Oregon Trust Agreement - Revocable - Multiple Trustees and Beneficiaries

Description

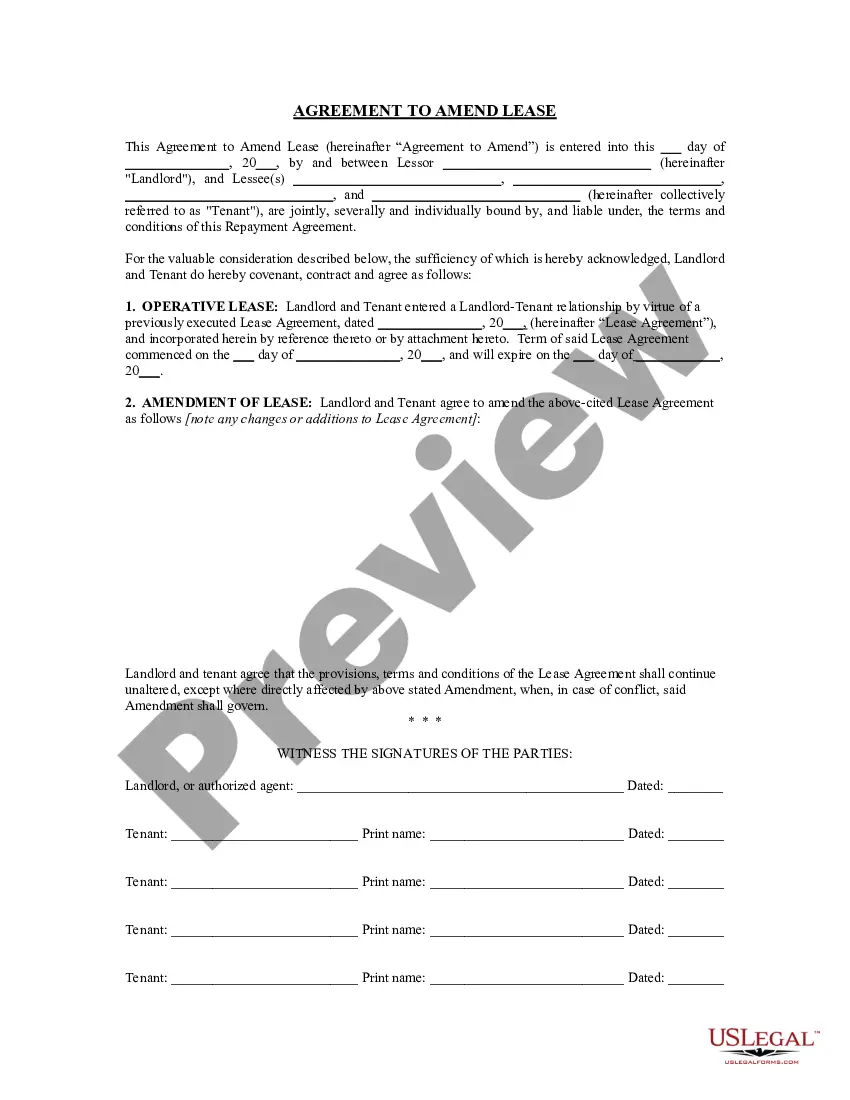

How to fill out Trust Agreement - Revocable - Multiple Trustees And Beneficiaries?

Selecting the appropriate legal document design might pose challenges. Certainly, there are numerous templates accessible online, but how can you locate the legal form you require? Leverage the US Legal Forms website. The platform provides thousands of templates, including the Oregon Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, which can be utilized for both business and personal purposes. All forms are evaluated by experts and comply with state and federal regulations.

If you are already registered, sign in to your account and click on the Download button to obtain the Oregon Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. Use your account to browse through the legal forms you have previously acquired. Visit the My documents section of your account to retrieve another copy of the documents you need.

