West Virginia Contract for Part-Time Assistance from Independent Contractor

Description

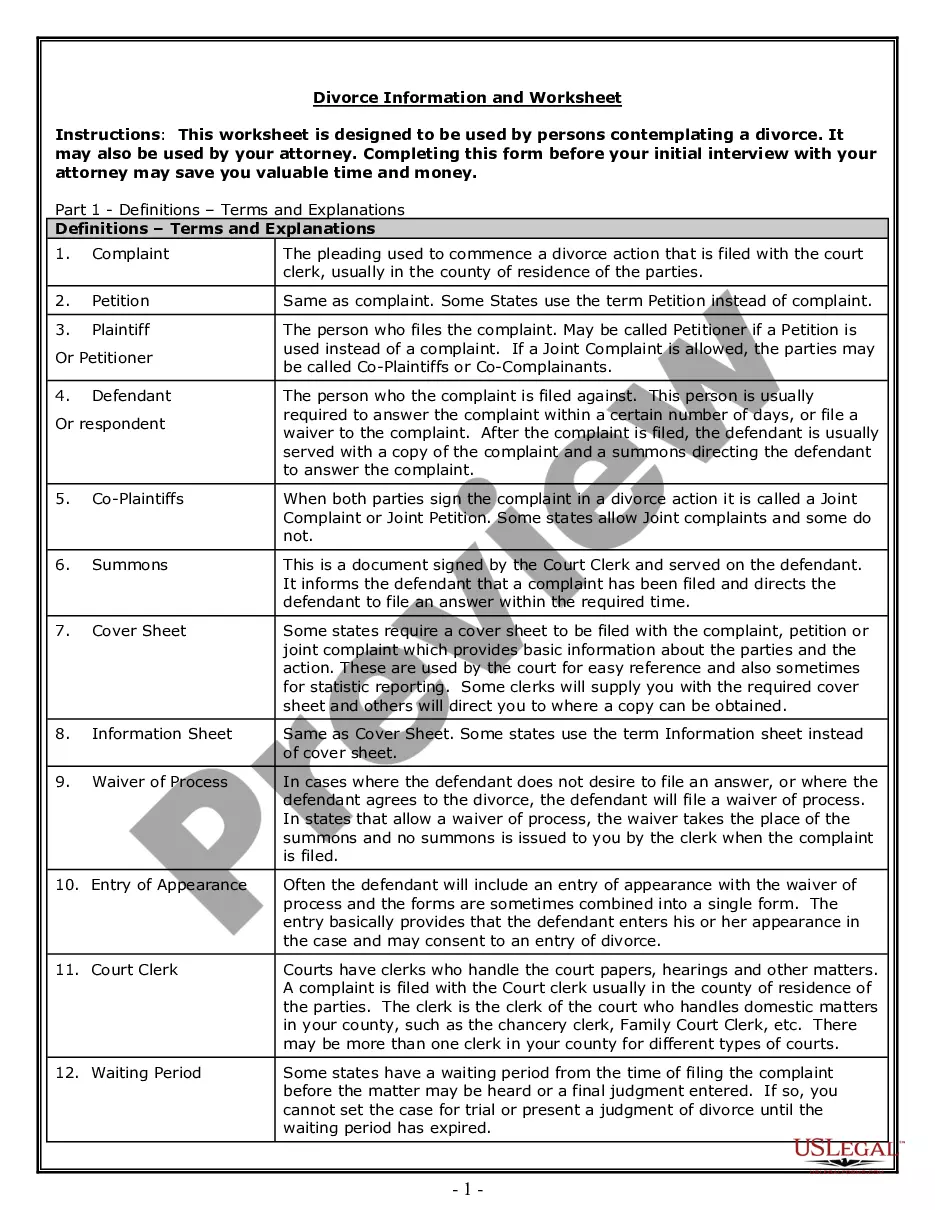

How to fill out Contract For Part-Time Assistance From Independent Contractor?

You have the ability to spend hours online trying to locate the valid documents template that satisfies the state and federal stipulations you require.

