West Virginia Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty

Description

How to fill out Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice Or Course Of Dealing Stockbroker Churning - Violation Of Blue Sky Law And Breach Of Fiduciary Duty?

Are you inside a placement in which you require documents for possibly organization or personal uses nearly every time? There are a lot of legal papers layouts accessible on the Internet, but getting ones you can trust isn`t simple. US Legal Forms provides a large number of develop layouts, just like the West Virginia Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty, which are created to satisfy state and federal needs.

When you are presently acquainted with US Legal Forms web site and possess an account, merely log in. After that, you can down load the West Virginia Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty format.

Should you not have an account and would like to start using US Legal Forms, abide by these steps:

- Discover the develop you want and ensure it is for your appropriate metropolis/area.

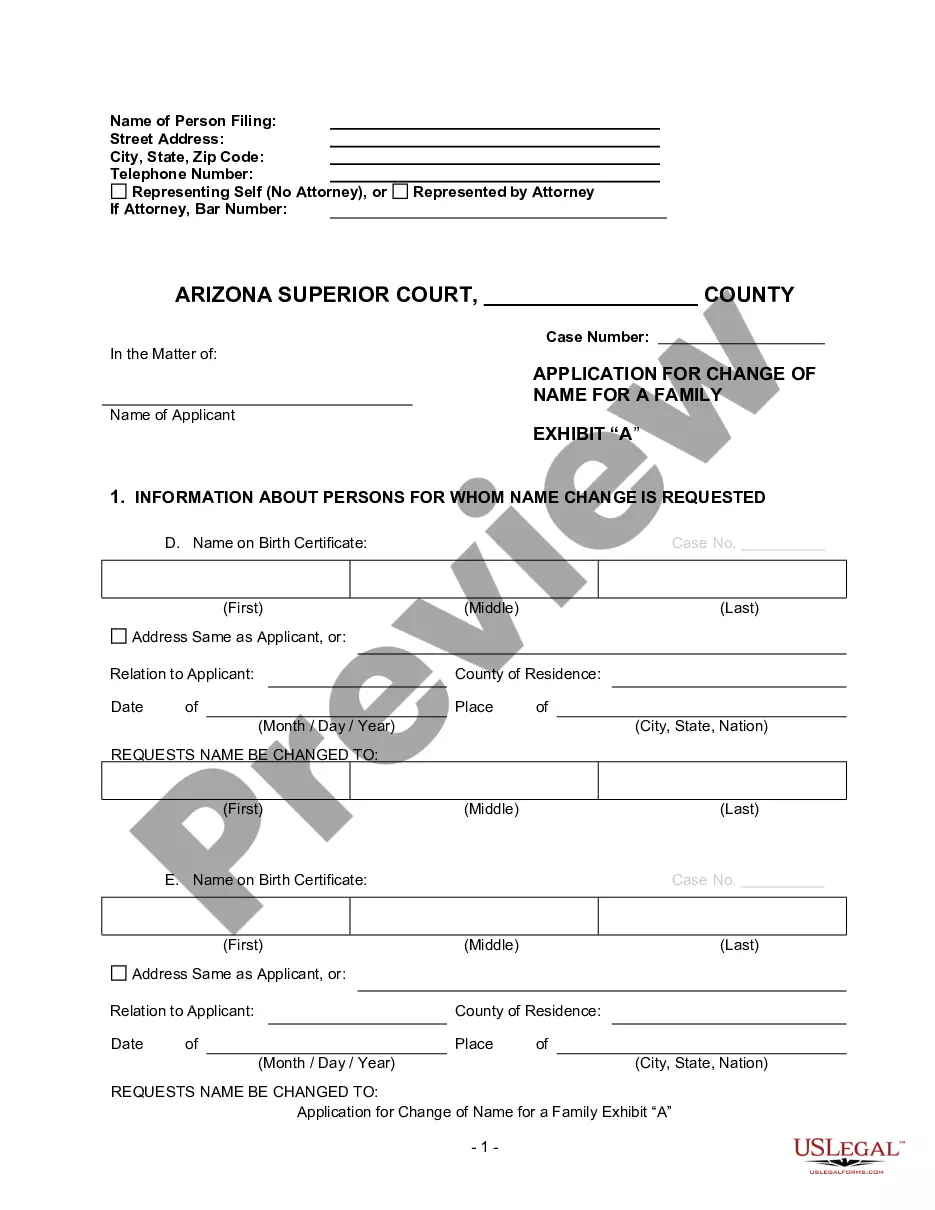

- Make use of the Review switch to analyze the form.

- See the information to actually have selected the correct develop.

- If the develop isn`t what you are seeking, make use of the Lookup area to find the develop that meets your requirements and needs.

- Once you get the appropriate develop, click on Buy now.

- Select the pricing plan you want, fill out the specified details to make your bank account, and buy an order using your PayPal or charge card.

- Decide on a hassle-free file formatting and down load your copy.

Get every one of the papers layouts you have purchased in the My Forms menus. You can aquire a extra copy of West Virginia Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty whenever, if possible. Just click on the essential develop to down load or print the papers format.

Use US Legal Forms, the most comprehensive variety of legal varieties, in order to save time as well as steer clear of mistakes. The assistance provides appropriately manufactured legal papers layouts that can be used for a range of uses. Produce an account on US Legal Forms and commence creating your lifestyle a little easier.