If you are a new user of US Legal Forms, here are simple steps you can follow: First, ensure you have selected the correct form for your area/region. You can review the form with the Preview option and examine the form description to confirm it is suitable for you. If the form does not meet your needs, utilize the Search field to find the appropriate form. Once you are certain the form is correct, select the Purchase now button to obtain the form. Choose the pricing plan you want and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the format and download the legal document design for your device.

- Complete, modify, print, and sign the acquired Oregon Trust Agreement - Revocable - Multiple Trustees and Beneficiaries.

- US Legal Forms is the largest repository of legal forms where you can find various document templates.

- Utilize the service to download appropriately drafted documents that comply with state regulations.

- The website is user-friendly and provides a secure checkout process.

- Explore different categories for diverse legal needs.

- Whether for personal or business use, find the right legal documents easily.

Form popularity

FAQ

Yes, a living trust can help avoid probate in Oregon. With an Oregon Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, assets held in the trust pass directly to beneficiaries upon the trustor's death. This streamlined process saves time and reduces costs associated with probate. Setting up a living trust through a reputable platform like US Legal Forms simplifies the journey of establishing your trust.

Yes, trustees can add beneficiaries to an Oregon Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. This flexibility helps address changes in family dynamics or financial situations. However, it is crucial for trustees to follow the terms outlined in the trust document. Consulting a legal professional can ensure that the modifications comply with the trust's provisions.

Yes, you can add more beneficiaries to a trust, especially in a revocable trust scenario. This feature allows you to modify the trust as your family changes or as your relationships evolve. As the grantor, you possess the authority to update the trust document to include additional beneficiaries whenever necessary. Utilize an Oregon Trust Agreement - Revocable - Multiple Trustees and Beneficiaries to manage these adjustments seamlessly.

The maximum number of trustees allowed in a trust often depends on state law and the terms set forth in the trust document. While there is no strict limit, it's practical to keep the number manageable to ensure effective communication and decision-making among trustees. For your Oregon Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, consider a balance that provides oversight without complicating management.

Generally, you cannot add to an irrevocable trust after its creation. This type of trust is designed to be permanent, and any changes to it must follow specific legal procedures. However, if you need more flexibility, consider establishing a revocable trust instead. An Oregon Trust Agreement - Revocable - Multiple Trustees and Beneficiaries may allow you to structure your assets with more adaptability.

One of the biggest mistakes parents make when setting up a trust fund is failing to properly fund the trust. Without transferring assets into the trust, it cannot function as intended. Many assume that simply establishing a trust is sufficient, but unless assets are included, the trust remains empty. For an effective Oregon Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, ensure you complete the funding process.

Yes, a revocable trust can have multiple trustees. This arrangement often enhances management and oversight of the trust. Multiple trustees can work together to make decisions, ensuring that all voices are heard and considered. When establishing your Oregon Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, listing more than one trustee can offer added support in managing the trust's assets.

Absolutely, adding a beneficiary to a trust account is possible. As the trustee, you can update the account details to include new beneficiaries as needed. This action is simple and allows you to maintain flexibility in your estate planning. Be sure to document these changes in accordance with your Oregon Trust Agreement - Revocable - Multiple Trustees and Beneficiaries.

Yes, you can add beneficiaries to a trust. This flexibility is one of the advantages of a revocable living trust. As the trust creator, you can modify the trust document to include additional beneficiaries at any time, ensuring your wishes reflect your current circumstances. Keep in mind, using an Oregon Trust Agreement - Revocable - Multiple Trustees and Beneficiaries can help you manage this process effectively.

To set up a revocable living trust in Oregon, you begin by choosing a name for your trust. Next, you need to draft the trust document, outlining the terms and conditions, along with the roles of multiple trustees and beneficiaries. After that, transfer your assets into the trust, making sure to change the title of each asset to the name of your trust. Utilizing platforms like US Legal Forms can simplify this process with templates specifically designed for Oregon Trust Agreements.