US Legal Forms provides a vast array of valid forms that can be evaluated by professionals.

You can download or print the West Virginia Contract for Part-Time Assistance from Independent Contractor from our platform.

If available, utilize the Review option to view the document template as well. If you want to find another version of the form, use the Search field to locate the template that fulfills your needs and specifications.

- If you possess a US Legal Forms account, you can Log In and select the Download option.

- Afterward, you can complete, modify, print, or sign the West Virginia Contract for Part-Time Assistance from Independent Contractor.

- Every valid document template you acquire is yours indefinitely.

- To obtain an additional copy of any purchased form, go to the My documents tab and select the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- Firstly, ensure you have chosen the correct document template for the county/region of your choice.

- Review the form details to confirm you have selected the correct form.

Form popularity

FAQ

Yes, as an independent contractor, you can typically set your own hours. This flexibility is one of the primary benefits of contracting work under a West Virginia Contract for Part-Time Assistance from Independent Contractor. You have the freedom to choose how and when you work, as long as you meet the agreed-upon deliverables. This autonomy allows you to align your work schedule with other personal or professional commitments.

Yes, you can work part-time as a contractor under a West Virginia Contract for Part-Time Assistance from Independent Contractor. Many individuals choose to maintain flexible schedules while providing their services. This arrangement allows for an enjoyable balance between work and personal life. Just make sure to clearly document the working hours and scope of work in the contract.

The 2 year contractor rule refers to a guideline that some states follow regarding independent contractors. It states that if you hire a contractor who worked in the same capacity for you for two consecutive years, they may need to be classified as an employee instead. When you create a West Virginia Contract for Part-Time Assistance from Independent Contractor, it's wise to consider this rule to prevent legal complications. Always review your staffing practices with legal experts.

Yes, a part-time employee can be classified as a 1099 independent contractor. This classification depends on the nature of the work and the agreement between the parties. When using the West Virginia Contract for Part-Time Assistance from Independent Contractor, it's crucial to define the terms clearly to avoid misclassification. Consulting with legal resources can help ensure compliance with IRS regulations.

Yes, having a contract for an independent contractor is highly recommended. This legal document protects both parties by clearly defining the terms of service and payment. It also establishes expectations, which can help prevent disputes in the future. The West Virginia Contract for Part-Time Assistance from Independent Contractor is a great option to ensure you cover all vital details.

Creating a contract for a contractor involves outlining the services expected, payment details, and duration of the agreement. Be clear and concise with the language you use to prevent any confusion over responsibilities. Additionally, consider potential contingencies and dispute resolution processes. Utilizing a West Virginia Contract for Part-Time Assistance from Independent Contractor simplifies this task by providing a solid structure.

Yes, you can 1099 a part-time employee, provided they meet the criteria for independent contractor status. It’s essential to ensure that the individual is not classified as an employee under labor laws. A contract helps establish this working relationship clearly. The West Virginia Contract for Part-Time Assistance from Independent Contractor is a reliable resource for creating such agreements.

Absolutely, a 1099 employee can and should have a contract. This document serves as the official record of the agreement between the independent worker and the hiring entity. It details the scope of work, compensation, and any deadlines. A solid West Virginia Contract for Part-Time Assistance from Independent Contractor can provide clarity for both parties involved.

To make your own contract agreement, you should start by identifying all key elements you want to include, such as services, duration, payment terms, and responsibilities. Next, draft the agreement while ensuring clarity and precision in your language. Finally, review the contract with the other party and adjust as necessary. Using a template, like the West Virginia Contract for Part-Time Assistance from Independent Contractor, can be a helpful guide.

Yes, a 1099 employee should have a contract to clarify the details of the working relationship. This contract outlines the expectations, responsibilities, and payment terms between the independent contractor and the hiring party. Having this documentation helps to avoid misunderstandings down the road. Utilizing a West Virginia Contract for Part-Time Assistance from Independent Contractor ensures you adhere to local regulations.