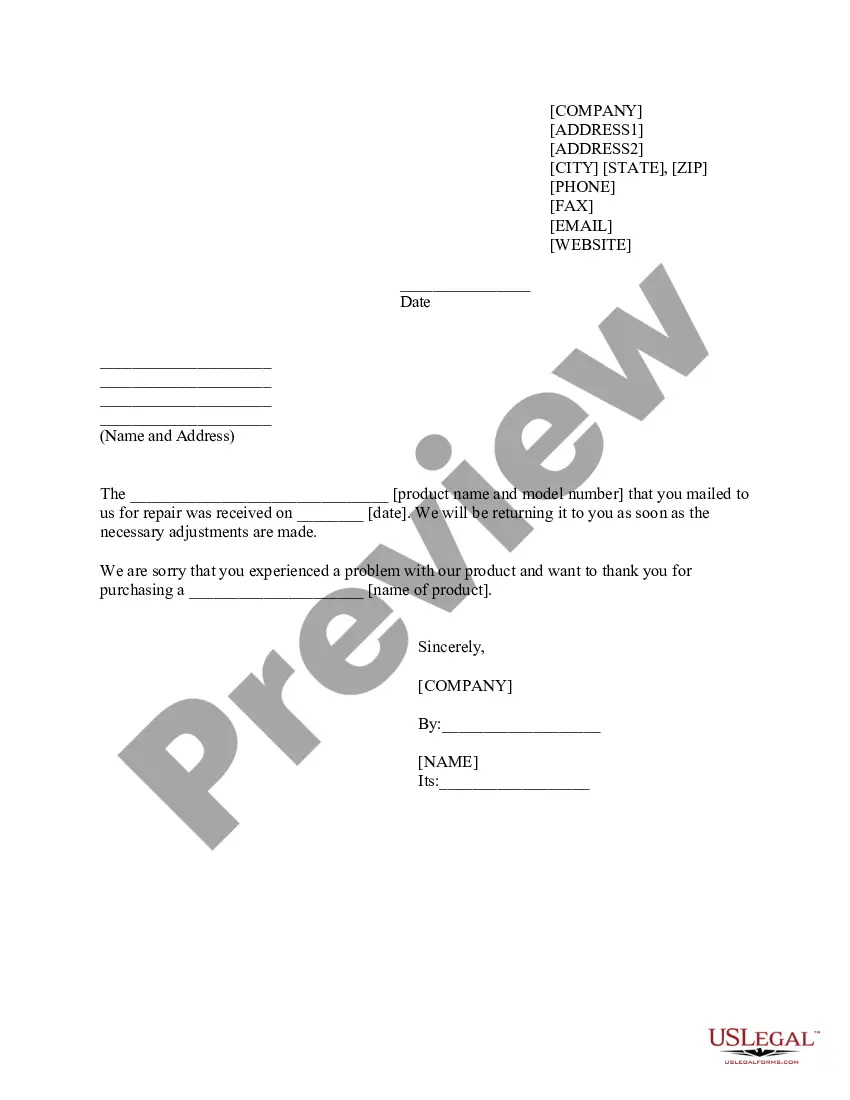

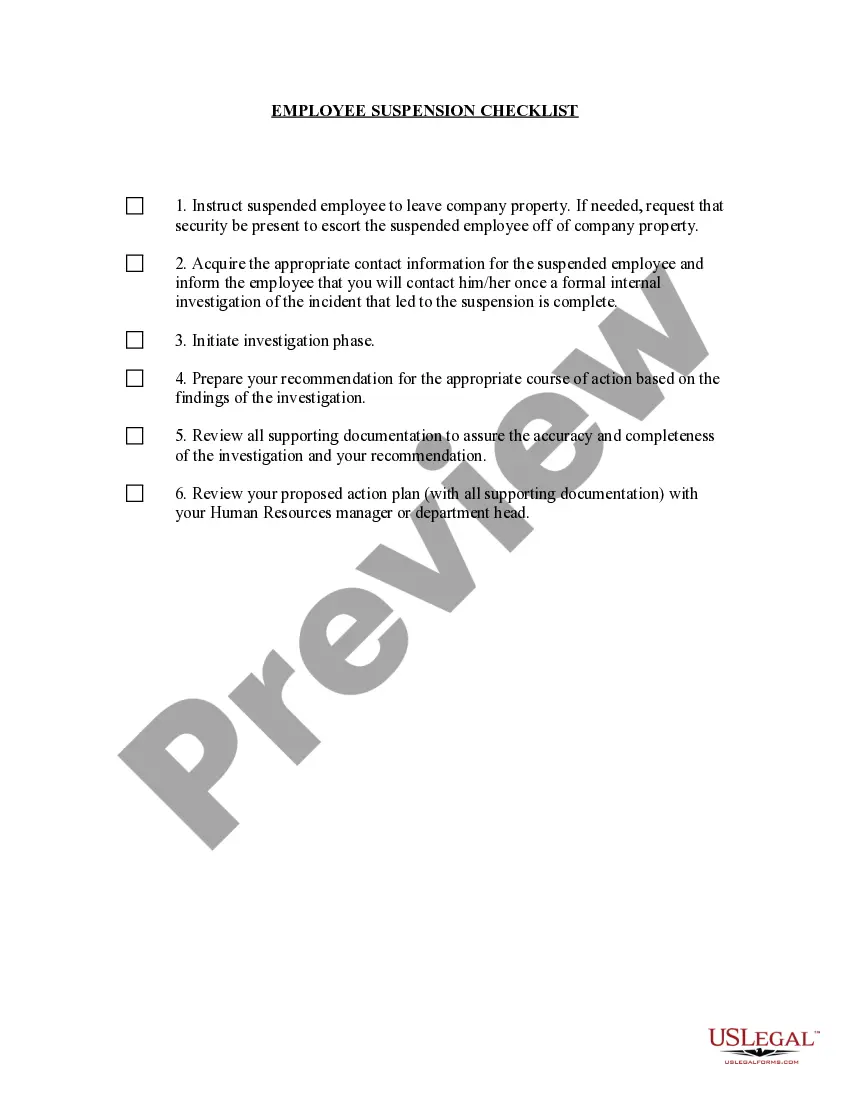

If available, use the Review button to browse through the document format as well. If you wish to find another version of the template, use the Search field to locate the format that meets your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain button.

- Subsequently, you can complete, modify, print, or sign the West Virginia Employment Statement.

- Every valid document template you obtain is yours permanently.

- To get another copy of any purchased form, visit the My documents tab and click on the appropriate button.

- If you’re using the US Legal Forms website for the first time, follow the straightforward instructions listed below.

- First, ensure that you have selected the correct document format for the area/city of your choice.

- Review the form description to confirm you have selected the correct template.

Form popularity

FAQ

To participate in E-Verify in West Virginia, employers need to gather information from the employee's Form I-9, including their Social Security number and identification documents. You'll also need to ensure compliance with federal and state E-Verify guidelines. Preparing a West Virginia Employment Statement in advance can help streamline this process.

The WV IT 103 form is a state tax return form that caters to individuals who earn income in West Virginia but do not reside there. This form simplifies the tax process for non-residents, allowing you to report your income and ensure compliance with state laws. Always refer to your West Virginia Employment Statement to verify your earnings and maintain accuracy when filing the WV IT 103.

Sign in to your my Social Security account to get your copy Creating a free my Social Security account takes less than 10 minutes, lets you download your SSA-1099 or SSA-1042S and gives you access to many other online services.

