West Virginia Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

Have you ever found yourself in a situation where you need documentation for either business or personal purposes nearly every day? There are numerous legal document templates available online, but locating ones you can trust is challenging.

US Legal Forms provides a vast array of form templates, including the West Virginia Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, which can be downloaded to satisfy both state and federal guidelines.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the West Virginia Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code template.

You can find all the document templates you have purchased in the My documents section. You can download an additional copy of West Virginia Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code at any time if needed. Simply click on the desired form to download or print the document template.

Utilize US Legal Forms, which offers one of the most extensive collections of legal forms, to save time and minimize errors. This service provides professionally crafted legal document templates that can be used for a wide range of purposes. Create an account on US Legal Forms and start making your life simpler.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- 1. Locate the form you need and confirm it is for your specific city/county.

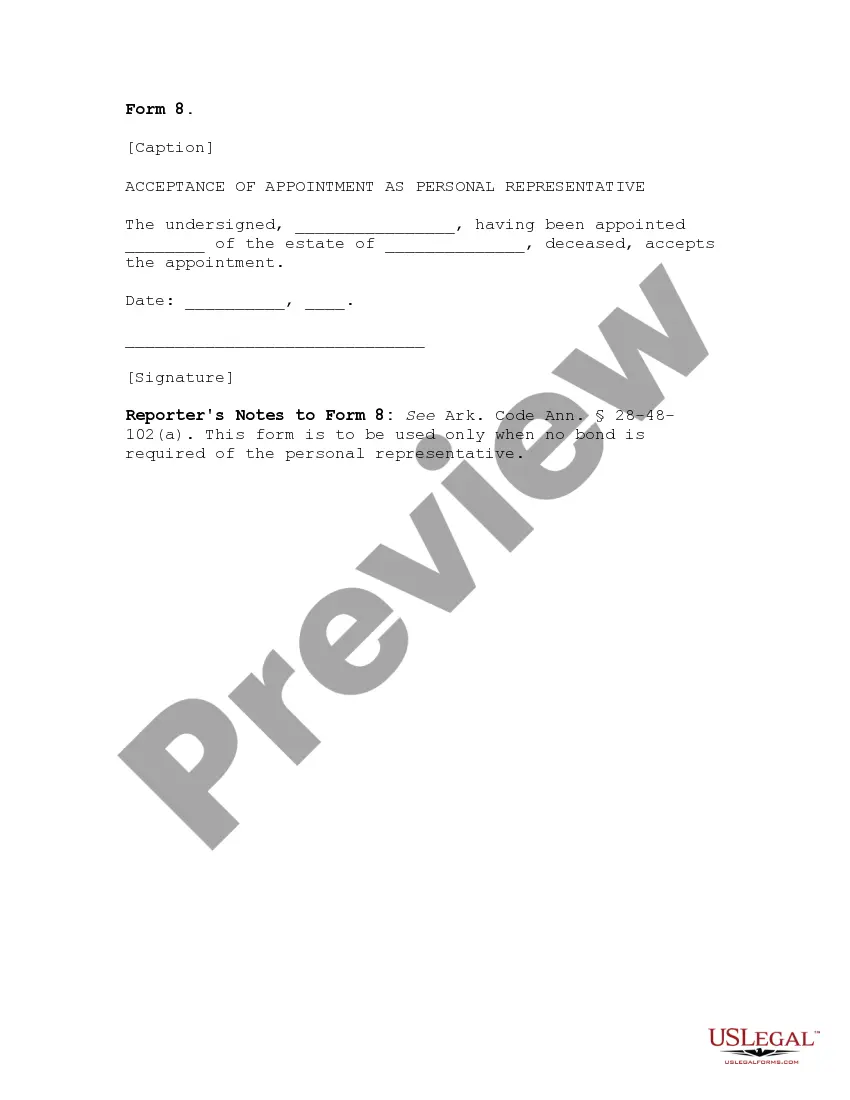

- 2. Utilize the Review option to inspect the form.

- 3. View the outline to ensure you have selected the correct form.

- 4. If the form does not meet your needs, use the Lookup field to find the form that fits your requirements.

- 5. Once you find the appropriate form, click Acquire now.

- 6. Choose the pricing plan you prefer, input the necessary information to create your account, and pay for the transaction via PayPal or credit card.

- 7. Select a suitable file format and download your copy.

Form popularity

FAQ

This is often the case in small corporations. Can the same person be the President, Secretary and Treasurer of a corporation? Yes.

Two or more offices may be held by the same individual, except the president may not also serve as secretary or treasurer.

Officers are usually appointed by the corporation's board of directors, and while specific positions may vary from one corporation to another, typical corporate officers include: Chief Executive Officer (CEO) or President.

How to Write Meeting Minutesthe name of the company, date, and location of the meeting.the type of meeting (annual board of directors meeting, special meeting, and so on.)the names and titles of the person chairing the meeting and the one taking minutes.the names of attendees and the names of those who did not attend.More items...

Officers are responsible for the day-to-day operation of a corporation. The main officer roles are president, vice president, treasurer, and secretary.

A board of directors (B of D) is the governing body of a company, elected by shareholders in the case of public companies to set strategy and oversee management. The board typically meets at regular intervals. Every public company must have a board of directors.

How to write corporate minutes: step by stepTaking Meeting Notes.Type Meeting Notes - Type up a full version of the meeting minutes.Circulate a Draft - Follow your corporation's policy about who must review the draft notes.Distribute Minutes to Board - Usually in advance of the next meeting.More items...

Any number of offices may be held by the same person unless the articles or bylaws provide otherwise. (b) Except as otherwise provided by the articles or bylaws, officers shall be chosen by the board and serve at the pleasure of the board, subject to the rights, if any, of an officer under any contract of employment.

The secretary also keeps the corporate seal if there is one. Some states provide that the offices of president and secretary cannot be occupied by the same person. The treasurer receives and keeps the corporation's money and is responsible for taxes, financial reports, etc.

Meeting minutes should always include the following information:Date of the meeting.Time and location of the meeting.Results of any voting held.Any updates on the goals of the LLC.Any changes in the LLC structure, management, or otherwise.