West Virginia Know-How License and Technical Assistance Agreement

Description

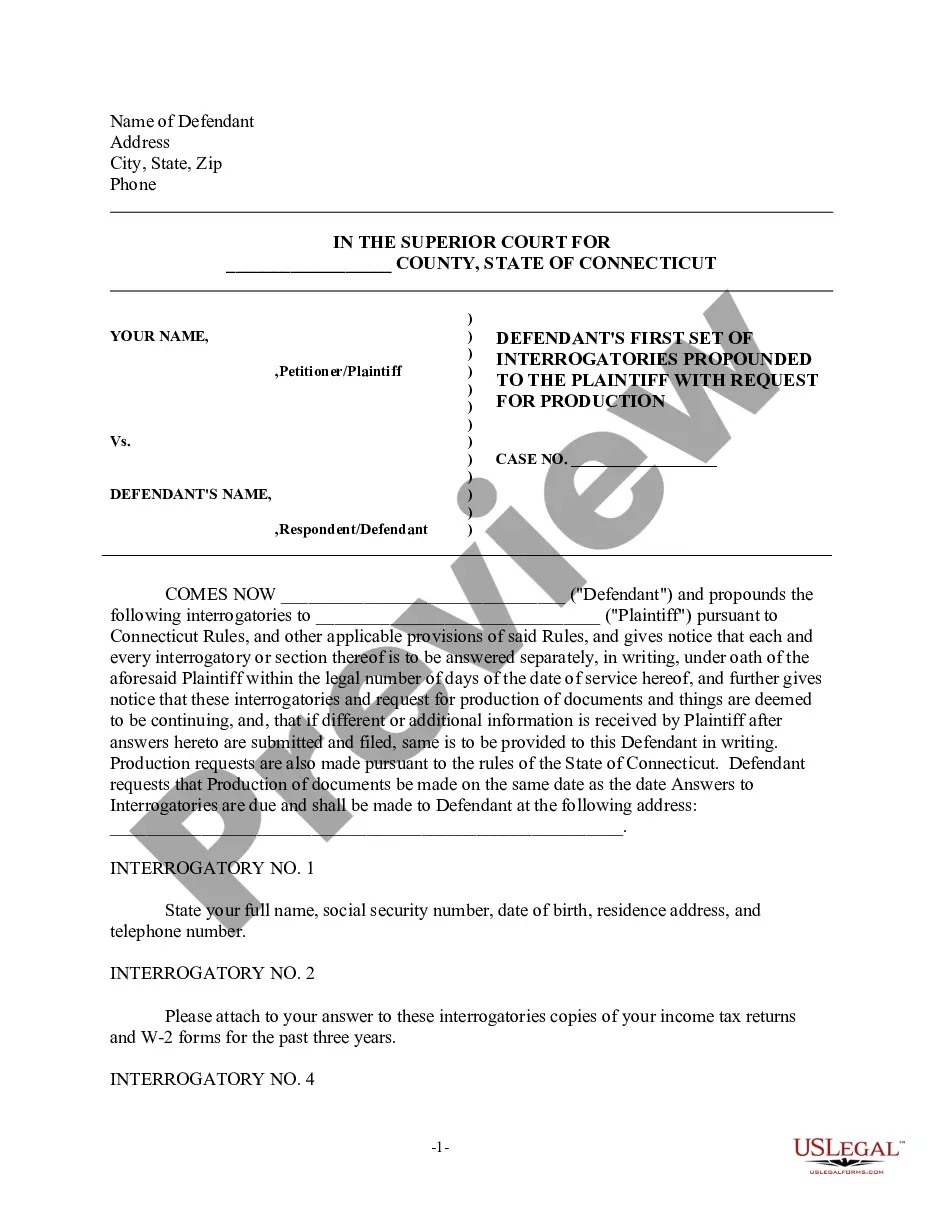

How to fill out Know-How License And Technical Assistance Agreement?

Have you been in a situation where you frequently require documentation for either business or personal activities? There are numerous legal document templates available online, but locating trustworthy ones can be challenging.

US Legal Forms offers thousands of template forms, including the West Virginia Know-How License and Technical Assistance Agreement, which can be downloaded to comply with federal and state regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. Then, you can download the West Virginia Know-How License and Technical Assistance Agreement template.

Choose a convenient document format and download your version.

Access all the document templates you have purchased under the My documents section. You can obtain another version of the West Virginia Know-How License and Technical Assistance Agreement at any time if needed. Just click on the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides well-crafted legal document templates suitable for various purposes. Create an account with US Legal Forms and start simplifying your life.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Search for the form you need and ensure it’s for the correct city/state.

- Use the Preview button to view the form.

- Read the description to confirm you have chosen the correct form.

- If the form is not what you're looking for, use the Search box to find the one that suits your needs and requirements.

- Once you find the correct form, click Acquire now.

- Select the pricing plan you prefer, enter the necessary information to create your account, and process the payment with your PayPal or Visa or Mastercard.

Form popularity

FAQ

How to get a sales tax permit in West Virginia. You can complete the form WV/BUS-APP found in this booklet or register online at Business for West Virginia. You need this information to register for a sales tax permit in West Virginia: Personal identification info (SSN, address, etc.)

The West Virginia Tax Identification Number is your nine character ID number plus a three digit adjustment code. Personal Income Tax filers should enter '000' in this field. Business filers are defaulted to '001'.

TAA compliance is only required for federal procurements. Governmental agencies cannot purchase non TAA products for contracts above the threshold of $180,000 (the value may change). Practically, each GSA Schedule value exceeds the threshold, so one could say that the TAA is applicable to all Schedules.

A Technical Assistance Agreement is a short-term agreement that allows a Federal laboratory and its researchers to provide technical, research or other resources to a non-Federal party with or without reimbursement 15 U.S.C § 3710a (b) (3) (A).

To request the SS-4 forms to obtain a taxpayer identification number from the Internal Revenue Service, call 1-800-829-4933. You may apply for your FEIN by mail or by calling the 800 number above or by visiting the website .

The objective of the Terminal Arrival Area (TAA) is to provide a new transition method for arriving aircraft equipped with FMS and/or GPS navigational equipment. The TAA contains within it a T structure that normally provides a NoPT for aircraft using the approach.

A good or service is TAA-compliant if manufactured or substantially transformed in the United States or manufactured in a TAA-designated country. A TAA-designated country is a nation with which the U.S. maintains a trade agreement and regards as a reliable or acceptable procurement source.

A Technical Assistance Agreement is a document which specifies the arrangement between you and the foreign person who will be the recipient of the defense service. A TAA must be approved prior to the release of technical data or a restricted defense service to a foreign person.

Agreements executed under the International Traffic in Arms Regulations (ITAR) serve as a licensing tool for the transfer of defense articles, technical data, manufacturing know-how, and defense services between a U.S. party and a foreign party.

You will need to complete Form SS-5, Application for a Social Security CardPDF. You also must submit evidence of your identity, age, and U.S. citizenship or lawful alien status.