To register and immediately receive a VEC Account Number, go to iReg, our new online registration process. You can also contact a VEC Local Office or download the form VEC-FC-27 from the Employer Services page on this website.

Companies who pay employees in West Virginia must register with the WV State Tax Department for an Employer Account Number and an Unemployment Compensation Account Number. Apply online to receive both numbers. Apply online at the Business for West Virginia portal to receive an Employer Account Number within 3 days.

To quickly get a copy of your 1099-G or 1099-INT, simply go to our secure online portal, MyTaxes, at and click the Retrieve Electronic 1099 link. This is the fastest option to get your form. To request a copy of your 1099-G or 1099-INT by phone, please call (304) 558-3333.

To quickly get a copy of your 1099-G or 1099-INT, simply go to our secure online portal, MyTaxes, at and click the Retrieve Electronic 1099 link. This is the fastest option to get your form.

If you already have a WV Withholding Tax Account Number, you can find this on previous tax filings or correspondence from the WV State Tax Department. If you're unsure, contact the agency at 1-304-558-3333.

If you are looking for 1099s from earlier years, you can contact the IRS and order a wage and income transcript. The transcript should include all of the income that you had as long as it was reported to the IRS. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS.

How to check the status of your claim? Go to and select the 6 th option down If you are a claimant and want specific information about your claim. Go to and log in using your username and password to access your dashboard.