West Virginia LLC Operating Agreement for Two Partners

Description

How to fill out LLC Operating Agreement For Two Partners?

If you need to obtain, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's simple and user-friendly search to find the documents you require. A range of templates for business and personal purposes are organized by categories and titles, or keywords.

Utilize US Legal Forms to acquire the West Virginia LLC Operating Agreement for Two Partners with just a few clicks.

Every legal document template you obtain belongs to you indefinitely. You will have access to every type you downloaded within your account.

Browse the My documents section and select a form to print or download again. Acquire and download, and print the West Virginia LLC Operating Agreement for Two Partners with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the West Virginia LLC Operating Agreement for Two Partners.

- You can also access forms you have previously downloaded under the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct state/country.

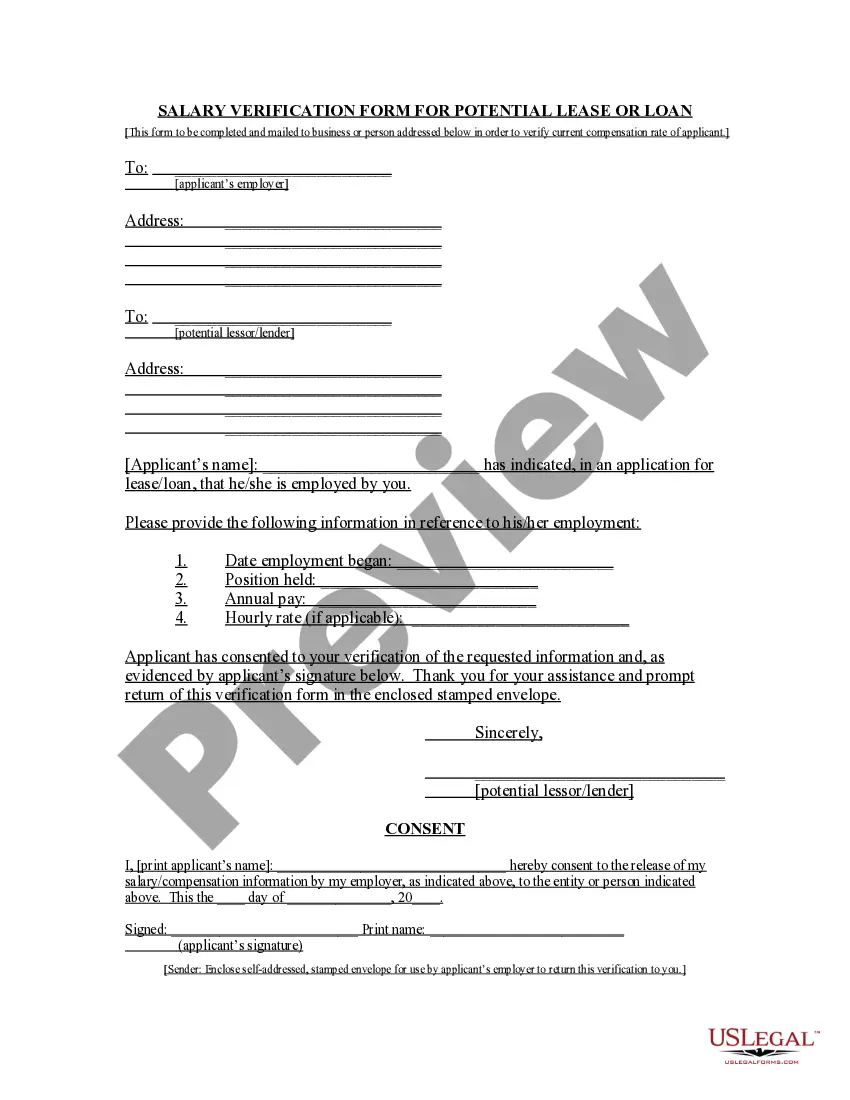

- Step 2. Use the Preview button to review the content of the form. Don't forget to check the details.

- Step 3. If you are not satisfied with the form, utilize the Search feature at the top of the screen to find alternative versions of the legal form.

- Step 4. Once you have found the form you want, select the Buy Now option. Choose your preferred pricing plan and provide your details to create an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finish the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the West Virginia LLC Operating Agreement for Two Partners.

Form popularity

FAQ

An operating agreement is specific to the structure and management of an LLC, while a Standard Operating Procedure (SOP) outlines routine operations and processes within a business. In the context of a West Virginia LLC Operating Agreement for Two Partners, the operating agreement directs how partners will manage their business's ownership and operations. In contrast, SOPs are more about executing day-to-day activities efficiently.

Yes, you need an operating agreement for your LLC in West Virginia. This document outlines the management structure and operational procedures of the business. Moreover, an operating agreement helps establish the rights and responsibilities of each member, which is crucial when forming an LLC with two partners.

Every West Virginia LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Importance of an Operating AgreementSometimes, only LLCs with more than one member are required to have an operating agreement.

Member LLC Operating Agreement is a document that establishes how an entity with two (2) or more members will be run. Without putting the contract into place, the entity is governed in accordance with the rules and standards established by the state, which may or may not align with the company's goals.

member LLC (also called a membermanaged LLC) is a limited liability company that has more than one owner but no managers. Instead, owners run the daytoday operations of the LLC.

Basic Steps to Form a Multi-Member LLCChoose a business name.Apply for an EIN (Employer Identification Number).File your LLC's articles of organization.Create an operating agreement.Apply for the necessary business licenses and permits.Open a separate bank account for your business.

An LLC operating agreement is a document that customizes the terms of a limited liability company according to the specific needs of its members. It also outlines the financial and functional decision-making in a structured manner. It is similar to articles of incorporation that govern the operations of a corporation.

California LLCs are required to have an Operating Agreement. This agreement can be oral or written. If it's written, the agreementsand all amendments to itmust be kept with the company's records. Limited Liability Companies in New York must have a written Operating Agreement.

The multimember operating agreement is specially designed for LLCs with more than one owner. It is the only document that designates an LLC's owners and the percentage of the company they own. Both members should sign the operating agreement in the presence of a notary public.